No Data

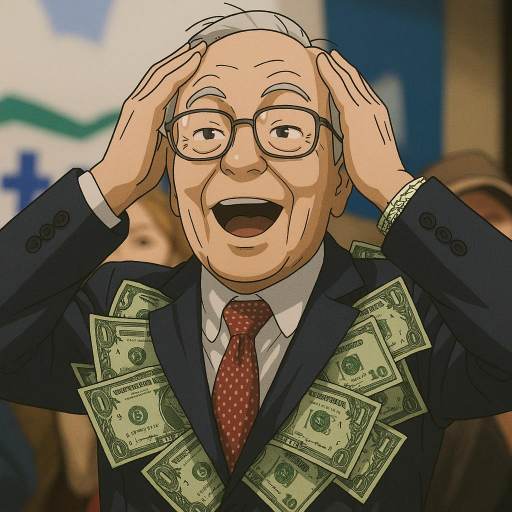

AAPL Apple

- 210.140

- +0.860+0.41%

- 210.300

- +0.160+0.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Tariff Pressures vs. AI-Driven Replacement Surge: What Will Apple's Earnings Show?

Options Plays Ahead of Earnings: AAPL, AMZN, META, MSFT

Apple Shakes Up AI Unit

Earnings Preview: Apple to Report Financial Results Post-market on May 01

A JPMorgan survey indicates that the S&P 500 Index has peaked this year, but investors remain bullish on the Magnificent 7.

① A JPMorgan survey shows that 93% of investors believe the S&P 500 Index will hover around 6000 points or lower in the next 12 months, with 40% expecting it to remain within the 5000-5500 points Range; ② Respondents unanimously believe that trade wars and tariff uncertainties will trigger economic consequences, with 61% expecting the USA economy to face stagflation in the next 12 months.

Wave of U.S. Data This Week May Give Tariff-weary Investors More to Worry About

Comments

Tariff aside, investors are awaiting more earnings reports from various companies. - about 1/3 of S&P 500-listed firms will be posting their results this week. Their earnings can definitely move the market.

$Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Alphabet-C (GOOG.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Apple (AAPL.US)$ $Palantir (PLTR.US)$ $Super Micro Computer (SMCI.US)$ $Strategy (MSTR.US)$

• Aussie markets: The Australian share market is up 8.9% from its low. Gold producers dim yearly production, implying more upside for gold.

• Stocks to watch: Fortescue, Northern Star and Ramelius, Woodside, Visa, Coca-Cola. And XYZ, Microsoft, Met...

The $Dow Jones Industrial Average (.DJI.US)$ led the way upward, adding 114.09 points (0.3%) to a 40,227.59 close, while the $S&P 500 Index (.SPX.US)$ inched up 3.54 ticks (0.06%) to 5,528.75.

However, the $Nasdaq Composite Index (.IXIC.US)$ bucked th...

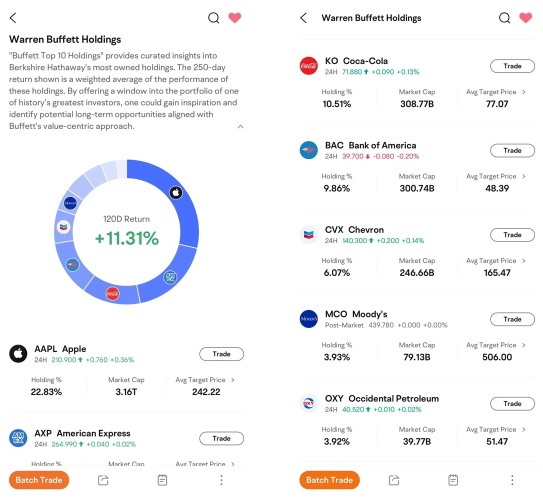

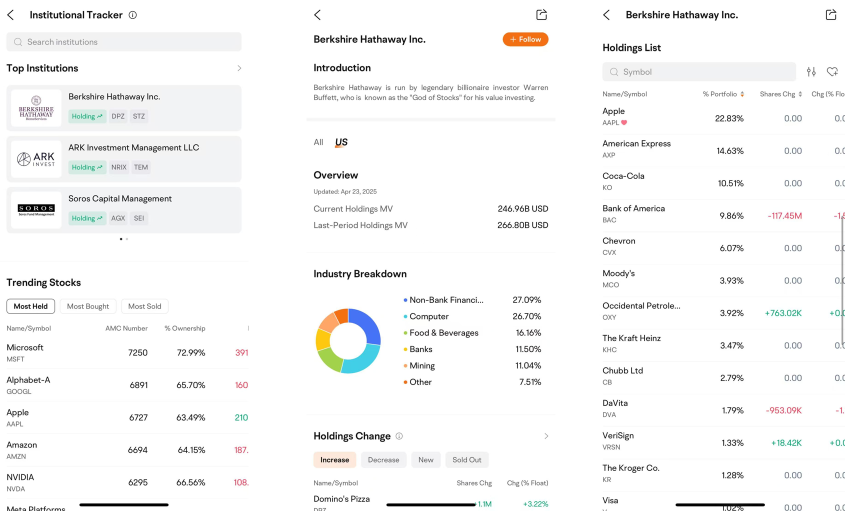

JoanFishers : Buffett loves cash right now — but with stocks rebounding, is holding $334 billion in cash still a smart move?

Hotbuns : Buffett sticks to Apple but avoids AI hype. Is he missing out on tech’s next wave, or is everyone else overvaluing it?