AU ETFDetailed Quotes

WIRE Global X Copper Miners ETF AUD Inc

- 12.160

- -0.050-0.41%

20min DelayMarket Closed Apr 30 15:59 AET

12.370High12.160Low

12.370High12.160Low35.61KVolume12.280Open12.210Pre Close436.43KTurnover15.73552wk High0.18%Turnover Ratio19.79MShares9.96052wk Low--EPS TTM240.59MFloat Cap15.735Historical High--P/E (Static)19.79MShs Float9.786Historical Low--EPS LYR1.72%Amplitude0.28Dividend TTM--P/B1Lot Size2.26%Div YieldTTM

• US markets: General Motors dives 7% into bear market, Ford sinks 3.9%. While Ferrari jumps 3.2% as its not expected to fare as bad amid new 25% auto tariffs.

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

From YouTube

33

2

3

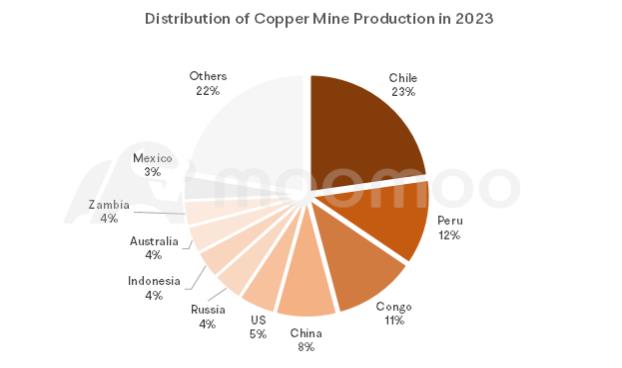

$Copper Futures(JUL5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

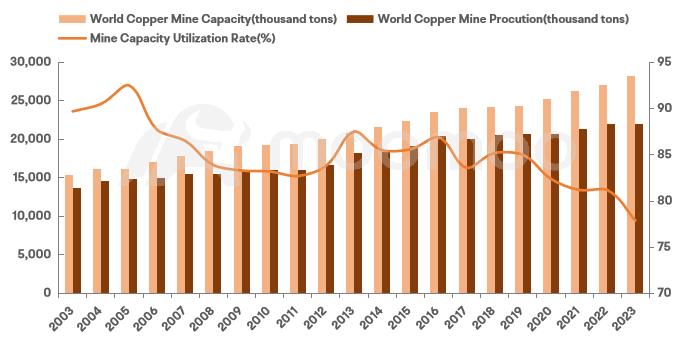

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

8

1

3

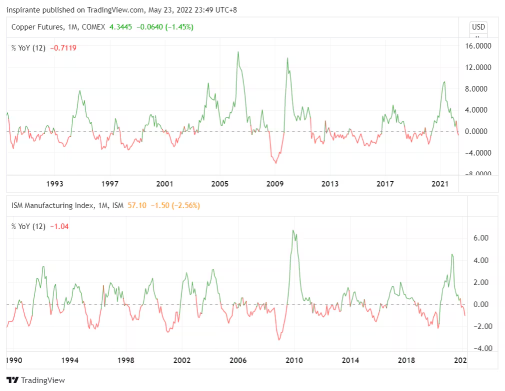

The recent pressure on share markets has many investors wondering about the economic outlook. Concerns about the impact of tariffs on global trade are driving selling in some of the most popular and widely held stocks, and technology stock prices have tumbled in many cases. However one of the most globally significant commodity markets is painting a much more positive picture.

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

44

10

3

The setup for Australian stocks, commodities, and China-facing stocks listed in the US could not look more bullish. And it seems we’re witnessing the birth of a brand-new bull market.

What are we seeing? Iron ore prices rose 10% on Monday, seeing the price of the key iron ore ingredient break out of its downtrend to US$112. Australia’s share market $S&P/ASX 200 (.XJO.AU)$ hit a record all-time high on Monday after rising for three consecutive weeks. China's mar...

What are we seeing? Iron ore prices rose 10% on Monday, seeing the price of the key iron ore ingredient break out of its downtrend to US$112. Australia’s share market $S&P/ASX 200 (.XJO.AU)$ hit a record all-time high on Monday after rising for three consecutive weeks. China's mar...

From YouTube

8

1

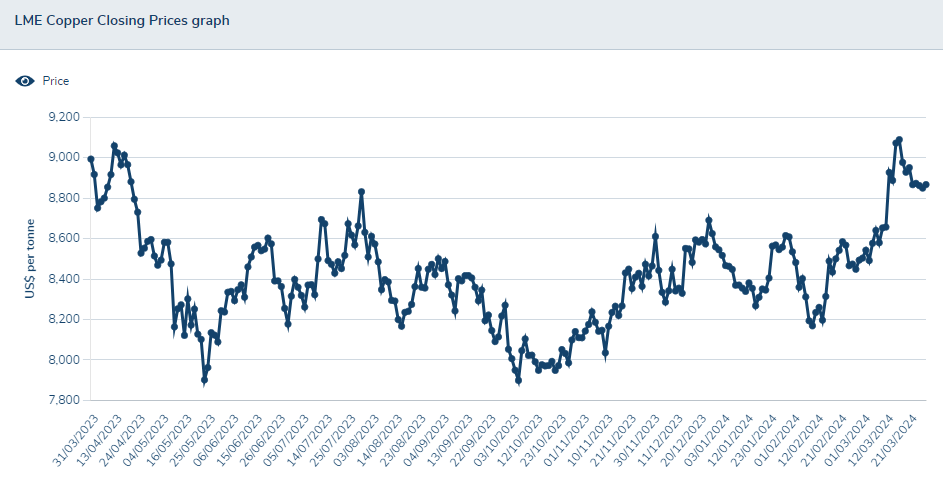

Copper prices soared to a 22-month high

After the global copper mine supply was impacted at the end of last year, as global manufacturing demand showed signs of recovery, copper mine supply reduction combined with stronger-than-expected demand, and copper prices rose strongly.Recently, the price of copper has been rising steadily and has attracted market attention. The LME copperfuturesprice has reached its highest level in 22 months.

...

After the global copper mine supply was impacted at the end of last year, as global manufacturing demand showed signs of recovery, copper mine supply reduction combined with stronger-than-expected demand, and copper prices rose strongly.Recently, the price of copper has been rising steadily and has attracted market attention. The LME copperfuturesprice has reached its highest level in 22 months.

...

+10

18

Since the fourth quarter of 2023, the global copper mining industry has experienced multiple supply disruptions, with recent news of planned production cuts by Chinese smelters intensifying market unease. Supported by expectations of a tight supply, $Copper Futures(JUL5) (HGmain.US)$ prices have been fluctuating with an upward trend since the end of October last year, and have recently seen an accelerated increase. Since March, g...

+4

13

2

8

No comment yet

151453268 witso : I knew you would come around, spot on we dont want power handouts and negligable tax cuts,we want action and intelligent change not woke glaringly obvious pork barrelling. strength to the beautiful bondi strategist

REYBENDEAD : i love it