No Data

VIXY250417P31000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

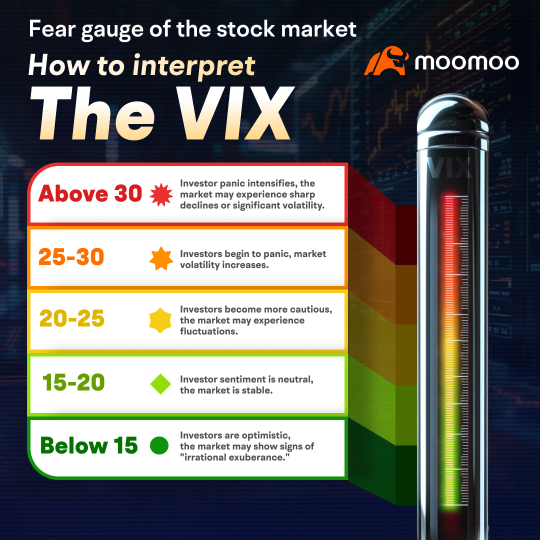

Wall Street's Fear Gauge Falls as Hopes for Trade Negotiations Rise

Unlocking Trends | Trump's Tariffs Shake Global Markets: How Aussies Can Navigate with ETFs?

The dilemma faced by Powell is the same as the market: "Schrödinger's Trump."

Should the economy be stimulated through interest rate cuts, or should high interest rates be maintained to curb potential inflation risks? Analysis suggests that under the uncertainty of tariff policies, the Federal Reserve cannot predict what Trump will do, much like the dilemma faced by the market: if he maintains tariffs as stated, the economy could rapidly shrink, and the S&P 500 Index may fall into a bear market; however, if tariffs are lifted, the economy may experience renewed growth, and the stock market could return to historic highs.

Has the plunge stopped, and have U.S. stocks reached the bottom? The 'seven-minute surge' on Monday was a 'field drill.'

Analysis suggests that in the short term, the perplexing 'quantum state' of Trump may lead the stock market, which plummeted, to stabilize. In the medium to long term, a genuine market reversal requires changing the narrative that altering tariffs will trigger an economic recession. Potential triggering factors include Trump making concessions on trade, other countries making concessions on trade, or intervention by the Federal Reserve.

Two major market anomalies worth noting: "the dollar that followed the sharp decline of the U.S. stock market last week," and "the U.S. Treasuries that were aggressively sold on Monday without a rise in the U.S. stock market."

Unlike past situations where the USD typically strengthened during market turbulence, the USD has significantly weakened after the new tariff policy was implemented; on Monday, while U.S. stocks barely stopped their decline, U.S. Treasuries faced heavy selling.

The U.S. stock market has only stopped the sharp decline, but the U.S. bond market has collapsed, and hedge funds are "desperately fleeing."

The overnight dip in the USA $29 trillion treasury market reflects that hedge funds are desperately reducing leverage, and investors are flocking to Cash to avoid market volatility.

Comments

The policy is expected to raise production costs, fuel inflation, and tighten financial conditions. Goldman Sachs has cut its 2025 U.S. GDP growth forecast from 2.4% to 1.7%.

Fears of trade friction and its impact on the economy ha...

SOMETHING WRONG WHY DOW JONES DOWN VIXY UP 🤔