No Data

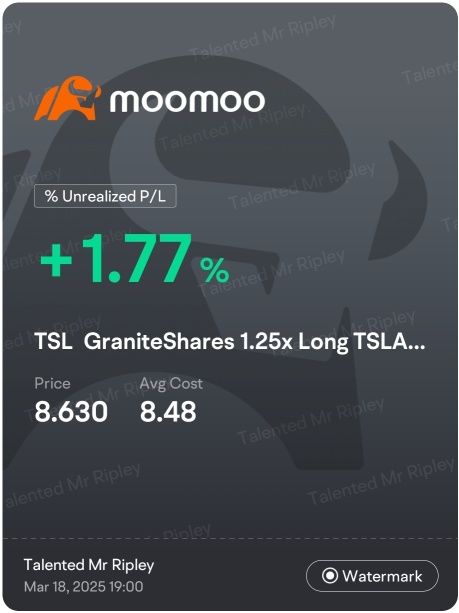

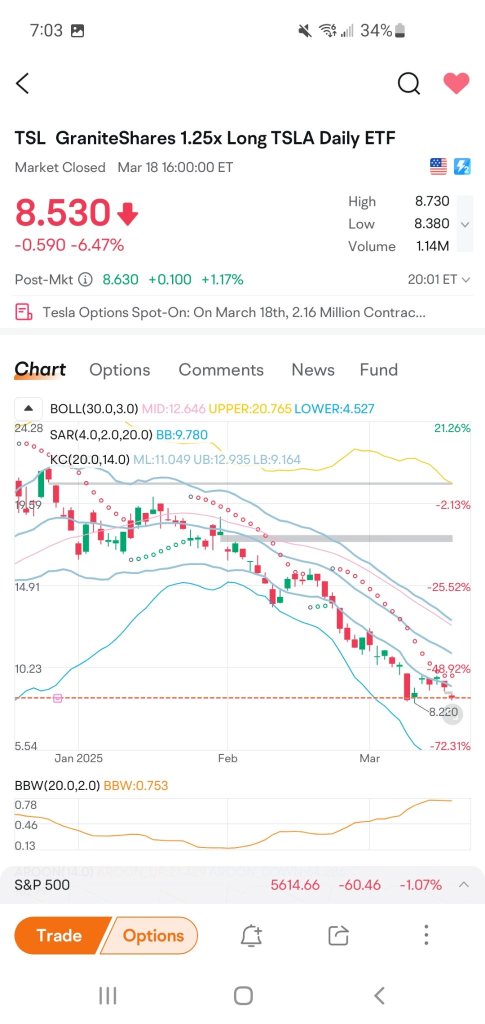

TSL GraniteShares 1.25x Long TSLA Daily ETF

- 11.170

- +1.210+12.15%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Musk's xAI is negotiating for financing of 20 billion US dollars, with an estimated valuation exceeding 120 billion US dollars.

Musk's XAI is seeking $20 billion in funding for its newly merged AI startup and Social Media business. If successful, it will raise the company valuation to over $120 billion. This would also become the second-largest funding round for a startup in history, second only to OpenAI's $40 billion funding earlier this year.

Options Market Statistics: Tesla Jumps 9.8% on U.S. Push for Self-Driving Cars ; Options Pop

Tesla Rolls Out Free FSD Transfers On All US Models, Including Cybertruck Amid Poor Sales

Uncertainty over tariffs suppresses the rise of U.S. stocks, Technology stocks provide support, Tesla surges nearly 10%, Gold retreats over 1%, and the overall trend falls for the week.

After Trump's "change of heart," the three major stock indexes rose for four consecutive days; NVIDIA's shares increased by more than 4%, and Tesla rose by 18% over the week; Google's strong performance initially saw a rise of over 4%, but most of the gains were later given back; the Chinese concept index halted three-day gains but rose over 7% for the week. The USD experienced its first weekly increase in over a month. Bitcoin once surged nearly $3,000, breaking through the $0.095 million mark. Gold saw its first weekly decline since the announcement of reciprocal tariffs. U.S. oil fell over 2% for the week.

Overnight US stocks | The three major indexes recorded increases this week, with Tesla (TSLA.US) rising by 9.8%.

At the close, the Dow Jones Industrial Average rose by 20.10 points, an increase of 0.05%, closing at 40,113.50 points; the Nasdaq rose by 216.90 points, an increase of 1.26%, closing at 17,382.94 points; the S&P 500 Index rose by 40.44 points, an increase of 0.74%, closing at 5,525.21 points.

Overview of international financial hotspots last night and this morning _ April 26, 2025 _ Financial news

For more global financial news, please visit the 7×24 hours real-time financial news market closing: US stocks closed higher with Technology stocks leading the rise. This week, the Nasdaq increased by over 6.7%. On April 25, the top 20 US stocks by trading volume: Tesla surged 9.8%, reports suggest the USA plans to relax autonomous driving regulations. On Friday, China Concept Stocks had mixed results, with New Oriental rising by 1.53%, while Weiwu dropped by 11.44%. WTI June Crude Oil Product futures rose by 0.37%, while spot Gold fell nearly 1% on Friday, accumulating a decline of 0.30% this week. Major European stock indices closed with collective increases, with the German DAX30 Index rising by 0.81%. Macroeconomically, Trump stated that he likes 'a million rich.'

Comments

Current Price: $248.71 (+5.27%) | After-Hours: $249.47

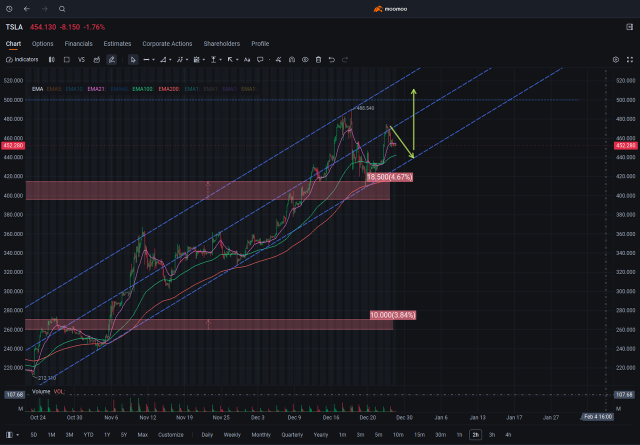

Trend: Short-term bullish trend confirmed, but a crucial inflection zone still needs to be cleared.

1️⃣ Multi-Timeframe & Market Structure Update

1H / 4H:

1H: Golden Cross 50/200MA about to occur; RSI in overbought zone.

Tom Demark Sequential "9's" suggest possible bearish reversal, potentially a last retest of support zone.

Old resistance has turned into support.

4H: Co...

US stocks punched to brand-new record all-time highs with defence stocks like GE rising almost 7% to a 24-year high. The Défense ETF ITA surged to a brand new record. While health names like Moderna gained 10%. And stocks like Palantir also rose,...

Here’s the thing: Tesla’s current hype isn’t really about hitting short-term delivery targets. It’s about the long game—autonomous driving, AI breakthroughs, and the big “Unsupervised FSD” rollout planned fo...

Ozempic

Ozempic  ? that's the Maga drama. it all now hinges on this.

? that's the Maga drama. it all now hinges on this.

Fucumoney : yeah $250

StoicWay : almost 100% down from fresh all time high which represents lack of market excitement..Tesla currently presents a high-risk scenario without the requisite strong market catalysts or positive sentiment needed to justify an investment. anyway thanks for tactical complicated analysis

103768083 StoicWay : Tesla stock also has a political and emotional side to consider

Kevin Matte OP 103768083 : Yeah, totally Tesla isn’t just a stock, it’s a political cult with a rockstar CEO. You’ve got bulls in love with Musk, bears dreaming of bankruptcy… and in the middle, the market reacts to every single statement like it’s reading Twitter instead of a financial report.

And that’s exactly the problem: emotions + trading = toxic combo. When rational analysis gets crushed by FOMO or political drama, it’s no longer investing — it’s poker with Tesla fanboys going all-in on Optimus and robotaxis.

StoicWay 103768083 : if you consider that factors in trading you will always disappointed I don’t mean don’t buy tesla just try to understand perspective while you have thousands opportunities why fighting with tons of resistances just to resist letting go emotional trading