No Data

TLT iShares 20+ Year Treasury Bond ETF

- 88.775

- +0.535+0.61%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is It Time to Buy U.S. Treasuries on the Dip?

Tesla welcomes a major policy package: the USA plans to relax regulations on autonomous driving.

On April 25, reports stated that the USA government will relax regulations on autonomous driving, reducing the originally cumbersome accident reporting process, allowing non-commercial test vehicles to skip certain compliance procedures. This move is seen as the USA's largest deregulation regarding autonomous driving, directly addressing the core demand for Tesla, and giving the green light for Musk's plan to launch the Cybercab autonomous taxi fleet in Texas this June.

Did Trump's "surrender" have a lot to do with the "U.S. debt vigilantes"?

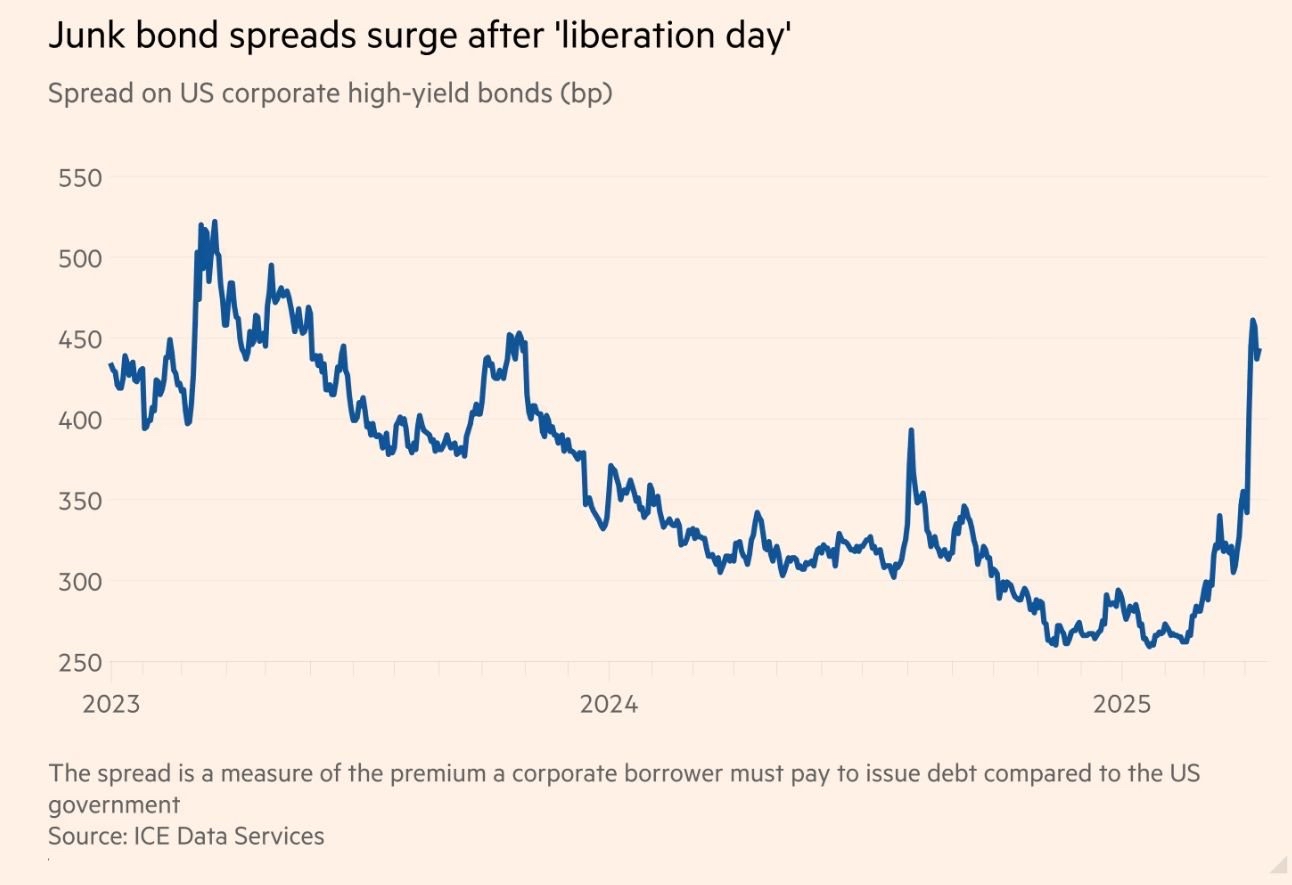

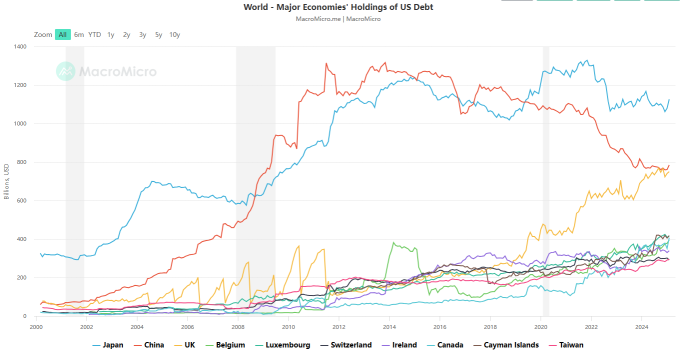

Under the strong pressure of US Treasury yields soaring to 5%, the "Bond vigilantes" successfully "forced a halt" to Trump's tariff policy. Trump admitted: "The bond market is very tricky, I have been monitoring it." Ed Yardeni stated that this is yet another victory for the "Bond vigilantes."

Trump's 'war' with the Federal Reserve has permanently damaged the credit of U.S. bonds.

Concerns about the independence of the Federal Reserve have led investors to intensify the selling of U.S. Treasuries, questioning the credibility of Treasuries as a safe-haven asset. Analysts point out that if the Federal Reserve shifts to a more lenient stance on inflation as Trump desires, or if Trump prematurely nominates a 'shadow chairman' to intervene in monetary policy, the Treasury market will decline further.

U.S. Quarterly Refunding Meeting Could Be Positive for Issuance Outlook -- Market Talk

New Federal Reserve News Agency: Trump has made it "harder" for the next Federal Reserve chairman.

The market worries that Trump's public belittling and pressure on Powell will leave an indelible "original sin" for Powell's successor. Regardless of who the next chairman is, the independence of the Federal Reserve will be in question. An independent central bank is often seen as more objective and professional, making its decisions more likely to guide market expectations and stabilize the economy. Since President Clinton's era, most U.S. presidents have adopted a stance of "non-interference" with the Federal Reserve.

Comments

Unfortunately this norm is very likely to continue for weeks, if not months.

This market will continue to be driven my tariffs related news. Not to forget, earnings season is ramping up, which will further complicate things. Invest safe!

$Trump Media & Technology (DJT.US)$ $Bitcoin (BTC.CC)$ $Strategy (MSTR.US)$ $Super Micro Computer (SMCI.US)$ $MARA Holdings (MARA.US)$ $Lululemon Athletica (LULU.US)$ $Johnson & Johnson (JNJ.US)$ $Intel (INTC.US)$ $Disney (DIS.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Enphase Energy (ENPH.US)$ $Dow Jones Industrial Average (.DJI.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $DiDi Global Inc (DIDIY.US)$ $Alibaba (BABA.US)$ $TENCENT (00700.HK)$

By Robert Musella – Founder of The Roman Sun Tzu Method™

⸻

“The battlefield is shifting—and only the prepared will survive.”

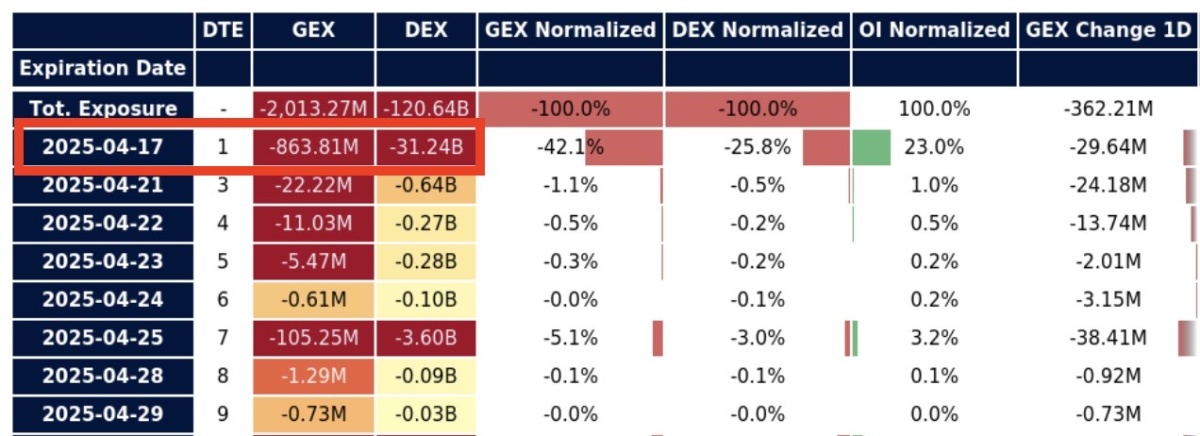

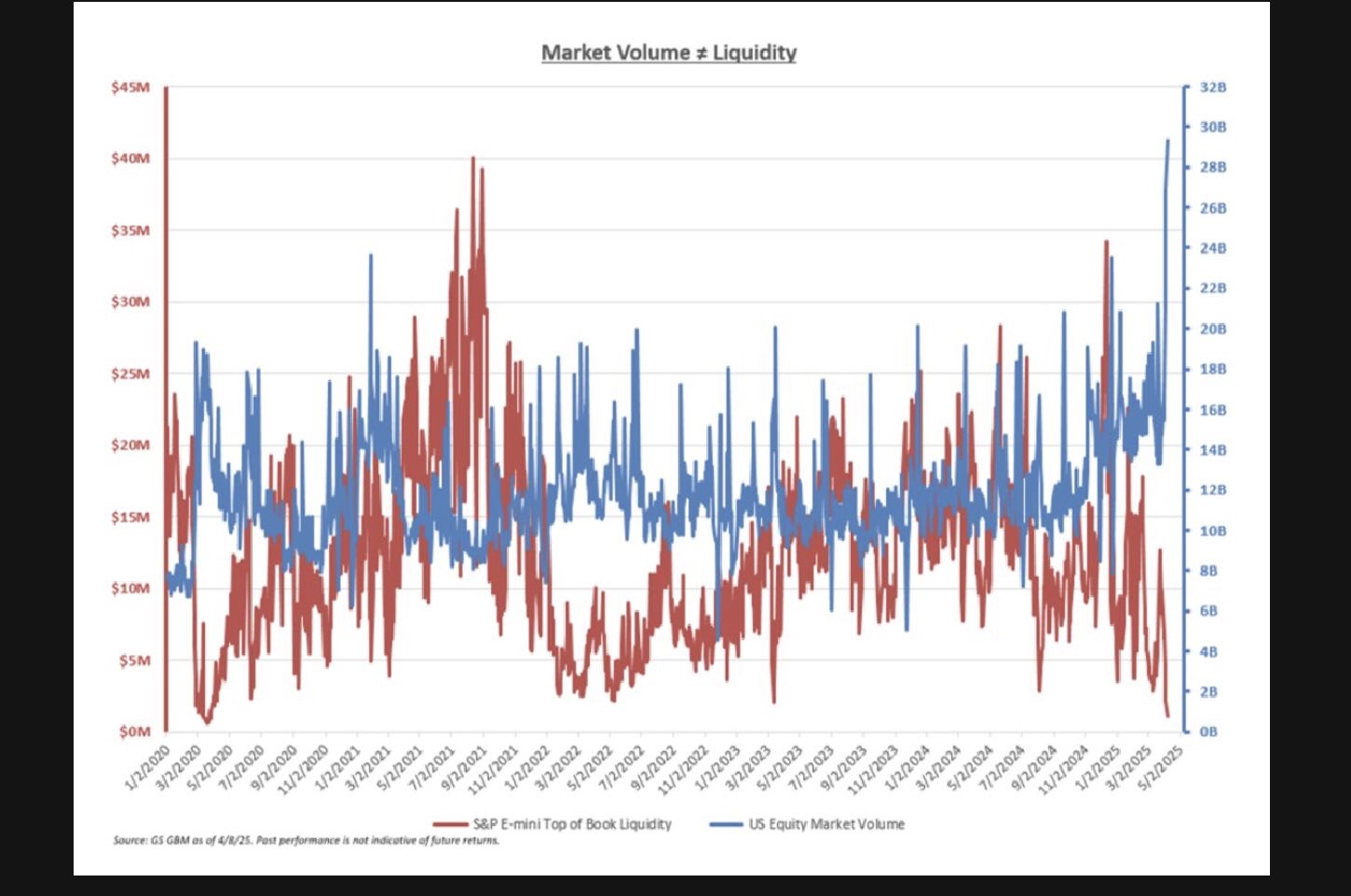

On April 17, we’re not just witnessing expiration-driven chop. We’re watching a multi-front war unfold across equities, credit, options, and global macro flows.

Let’s break down the signals that matter—and what they mean for your next move...

U.S. Treasury bonds are issued by the U.S. government to borrow money from the market, promising repayment of princip...

The 3 major indexes are on track to clinch their third straight winning sessions.

Today’s movement looks more tamed than the last 2 weeks. Wall Street getting used to tariff uncertainty? Or because Trump hasn’t come out to shock and spoil the world again?

$Boeing (BA.US)$ $Johnson & Johnson (JNJ.US)$ $Logitech International (LOGI.US)$ $Micron Technology (MU.US)$ $GlobalFoundries (GFS.US)$ $Peloton Interactive (PTON.US)$ $Corsair Gaming (CRSR.US)$ $Upstart (UPST.US)$ $Clover Health (CLOV.US)$ $Zoom Communications (ZM.US)$ $Crude Oil Futures(JUN5) (CLmain.US)$ $Merck & Co (MRK.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ �...

CaptainBoi : Will continue for the rest of the year

jian1133 CaptainBoi : I think this week it is advisable to Hold.

KC67 Chan CaptainBoi : By year end , SPY probabaly like 50 or something lol

怪懒神 OP KC67 Chan : lol, impossible la![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

CaptainBoi KC67 Chan : Honestly I hope. If buffet buy you buy. Rn he’s waiting at the 300s or low 400s. He’s also old af so he might honestly be gone before he sees the end of the bear market

View more comments...