No Data

SVXY250404P57000

- 11.89

- 0.000.00%

- 5D

- Daily

News

March US Producer Price Index, Core PPI Both Decline Unexpectedly, Year-Over-Year Rates Slow

US Morning News Call | China Raises Tariffs on U.S. Goods to 125%

The dominance of the US dollar is faltering! Global de-dollarization is accelerating, and the euro and Gold have become the new favorites.

Bank of America pointed out that the dollar's share in Global Forex reserves has decreased from 66% in 2015 to less than 58% in the third quarter of 2024, and the attraction of U.S. Treasuries has also significantly declined. The three major factors that previously restricted the Euro have all been reversed, and central banks' Gold Buy volumes have exceeded 1,000 tons for three consecutive years. These two Assets are becoming a new direction for central banks' diversified allocation.

China Raises Retaliatory Tariffs on U.S. Goods to 125%

Trump's pause on the "tariff war" is useless! JPMorgan: The US stock market will continue to pull back, with uncertainty being the key.

①David Kelly, Chief Global Strategist at JPMorgan Asset Management, warned that despite President Trump postponing "reciprocal tariffs," the uncertainty around tariffs will still weigh down US stocks; ②Kelly believes that the biggest tax imposed on the US economy by Washington currently is the "tax of uncertainty," causing companies to halt hiring and cut costs due to unpredictability.

'There'll Be A Transition Cost,' Trump Says Amid Tariff Woes As Bessent Hints At Behind-The-Scenes Negotiations

Comments

Let's be real, I'm getting cold feet about diving in to catch this falling knife. But thank my lucky stars, I'm not in too deep! So if this rollercoaster keeps plummeting, I reckon it might just cough up a golden opportunity. As for my dip-buying strategy? I've got my eagle eyes on these 2key areas

1.Dollar-Cost Averaging into US Stocks

Doll...

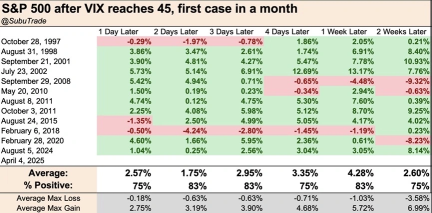

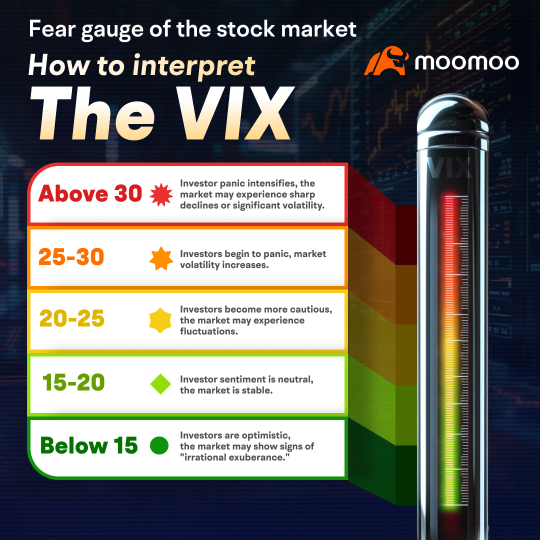

* VIX (Cboe Volatility Index):

* This is not a stock or company. It's an index that measures the market's expectation of volatility over the next 30 days. It's often referred to as the "fear index." When the VIX rises, it generally indicates increased market fear and a potential downturn.

* Inverse ETFs:

* These are exchange-traded funds (ETFs) designed to perform inversely to a market inde...

The policy is expected to raise production costs, fuel inflation, and tighten financial conditions. Goldman Sachs has cut its 2025 U.S. GDP growth forecast from 2.4% to 1.7%.

Fears of trade friction and its impact on the economy ha...

What failed:

1. My bet on $ProShares Ultra Bloomberg Crude Oil ETF (UCO.US)$ was crushed by the second day of decline on Friday when the Sauds decided that they are giving up on $100 oil and resuming higher prod...

Keiith : You think NVDA’s dip is worth averaging into now or wait for more carnage?

Tliet : Bro, my NVDA bags are HEAVY right now… you really think this is a buying opportunity?

WoodYouLikeSomeCash : Do not buy for another few months. Retail is the only one buying, once that steams runs out we will see a free fall.

74830086 WoodYouLikeSomeCash : agreed

Ultra Thinker : tbh I'm scared lol it's gotta hit 180 for me to buy now l

View more comments...