US OptionsDetailed Quotes

SPY250417P469000

- 0.01

- 0.000.00%

15min DelayClose Apr 17 16:14 ET

0.00High0.00Low

0.01Open0.01Pre Close0 Volume1.73K Open Interest469.00Strike Price0.00Turnover1405.45%IV10.91%PremiumApr 17, 2025Expiry Date0.00Intrinsic Value100Multiplier-2DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type-0.0017Delta0.0003Gamma52641.00Leverage Ratio-15.7792Theta0.0000Rho-86.95Eff Leverage0.0001Vega

SPDR S&P 500 ETF Stock Discussion

2

4

$SPDR S&P 500 ETF (SPY.US)$

More duties/ tariffs on the Consumer. This man really wants to cook supply chains. The trade war is going to last for the next 4 years 💪 Last chance to sell everything.

Effective October 14, 2025, the U.S. will impose the following fees:

Chinese-built and Chinese-owned vessels:$50 per net ton, increasing by $30 annually over the next three yearsAlternatively, $120 per container unloaded, rising to $250 after three years.

Chinese-built ships owned by non-Chinese firms:

...

More duties/ tariffs on the Consumer. This man really wants to cook supply chains. The trade war is going to last for the next 4 years 💪 Last chance to sell everything.

Effective October 14, 2025, the U.S. will impose the following fees:

Chinese-built and Chinese-owned vessels:$50 per net ton, increasing by $30 annually over the next three yearsAlternatively, $120 per container unloaded, rising to $250 after three years.

Chinese-built ships owned by non-Chinese firms:

...

2

$SPDR S&P 500 ETF (SPY.US)$ when spy futures open?

2

With Trump’s unpredictable tariff announcements, the ongoing US-China trade war, and earnings season heating up, this kind of market turbulence and whipsaw movements are likely here to stay — at least for the next few weeks, if not months.

If you’re investing or trading right now, you need to be mentally prepared for that.

Stocks covered in my video (technical analysis) – SPY, Apple, Tesla, Google, Meta, Microsoft, Nvidia + Option trades

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-A (GOOGL.US)$ $Netflix (NFLX.US)$ $Palantir (PLTR.US)$

If you’re investing or trading right now, you need to be mentally prepared for that.

Stocks covered in my video (technical analysis) – SPY, Apple, Tesla, Google, Meta, Microsoft, Nvidia + Option trades

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-A (GOOGL.US)$ $Netflix (NFLX.US)$ $Palantir (PLTR.US)$

From YouTube

9

$SPDR S&P 500 ETF (SPY.US)$ we are still in for a rough ride if Trump doesn’t back off the tariffs or at least stop negotiating over social media and press releases. He is making the market so unstable that it is driving investors to other markets. I think the only reason the market hasn’t dropped further and faster is to prevent trading halts and keeping retail investors from jumping ship before the hedge funds can reposition themselves.

1

2

$SPDR S&P 500 ETF (SPY.US)$

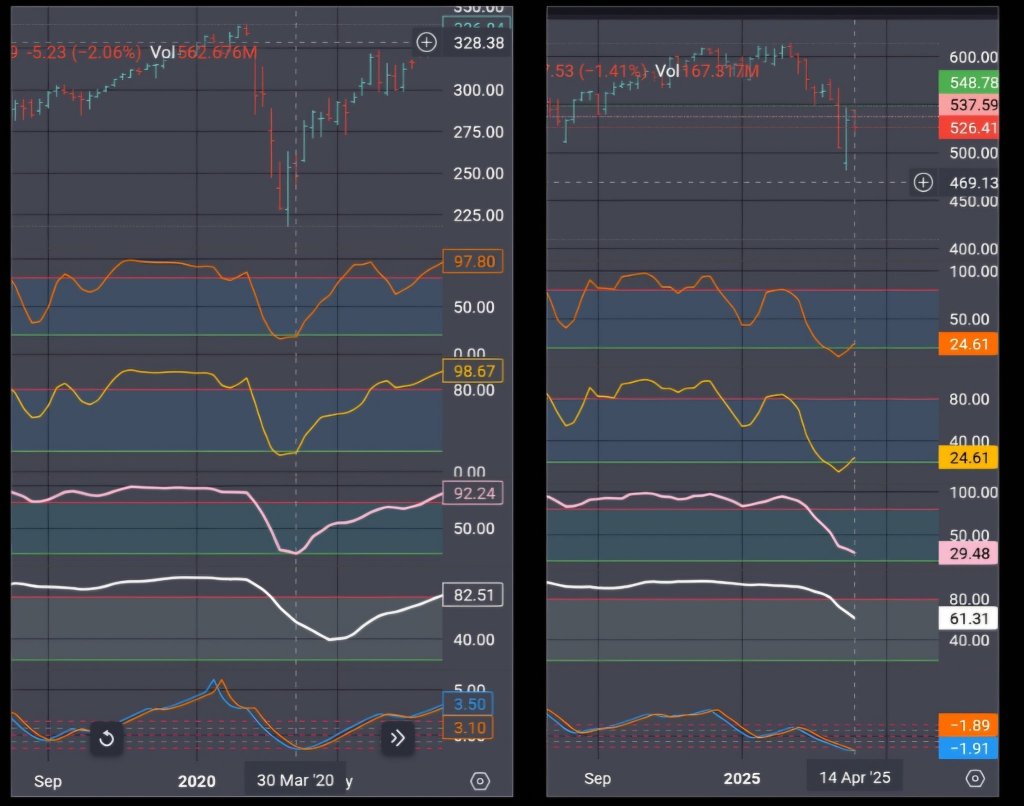

$SPY left is 2020, right side is now. Peek at the dotted line and how all the indicators are ligned up identical, including the chart and sequence of red and green bars on the weekly chart. A few more days and bottom indicators should lign up just like they did back then, and Bam!

$SPY left is 2020, right side is now. Peek at the dotted line and how all the indicators are ligned up identical, including the chart and sequence of red and green bars on the weekly chart. A few more days and bottom indicators should lign up just like they did back then, and Bam!

2

3

$SPDR S&P 500 ETF (SPY.US)$

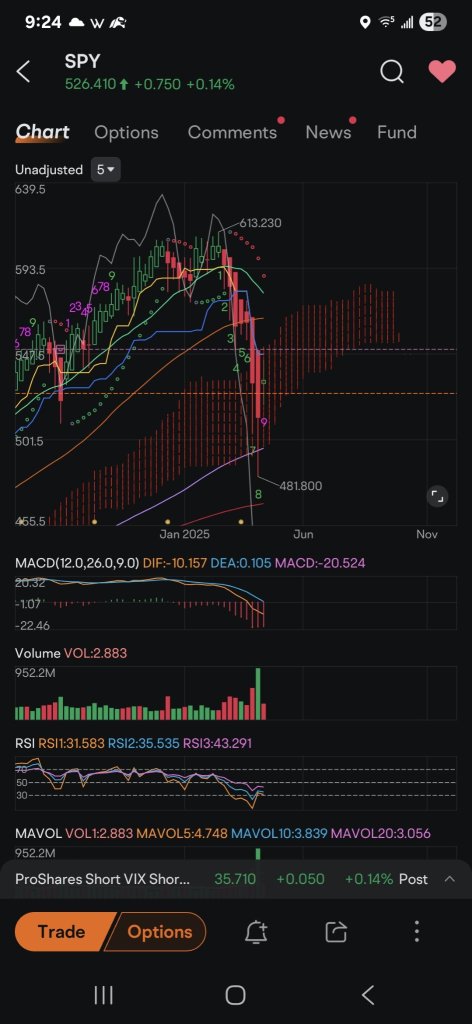

9s down complete on weekly, even seeing a green candle forming. thinking a W we are low still. lot going on nobody knows very random now interesting time to be in the market. also I don't rely on chart technicals I actually think about current situation and enjoy seeing how things play out

9s down complete on weekly, even seeing a green candle forming. thinking a W we are low still. lot going on nobody knows very random now interesting time to be in the market. also I don't rely on chart technicals I actually think about current situation and enjoy seeing how things play out

1

3

No comment yet

we left off like this I do suspect opening high because the 3 day weekend should cool off vix

we left off like this I do suspect opening high because the 3 day weekend should cool off vix

okg : Future is red

Ultratech OP okg : chill.

Ultratech OP : im looking at more than that

Ultratech OP : its red yes I see this. to the untrained eye I suspect nothing less but then you have vix futures too which are scarey high and will come down.