No Data

What the 'Fire Powell' Trade Could Look Like as Trump Attacks Fed Chair Again

Trump's new policy "quarterly report" released: S&P Index sets the worst record for presidential openings in a century!

① Since Trump's inauguration as President of the USA on January 20, the S&P 500 Index has fallen by 14%, marking the worst record in a century; ② Trump's tariff policy and "America First" strategy have weakened the dollar's credibility, leading to a continuous decline in the US stock market; ③ In contrast, stock markets in Europe and Asia have performed robustly, with multiple markets still maintaining an upward trend despite the impact of Trump.

Trump is suspected of manipulating Powell, causing sell-offs and calculating the bottom level of the US stock market.

Market concerns about the replacement of Federal Reserve Chairman Jerome Powell further weaken investors' confidence in dollar Assets, leading to a significant sell-off in the U.S. stock market after Monday's holiday.

Behind the "Triple Kill" of stocks, bonds, and foreign exchange in the USA: Why is Wall Street so afraid of the Federal Reserve becoming a "puppet"?

① The Federal Reserve is actually a buffer against the worst effects of the whimsical "Trump economics"; ② From Trump's own perspective, there is almost no place for inflation at present...

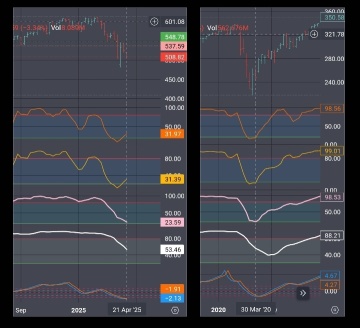

With the rise in US Treasury yields and the weakening of the dollar, the US market is facing synchronized pressure in stocks, bonds, and foreign exchange.

① In the face of the tyrannical "King of Understanding", investors around the world submitted their market trading "report cards" once again this Monday: selling off all USA Assets... ② Market data shows that the USA market experienced a tragic episode of "three kills in stocks, bonds, and currency" again this Monday— the US dollar, US stocks, and US bonds all fell simultaneously, and the declines were significant.

U.S. stocks fell sharply on low volume, Wall Street is "numb," with only retail investors still buying the dip.

On Monday, the trading volume of US stocks was approximately 13.5 billion shares, which is a significant drop from the normal 20 billion shares, far below the average level from April; by 2:30 PM New York time on Monday, retail traders had net bought 2.2 billion dollars worth of Stocks, noticeably higher than the average level over the past month.