US OptionsDetailed Quotes

SPY250409P414000

- 0.01

- 0.000.00%

15min DelayClose Apr 10 16:15 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume427 Open Interest414.00Strike Price0.00Turnover1689.65%IV21.36%PremiumApr 9, 2025Expiry Date0.00Intrinsic Value100Multiplier-9DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type-0.0007Delta0.0001Gamma52641.00Leverage Ratio-4.8151Theta0.0000Rho-38.57Eff Leverage0.0001Vega

SPDR S&P 500 ETF Stock Discussion

$SPDR S&P 500 ETF (SPY.US)$

$Alibaba (BABA.US)$

so I said the chance of a deal is small, if any, not least due to Trump's Agenda to crush CCP, but also due to the current political infighting inside CCP, where Xi might even be under some sort of restraining orders, his wife kept as a hostage in case they defect (but Xi won't defect to Vietnam, Cambodia or Malaysia, these countries cannot support his lifestyle nor have the political clout to accept Xi's defection).

Weirdly, for 2 weeks, I have been...

$Alibaba (BABA.US)$

so I said the chance of a deal is small, if any, not least due to Trump's Agenda to crush CCP, but also due to the current political infighting inside CCP, where Xi might even be under some sort of restraining orders, his wife kept as a hostage in case they defect (but Xi won't defect to Vietnam, Cambodia or Malaysia, these countries cannot support his lifestyle nor have the political clout to accept Xi's defection).

Weirdly, for 2 weeks, I have been...

1

2

As promised in my earlier posts, this post will be talking about the feature on Moomoo and how I utilize it to get an early overview of big institutional plays.

Afterall, if someone's betting a gazillion dollars that the market's going down, you best believe they're doing everything in their power to make that happen.

(Not financial advice, all unusual trades shown may have been hedged.)

Alright, to start off we'll be usi...

Afterall, if someone's betting a gazillion dollars that the market's going down, you best believe they're doing everything in their power to make that happen.

(Not financial advice, all unusual trades shown may have been hedged.)

Alright, to start off we'll be usi...

+6

35

2

2

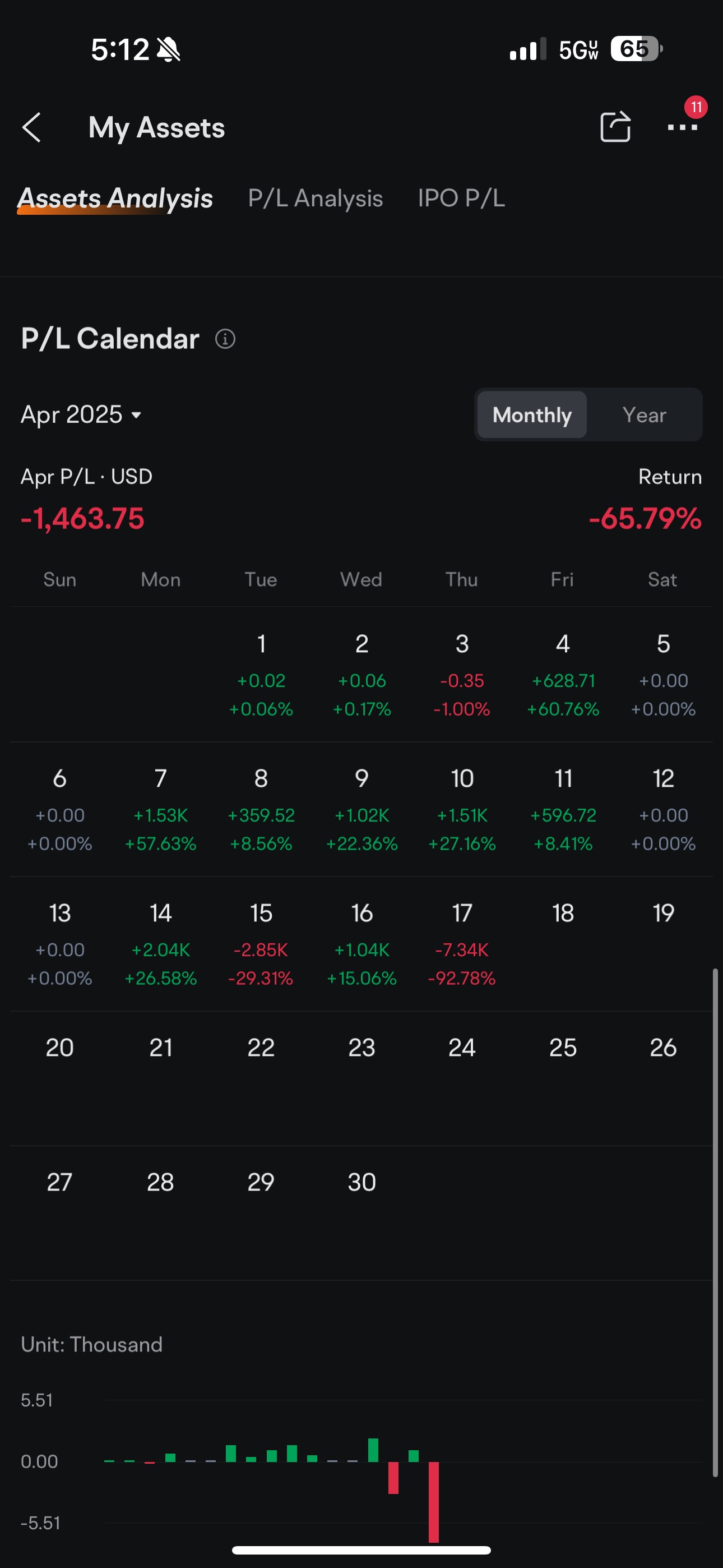

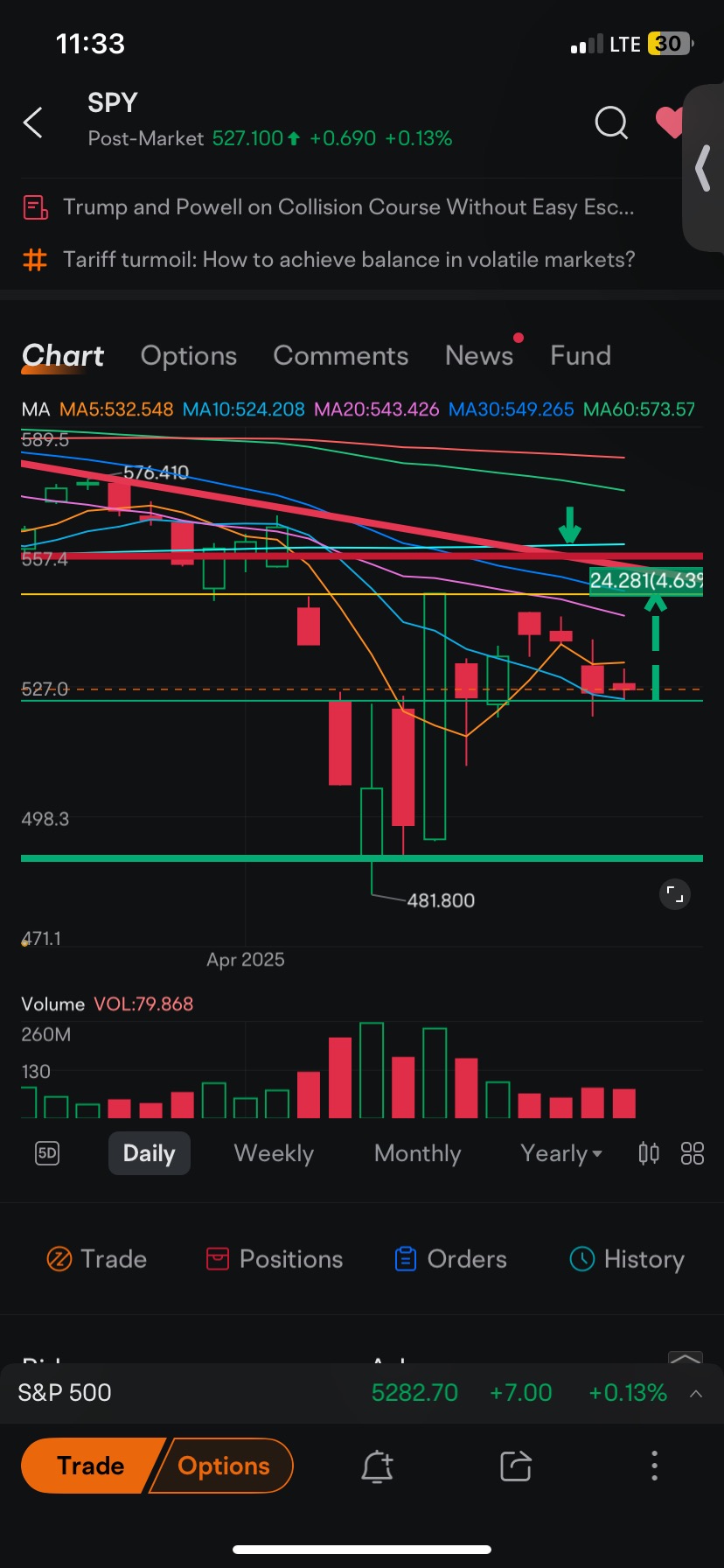

$SPDR S&P 500 ETF (SPY.US)$ so it started 527 and ended 527 , brillant ! and with so much volatilty juicy premium

$SPDR S&P 500 ETF (SPY.US)$ Spy is going to drop 20-30% if this keeps going. Maybe build the god damn infrastructure in place or fix our vulnerable supply chains before you go around slapping tariffs on everyone. People saying we’re going to import from other Asian countries are delusional. Also surprise suprise, other countries like Vietnam and Malaysia get materials from China then assemble them. 🤦♂️You can’t take and extract a factory and then put it somewhere else like a chess piece. It take...

2

10

5

5

$SPDR S&P 500 ETF (SPY.US)$ looks like it didn’t move after i went to sleep 🤣

2

$SPDR S&P 500 ETF (SPY.US)$ Open at 531.6 on Monday.

2

$SPDR S&P 500 ETF (SPY.US)$

to some, I was a hero; to many a fool 😔 WE TRIED BOYS GG

to some, I was a hero; to many a fool 😔 WE TRIED BOYS GG

18

9

1

No comment yet

Beta seeker : Predicting the rise and fall of the Large Cap the next day is the most difficult thing in the world, bar none. The average confidence level of all predictions, including those from the so-called elites of Wall Street, does not exceed 40%. If someone could accurately predict the results every day, it would be akin to someone winning the POWERBALL every day, and such a thing has never happened.

Fredo in the cut OP Beta seeker : just look at buyers and seller and the rest is easy . if we sell a level thats been bought up it now become resistance if the level we had sellers no longer get sold then we push to next level of sellers its not about predicting its about finding liquidity

Beta seeker Fredo in the cut OP : This model has many shortcomings; it does not consider the impact of external market shocks on Large Cap, does not take into account human psychological factors, and does not account for the impact of external incremental capital on your model. The results will not contradict the law of large numbers and will not affect the average confidence level, for your reference