US OptionsDetailed Quotes

SPXS250404P7000

- 0.01

- 0.000.00%

15min DelayTrading Apr 4 16:00 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume1.21K Open Interest7.00Strike Price0.00Turnover0.00%IV6.74%PremiumApr 4, 2025Expiry Date0.00Intrinsic Value100Multiplier-4DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma749.50Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Direxion Daily S&P 500 Bear 3X Shares ETF Stock Discussion

$Direxion Daily S&P 500 Bear 3X Shares ETF (SPXS.US)$ I am having a hard time picturing the S&P dropping much lower than 5000. It just feels like a hard stopping point in my head. Someone tell me I am wrong lol.

3

$Direxion Daily S&P 500 Bear 3X Shares ETF (SPXS.US)$ ABOVE 12.50 EXTREME FEAR😱

The Fortress Wall Has Fallen: Strategic Breakdown, Not a Bounce

By Robert Musella | April 6, 2025

© 2025 Robert M. Musella. All rights reserved.

⸻

Sunday night futures didn’t just wobble—they broke.

• S&P futures -3.97%

• NASDAQ futures -4.97%

• Small caps -5.46%

• VIX +28.16%

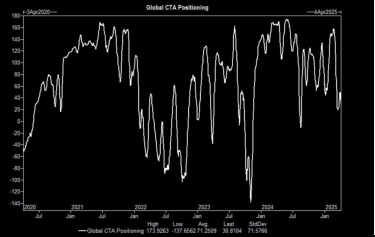

This isn’t a “healthy correction.” This is a structural unwind. A strategic breakdown. And the fortress wall at 4900–5000 SPX, which held for months, h...

By Robert Musella | April 6, 2025

© 2025 Robert M. Musella. All rights reserved.

⸻

Sunday night futures didn’t just wobble—they broke.

• S&P futures -3.97%

• NASDAQ futures -4.97%

• Small caps -5.46%

• VIX +28.16%

This isn’t a “healthy correction.” This is a structural unwind. A strategic breakdown. And the fortress wall at 4900–5000 SPX, which held for months, h...

+5

2

4

1

6

22

Markets in Shock: The Repricing Has Begun

April 4 – Morning Tactical Post

The Catalyst:

China retaliates with 34% tariffs on all U.S. goods, effective April 10. This is not negotiation—it’s escalation. A full-blown economic war repricing has begun.

Futures Imploding:

• S&P 500 Futures (ES): 5250, down -3.36%

• NASDAQ Futures (NQ): 17,989, down -3.68%

• NDX Index: down -5.41%

• VIX Futures: 32.10, up +22.29%

• Spot VIX: breaking above 45 — a volatil...

April 4 – Morning Tactical Post

The Catalyst:

China retaliates with 34% tariffs on all U.S. goods, effective April 10. This is not negotiation—it’s escalation. A full-blown economic war repricing has begun.

Futures Imploding:

• S&P 500 Futures (ES): 5250, down -3.36%

• NASDAQ Futures (NQ): 17,989, down -3.68%

• NDX Index: down -5.41%

• VIX Futures: 32.10, up +22.29%

• Spot VIX: breaking above 45 — a volatil...

10

4

5

$Direxion Daily S&P 500 Bear 3X Shares ETF (SPXS.US)$ easy money been buying since jan Feb no worries

1

$Direxion Daily S&P 500 Bear 3X Shares ETF (SPXS.US)$ ABOVE 10$ Real fear 💯💰

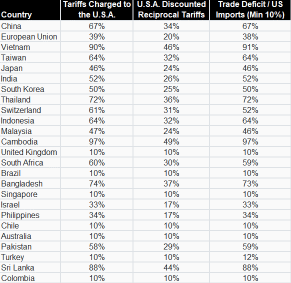

The Trump administration’s recent announcement of reciprocal tariff policies has far exceeded market expectations, especially when it comes to the tariff rates and the scope of their application.

The policy takes a cumulative approach, rather than a substitution model, meaning that tariffs will be added on top of existing duties, which will systematically raise the cost of imported goods. For example, the overall tariff on Chinese exports to the U.S. could re...

The policy takes a cumulative approach, rather than a substitution model, meaning that tariffs will be added on top of existing duties, which will systematically raise the cost of imported goods. For example, the overall tariff on Chinese exports to the U.S. could re...

+2

30

7

9

curious on how these play out tommorrow. i feel like big red two fold then new long opportunities #OM calls #MAXN calls #TSLA puts QQQ puts

$SPXS 250502 6.50C$

$SPXS 250502 6.50C$

No comment yet

Wjin1234 : you’re right

Stock Therapy : thats what I said at 5500. Now I’m wondering 4500.

VIKTIM OP Stock Therapy : Yeah, I am starting to think that too.