No Data

SBSW Sibanye Stillwater

- 4.590

- +0.060+1.32%

- 4.580

- -0.010-0.22%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Base Metal Prices Mixed as Copper Gains on Record Chinese Inventory Decline -- Market Talk

Gold has come to a sudden stop, long positions have drastically decreased, and analysts warn that the trend has diverged from the fundamentals.

Barclays strategist Stefano Pascale stated that the surge in Gold Call Options after Trump's tariffs, leading to an inverted skew indicator, coupled with a sharp reduction in hedge fund long positions and the recent pullback in Gold prices, are all reasons to adopt a cautious outlook on Gold prices in the short term. The movement of Gold has already "decoupled" from the "fundamental drivers" such as the US dollar and real interest rates.

Gold Falls Globally: US$ -1.29%, RM -1.34%

Betting on Gold for 15 years, Paulson achieved great success; he did not buy gold bars, but instead bought gold mines.

As early as when gold prices were around $900 per ounce, Paulson heavily bought gold mining stocks, including Perpetua Resources, Agnico Eagle Mines, and International Tower Hill Mines, among which several saw an increase of over 30% last year. Paulson believes that as gold prices rise, the profits of mining companies will multiply, and mining costs are relatively fixed, so even if gold prices adjust, there will still be room for profits.

Is there a warning of a bullish-bearish reversal in the Options market? Cracks are appearing in the myth of Gold's surge?

This month, Gold's upward trend surpasses all major asset classes, as Trump's tariff war reshapes the Global economic order, with safe-haven funds continuously pouring into the gold market. However, changes in Options positions are causing some market observers to remain cautious.

The gold-silver ratio has rarely broken 100! Silver is expected to welcome a valuation repair window.

As of April 21, 2025, the price ratio of Gold to Silver (hereinafter referred to as the gold-silver ratio) has risen to 105.26, well above the historical average of 50 to 80. A gold-silver ratio over 100 signifies extreme pricing in light of stagflation risks and indicates that the window for Silver valuation recovery is gradually opening.

Comments

LED: $OSRAM LICHT AG UNSP ADR EA REPR 0.333 ORD SHS (OSAGY.US)$ $Acuity (AYI.US)$

Silicon: $Advanced Micro Devices (AMD.US)$ $Intel (INTC.US)$ $NVIDIA (NVDA.US)$ $Broadcom (AVGO.US)$ $Qualcomm (QCOM.US)$ $Applied Materials (AMAT.US)$

Platinum: $ANGLO AMERICAN PLATINUM LTD SPON ADR EACH REP 0.16667 ORD SHS (ANGPY.US)$ $IMPALA PLATINUM HLDGS SPON ADR 1 REP 1 ORD ZAR0.025 (IMPUY.US)$ $Sibanye Stillwater (SBSW.US)$

���������...

looks like buying more lol

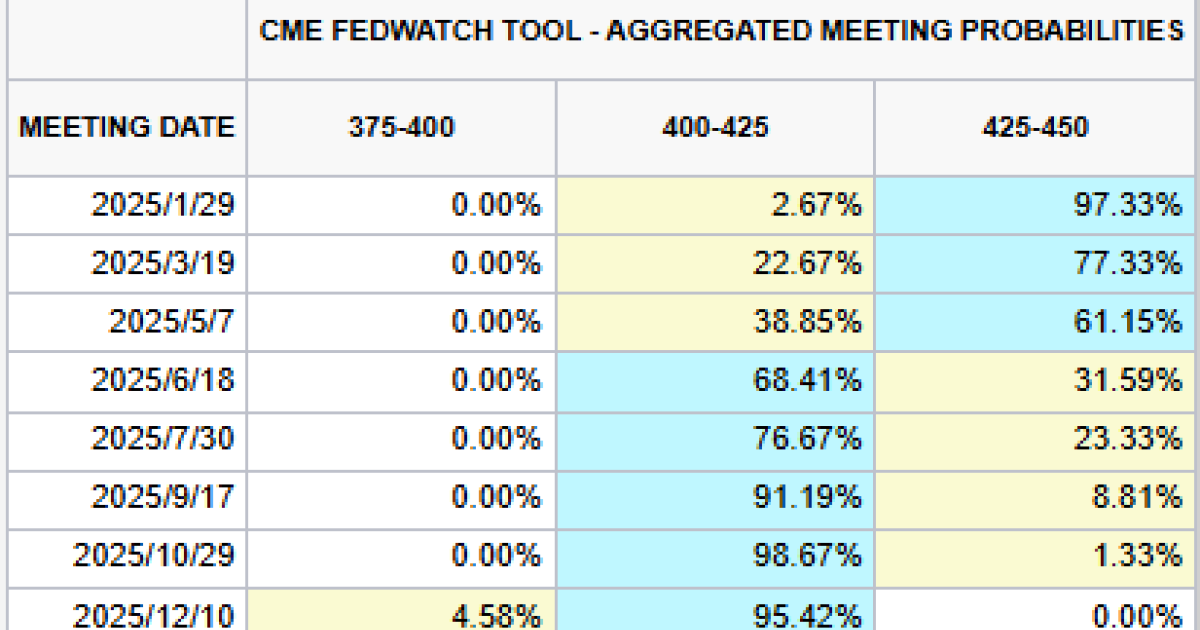

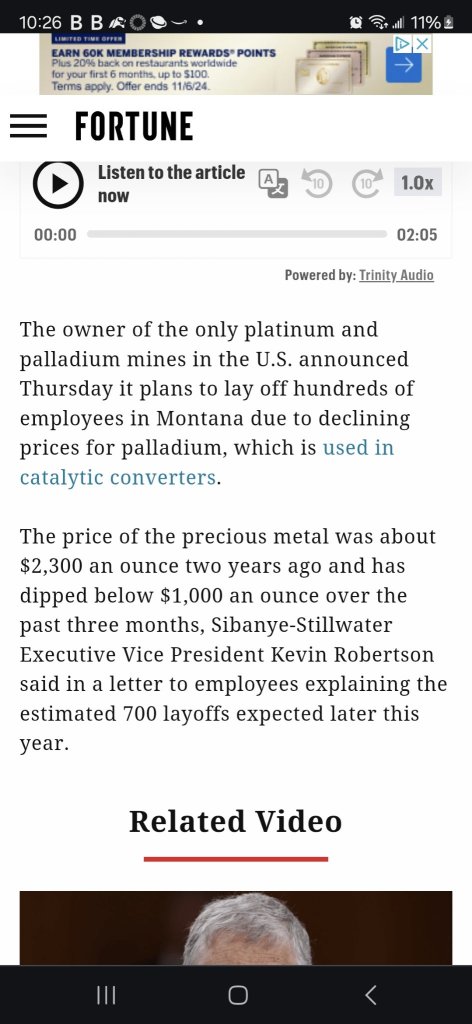

Montana miner laying off 700 as price for metal used in catalytic converters collapses

$Sibanye Stillwater (SBSW.US)$

$First Majestic Silver (AG.US)$

$SPROTT NICKEL MINERS ETF (NIKL.US)$

$Etf Managers Trust Purefunds Ise Jr Silver Small Miners Exp (SILJ.US)$

$Sprott Physical Platinum & Palladium Tr (SPPP.US)$

$Endeavour Silver (EXK.US)$

$Coeur Mining (CDE.US)$

Buy n Die Together❤ :

Svetlana Polishuk :