No Data

MSFT250404P362500

- 2.99

- 0.000.00%

- 5D

- Daily

News

Mag 7 Earnings May Be OK. Watch Out for Guidance. -- Barrons.com

Cantor Fitzgerald Maintains Microsoft(MSFT.US) With Buy Rating

Tariff crushes hopes for a rebound in US stocks, the Dow plunged over 2,000 points during the session, the S&P erased more than 4% of its gains and turned negative, and Apple fell 11% from its daily high at one point.

NVIDIA, which rose over 8% in the early session, closed down more than 1%. Tesla, which rose over 7% in the early session, closed down nearly 5%. The China concept Index has closed down more than 5% for two consecutive days. The yield on the two-year U.S. Treasury bond dropped nearly 20 basis points during the session. The Swiss franc surged nearly 2% in the session. Bitcoin dropped over $5,000, falling below the 0.078 million mark during the session. Crude Oil Product once fell more than 4%. Copper rose over 4% during the session but later fell more than 2%.

U.S. stocks closed with an early rise followed by a drop, with the Nasdaq down over 2%. Apple and Tesla both fell nearly 5%.

① Nasdaq China Golden Dragon Index fell more than 5%; ② PHLX Semiconductor Index fell 3.57%; ③ Trump's administration promotes Coal project mining; ④ Canada's reciprocal tariffs on USA Autos will take effect.

Bottom fishing in a declining market? Amid the historical crash of U.S. technology stocks, leveraged funds that multiply investments by three have set a record for single-day inflow.

① Investors are betting on the rebound of American Technology Stocks, with 1.5 billion USD invested in the ProShares UltraPro QQQ Fund, setting a record for the largest single-day inflow into the fund; ② Despite being affected by Trump's tariff policies, the NASDAQ 100 Index has cumulatively fallen over 19% this year, and TQQQ has dropped over 50%, but traders have continuously increased their Shareholding in this ETF, with total inflow surpassing 3 billion USD this year.

On April 8, the top 20 trading volumes in the U.S. stock market: Apple has fallen for four consecutive days, with a drop of up to 23%.

On Tuesday, NVIDIA ranked first in U.S. stock trading volume, with a decline of 1.37% and a transaction of 47.37 billion USD. HSBC Analyst Frank Lee expressed caution regarding the future trend of NVIDIA Stocks, believing that there is limited room for growth.

Comments

- YouTube full video with explanation

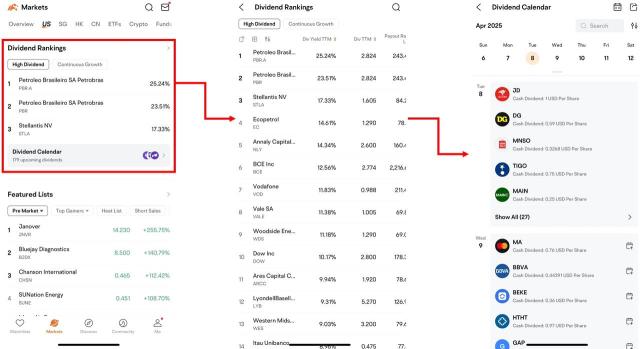

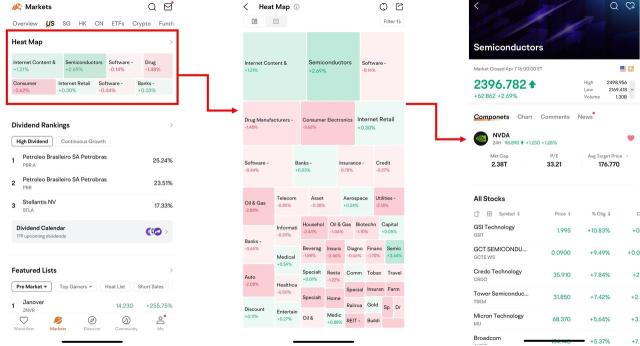

Recently, the market has been experiencing dramatic fluctuations. Many moomoo users are working hard to find their next investment opportunity. Team moomoo prepares 5 key features for you, aiming to help you better discover investment opportunities and navigate market volatility. Check them out now!

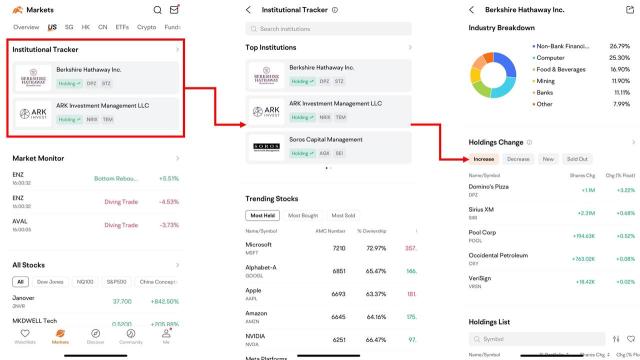

1.Institutional Tracker

...

After a brutal stretch of tariff-induced selling and tech capitulation, the Magnificent 7 roared back with a vengeance. But make no mistake — this is a trader’s bounce, not a policy pivot (yet).

Today’s Standout Movers:

• NVDA $NVIDIA (NVDA.US)$ : +5.66% — semis lit the fuse early and didn’t look back

• TSLA $Tesla (TSLA.US)$ : +5.50% — back above $245, reclaiming key levels

• MSFT $Microsoft (MSFT.US)$...

104274635 : your posting is for Monday ....