No Data

No Data

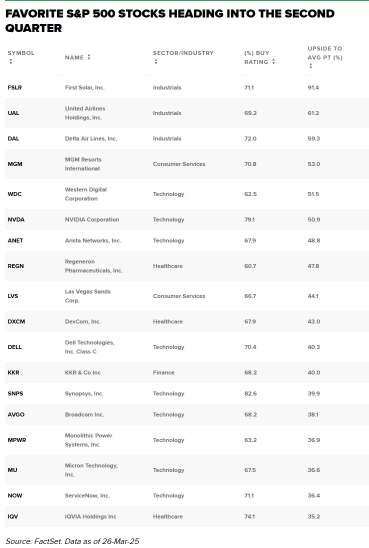

Express News | Macquarie Maintains Outperform on MGM Resorts International, Lowers Price Target to $48

A Quick Look at Today's Ratings for MGM Resorts International(MGM.US), With a Forecast Between $44 to $59

MGM Resorts International First Quarter 2025 Earnings: In Line With Expectations

Morgan Stanley: Hold a defensive strategy for the gaming stocks and selectively absorb. In the short term, it is recommended to go long on MGM CHINA (02282).

In the short-term outlook, JPMorgan adopts a defensive strategy, recommending to buy MGM CHINA (02282) with a Target Price of HKD 13.5, due to its strong profitability and relative value and yield performance.

Morgan Stanley has raised the Target Price of MGM CHINA (02282) to HKD 13.5 and listed it as the industry favorite, maintaining a "Shareholding" rating.

The company's market share remains at 15.7%, meeting the company's "double-digit" target, but still exceeding market expectations for this year.

Hong Kong stocks fluctuate | MGM CHINA (02282) rose over 3% during trading. Morgan Stanley indicated that its profits exceeded expectations again, with April's Macau Gambling income rising 1.7% year-on-year.

MGM CHINA (02282) rose over 3% during the trading session, as of the time of writing, it is up 2.79%, priced at 10.32 Hong Kong dollars, with a transaction amount of 38.5276 million Hong Kong dollars.