No Data

META250404P517500

- 12.60

- 0.000.00%

- 5D

- Daily

News

Meta Restricts Live Streaming For Teens Under 16 As Part Of Expanded Safety Measures

Express News | In Overnight Trading, Tech Giants Extend Losses; Nvidia and Meta Drop Over 3%, Palantir Slumps 4%

Tariff crushes hopes for a rebound in US stocks, the Dow plunged over 2,000 points during the session, the S&P erased more than 4% of its gains and turned negative, and Apple fell 11% from its daily high at one point.

NVIDIA, which rose over 8% in the early session, closed down more than 1%. Tesla, which rose over 7% in the early session, closed down nearly 5%. The China concept Index has closed down more than 5% for two consecutive days. The yield on the two-year U.S. Treasury bond dropped nearly 20 basis points during the session. The Swiss franc surged nearly 2% in the session. Bitcoin dropped over $5,000, falling below the 0.078 million mark during the session. Crude Oil Product once fell more than 4%. Copper rose over 4% during the session but later fell more than 2%.

U.S. stocks closed with an early rise followed by a drop, with the Nasdaq down over 2%. Apple and Tesla both fell nearly 5%.

① Nasdaq China Golden Dragon Index fell more than 5%; ② PHLX Semiconductor Index fell 3.57%; ③ Trump's administration promotes Coal project mining; ④ Canada's reciprocal tariffs on USA Autos will take effect.

Meta Platforms (META) Stock Moves -1.12%: What You Should Know

On April 8, the top 20 trading volumes in the U.S. stock market: Apple has fallen for four consecutive days, with a drop of up to 23%.

On Tuesday, NVIDIA ranked first in U.S. stock trading volume, with a decline of 1.37% and a transaction of 47.37 billion USD. HSBC Analyst Frank Lee expressed caution regarding the future trend of NVIDIA Stocks, believing that there is limited room for growth.

Comments

Recently, the market has been experiencing dramatic fluctuations. Many moomoo users are working hard to find their next investment opportunity. Team moomoo prepares 5 key features for you, aiming to help you better discover investment opportunities and navigate market volatility. Check them out now!

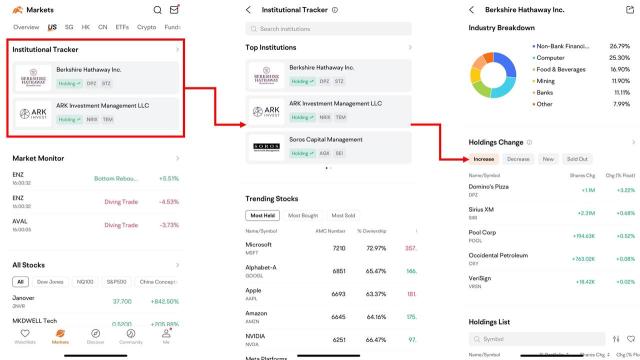

1.Institutional Tracker

...

After a brutal stretch of tariff-induced selling and tech capitulation, the Magnificent 7 roared back with a vengeance. But make no mistake — this is a trader’s bounce, not a policy pivot (yet).

Today’s Standout Movers:

• NVDA $NVIDIA (NVDA.US)$ : +5.66% — semis lit the fuse early and didn’t look back

• TSLA $Tesla (TSLA.US)$ : +5.50% — back above $245, reclaiming key levels

• MSFT $Microsoft (MSFT.US)$...

The custom will start collecting the duties from midnight 12:01 am.

The custom will start collecting the duties from midnight 12:01 am.

Cui Nyonya Kueh : Just to share, Institution tracker will need some time to track/ update. By the time they declare could have been too late.

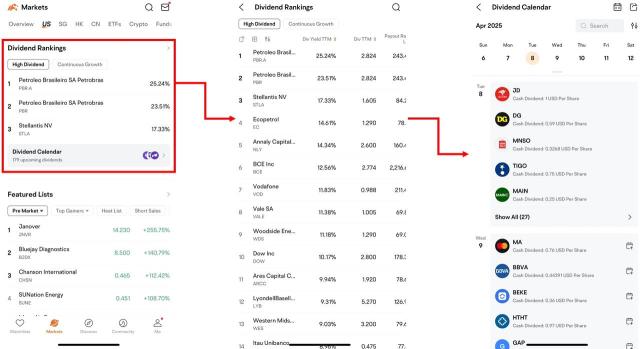

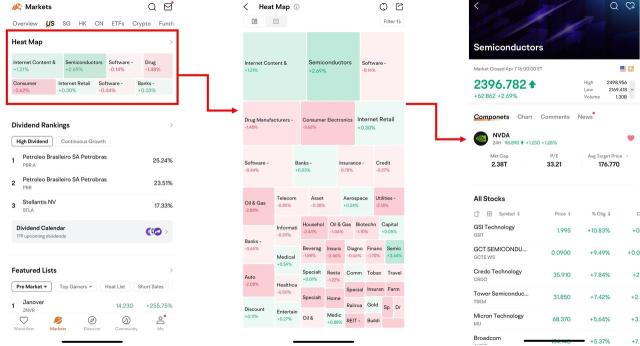

CNNT : Among the tools mentioned above, I have used the industry chain and heat map to understand where my target company sit in the value chain hierarchy and how the overall sector is doing over time.

I have yet to fully utilise the institutional tracker and investment themes, which I should have since its free resources.

For US stocks, I stay away from dividend stocks as much as I can due to the 30% WHT. I also got burnt badly by focusing on high dividend US stocks in my early investment days, a wary from experience case right here.

I wish Moomoo could have a feature that lets us see order blocks on the chart because I see some traders out there is the wild use it as a more reliable support/ resistance indicator.

104077697 : The chart displayed on the phone needs some optimization.