No Data

JPYUSD JPY/USD

- 0.006967

- +0.000010+0.14%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Nikkei Gains 1.0%, Led by Auto Stocks -- Market Talk

JGB Futures Consolidate Ahead of Holiday, BOJ Meeting -- Market Talk

Nikkei May Rise as Fears About U.S.-China Tensions Ebb -- Market Talk

Next week's important schedule: USA and Europe Q1 GDP, USA non-farm employment, China PMI, Buffett Shareholders' Meeting, Microsoft, Apple, Meta, and Amazon Earnings Reports.

Berkshire Hathaway Inc. will hold its Shareholder Meeting, Meta will host its first AI Developer Conference, the Bank of Japan will announce its interest rate decision, and Japan and the USA may engage in a second round of negotiations. In terms of data, pay attention to the USA and Eurozone's Q1 GDP, the USA's April non-farm payroll report, March's PCE price index, and China's April manufacturing PMI. Regarding Earnings Reports, focus on Microsoft, Meta, Apple, Amazon, Pfizer, Eli Lilly and Co, Coca-Cola, Kweichow Moutai, and others.

Bank of America Hartnett: Sell US stocks at highs, Buy Gold at lows.

Hartnett pointed out that as the "American exceptionalism" shifts to "American denialism," funds are flowing from the USA market to other regions, especially the Emerging Markets and Europe. Based on expectations of continued US dollar depreciation, increased market uncertainty, and rising demand for safe-haven assets, Hartnett remains Bullish on Gold.

The "Trump recession" has sparked a new trend in USA Social Media: learning how to survive tough days.

① As Trump imposed tariffs that impacted Global trade and the economy, Consumer panic about "an impending recession" reached its peak in recent years; ② In the face of economic uncertainty, many netizens have started to pay attention to posts on Social Media that teach "survival tips during a recession"; ③ American internet users have also discovered that due to the surge in living costs in recent years, the "money-saving tips" from more than a decade ago may no longer be effective today.

Comments

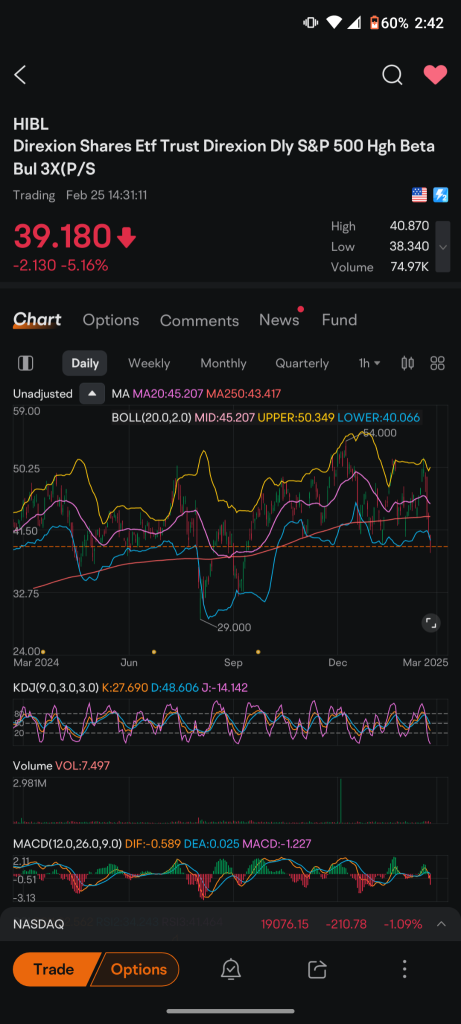

here's a chart that goes back to March of 24

with really the exception of July which was a bloodbath when the yen dollar started under one which climaxed in August 5th.

we are on a long-term support line here

you need to look at the portfolio so you understand what the holdings are and if you go ...

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $JPY/USD (JPYUSD.FX)$ $USD/JPY (USDJPY.FX)$ $Bank of America (BAC.US)$

?

? If this up, NVDA will be up too, I see SP500 in the title.

If this up, NVDA will be up too, I see SP500 in the title.