No Data

Tariff turmoil spurs a steep gamble, with the 30-Year/2-Year T-Note spread rising for nine consecutive weeks, breaking records.

In the trade war that President Trump of the USA is constantly escalating, investors are fleeing from long-term Bonds, causing long-term debt rates to surge.

So What, Exactly, Is a Recession Anyway? -- WSJ

About The Wall Street Journal Economic Forecasting Survey -- WSJ

A historic week has passed, with both the US stock market and Bitcoin rising in the end, but the market has completely changed!

The volatility of US stocks has rarely exceeded that of Emerging Markets and Bitcoin, while US Treasuries, which have always been regarded as safe Assets, have experienced severe fluctuations, prompting investors to begin questioning the wisdom of holding USA Assets. UBS Group believes that once the Global risk-free interest rates fluctuate, it means that all markets will be disrupted. Analyst Ed Al-Hussainy pointedly stated, "I'm not really worried about a recession; I'm worried about a financial crisis."

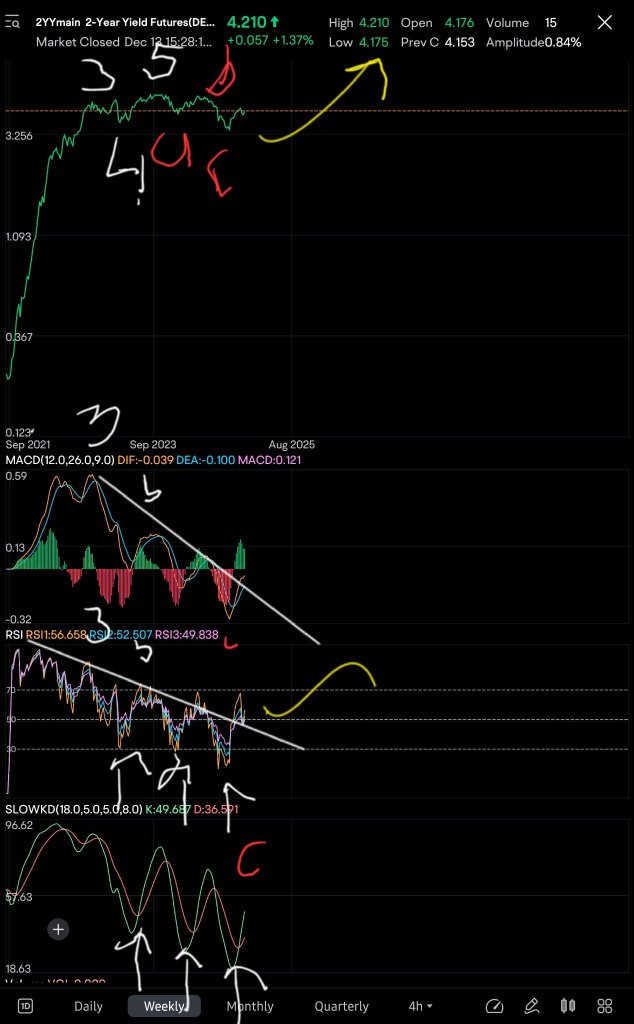

The sell-off of U.S. bonds continues! On Friday, the yield briefly broke 4.5%, and the White House stated that the Treasury Secretary is closely monitoring the bond market.

The U.S. 10-Year Treasury Notes Yield rose by a total of 49.52 basis points this week, marking the largest weekly increase since 2001. The White House stated on Friday that U.S. Treasury Secretary Yellen is closely monitoring the bond market trends and has communicated with the White House. Analysts believe that the movement of U.S. Treasuries signifies a significant shift in investors' perception of them. Typically, during turbulent times, investors view U.S. Treasuries as a safe haven. However, this week is entirely different, as traders speculate that due to escalating trade tensions, major bondholders in Japan are selling off U.S. Treasuries.

The head of JPMorgan warns: the Global economy faces a "sea of storms," and the "minor turbulence" in U.S. debt may prompt intervention from the Federal Reserve.

Dimon stated that the economic turmoil caused by tariffs makes it very important for Banks to maintain excess capital and sufficient liquidity. He expects that in the coming weeks, many large companies may cancel their earnings guidance when announcing their first quarter Earnings Reports. He observed a stagnation in corporate hiring and mergers and acquisitions. Dimon also anticipated a "small turmoil" in the USA Treasury market, which would compel the Federal Reserve to intervene.