No Data

HYG250411C100000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

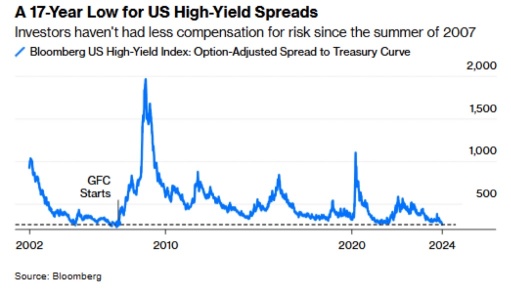

Treasury's $39B 10-yr Note Auction Draws Strong Demand Amid Broader Bond Selloff

Vanguard Sounds Alarm on Recession Risk as Tariffs Cause a Shock to the Market

Confounding Bond Selloff Continues as US10Y Briefly Tops 4.50% for First Time Since Feb

Today's Treasury Auction Could Make or Break the Bond Market

Trump's tariffs have triggered a wave of selling in U.S. bonds, with investors rushing to German government bonds for safety.

① As USA President Trump initiated reciprocal tariffs, causing a decline in global stock markets, the global Bonds market experienced severe fluctuations on Wednesday, with investors seeking safe Assets, and German government bonds became the preferred choice; ② The German government recently launched a massive fiscal plan covering infrastructure, climate, and defense sectors.

Safe-Haven Appeal of Dollar, Treasurys in Doubt -- Market Talk

Comments

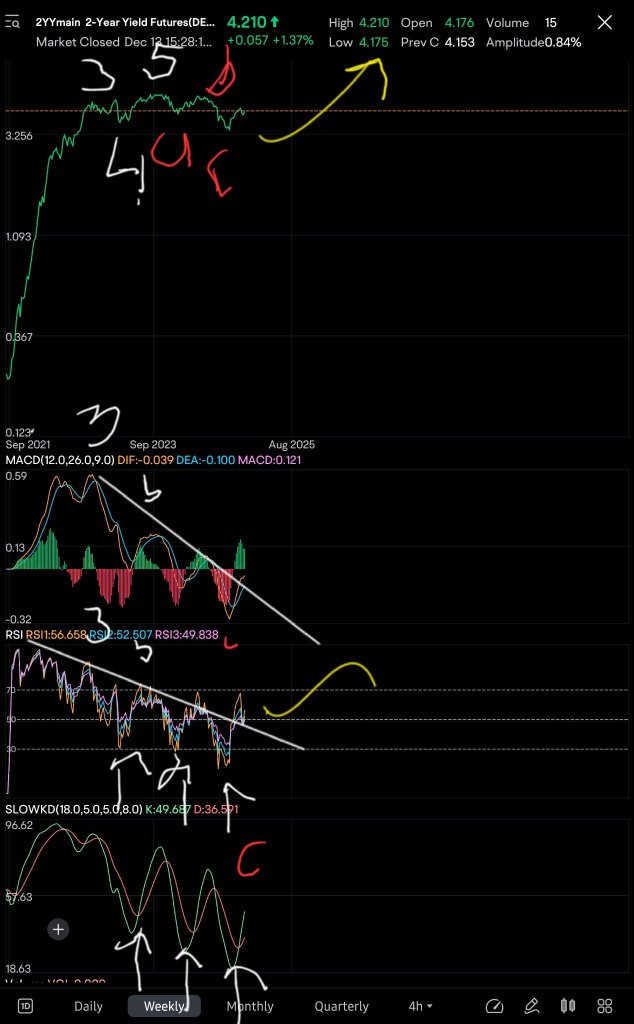

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...