No Data

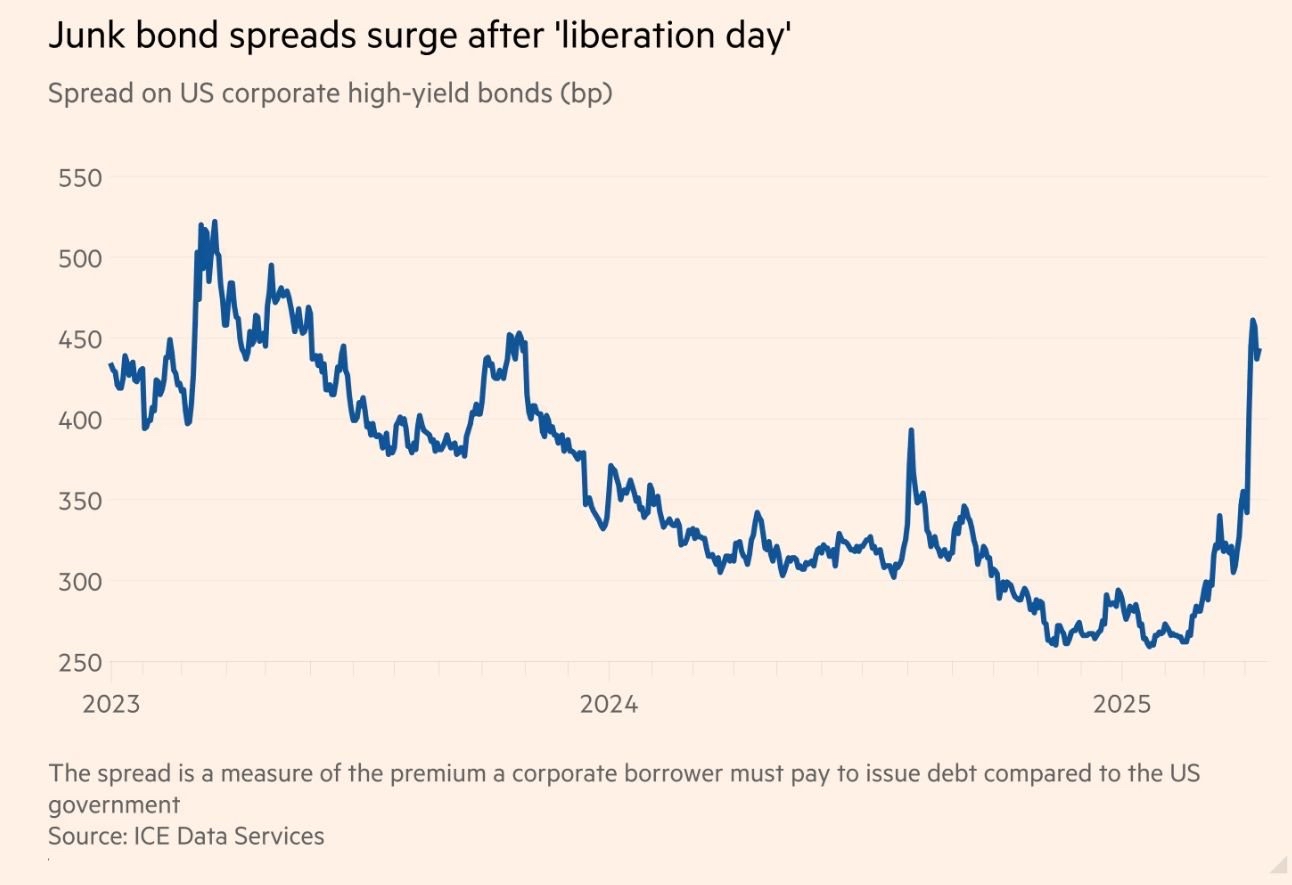

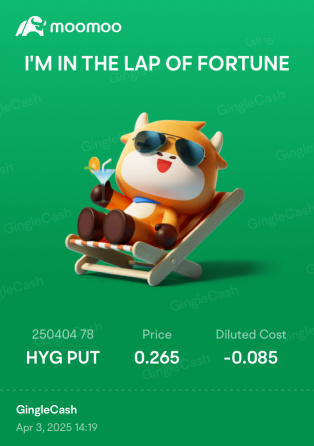

HYG Ishares Iboxx $ High Yield Corporate Bond Etf

- 78.870

- +0.170+0.22%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is It Time to Buy U.S. Treasuries on the Dip?

U.S. Quarterly Refunding Meeting Could Be Positive for Issuance Outlook -- Market Talk

Daily Roundup of Key US Economic Data for April 24

March US Durable Goods New Orders Post Much Larger-Than-Expected Gain, Lifted by Transporation Surge

The USA debt crisis is approaching, and BTC will reach a new high again.

An imbalanced world of policies, a world where trust is scarce, a world where debt is monetized - these are the main sources of Bitcoin's greatest bull market.

The long-term bear market for the US dollar has arrived! Deutsche Bank: This will have a profound impact on the Global economy and capital flows.

Deutsche Bank believes that the dollar bull market has ended and a bear market has begun. The core reasons include a decrease in the global willingness to finance the U.S. twin deficits, a peak in the holdings of U.S. Assets, and a tendency among many countries to promote growth through domestic fiscal measures. The EUR/USD Exchange Rates are expected to reach 1.15 by the end of 2025, gradually approaching 1.30 thereafter.

Comments

By Robert Musella – Founder of The Roman Sun Tzu Method™

⸻

“The battlefield is shifting—and only the prepared will survive.”

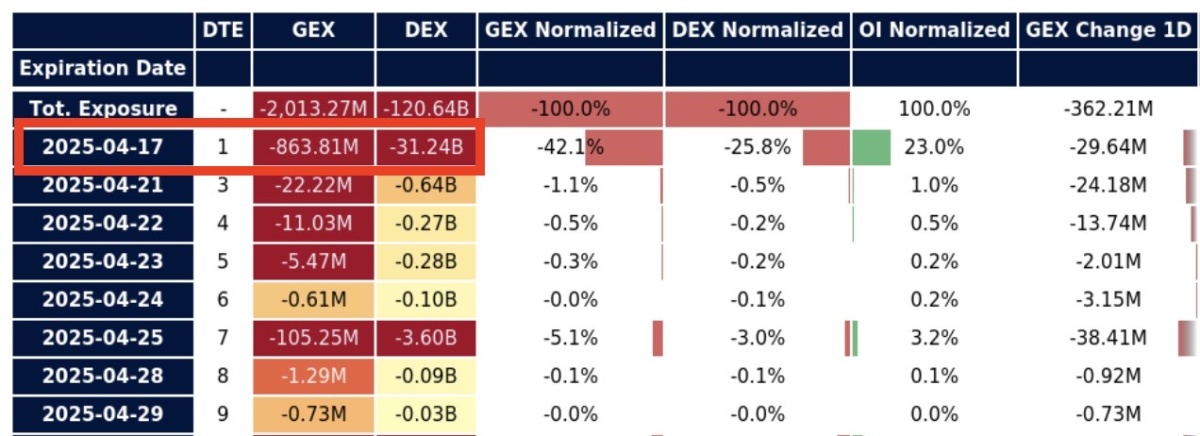

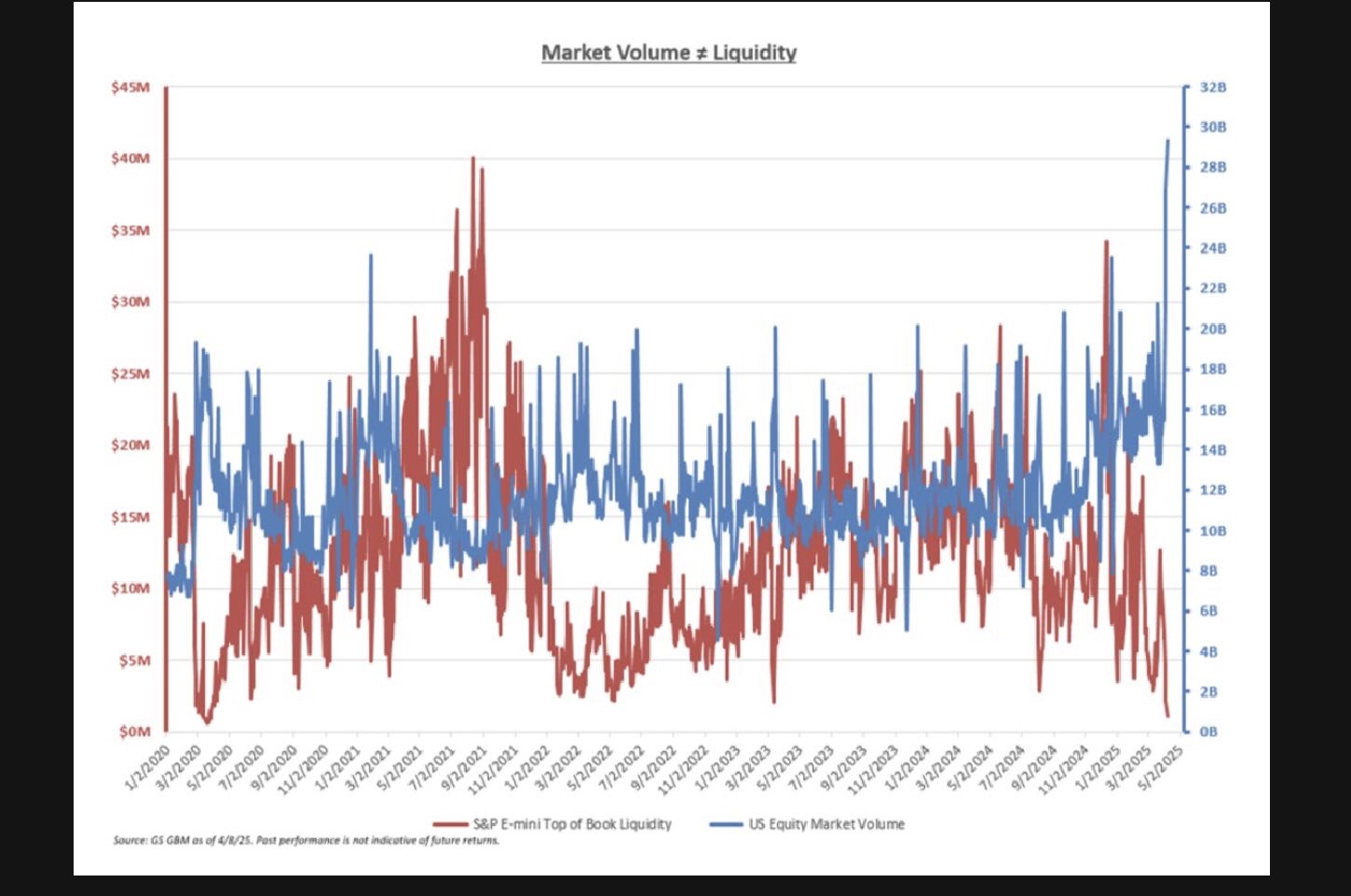

On April 17, we’re not just witnessing expiration-driven chop. We’re watching a multi-front war unfold across equities, credit, options, and global macro flows.

Let’s break down the signals that matter—and what they mean for your next move...