No Data

No Data

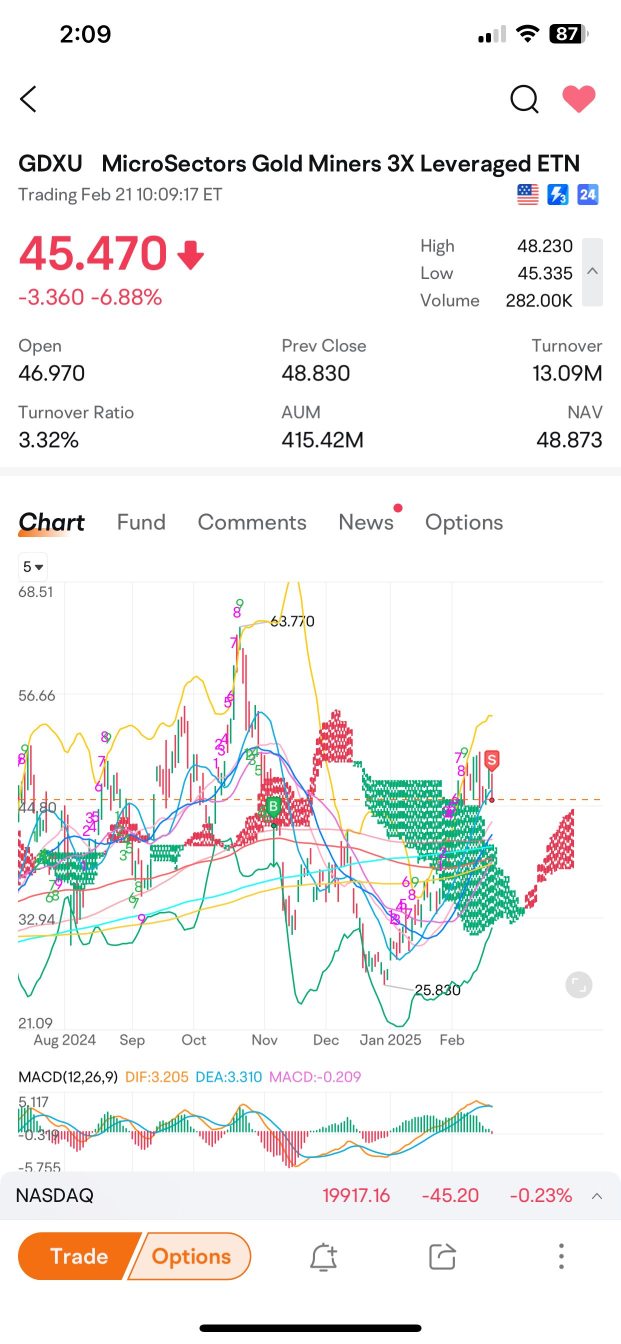

The central bank is accelerating its accumulation of Gold, ETF funds are flowing back, and the value of safe-haven assets is rising… Gold is facing favorable conditions!

Deutsche Bank believes that despite the pullback this week, the bullish fundamentals for Gold remain strong, and it is expected that gold prices will rise to $3,350 per ounce by the end of the year. Traditional pricing models based on the dollar, real interest rates, and risk sentiment have become difficult to explain the trend of gold prices; Gold may have entered a "new normal" driven by structural factors, especially the central bank Bid.

Gold Prices Hit 3-wk Low as Market Turmoil Forces Investors to Cash Out

China has increased its Shareholding in Gold for five consecutive months.

As of the end of March, China's Gold reserves were 73.7 million ounces, compared to 73.61 million ounces at the end of February, an increase of 0.09 million ounces or 0.15%. As of the end of March 2025, the country's Forex reserves amounted to 3,240.7 billion USD, an increase of 13.4 billion USD from the end of February, a rise of 0.42%.

Update: Gold Falls as Markets Tumble on Tariff Wars Even as U.S. Hiring Surged in March

Gold Futures Close Lower Amid Price Correction, Tracking Comex Performance And US Tariff Exemption

Gold Surges to Record High Amid Trump's Escalating Tariff Policies

loading...