No Data

US Stock MarketDetailed Quotes

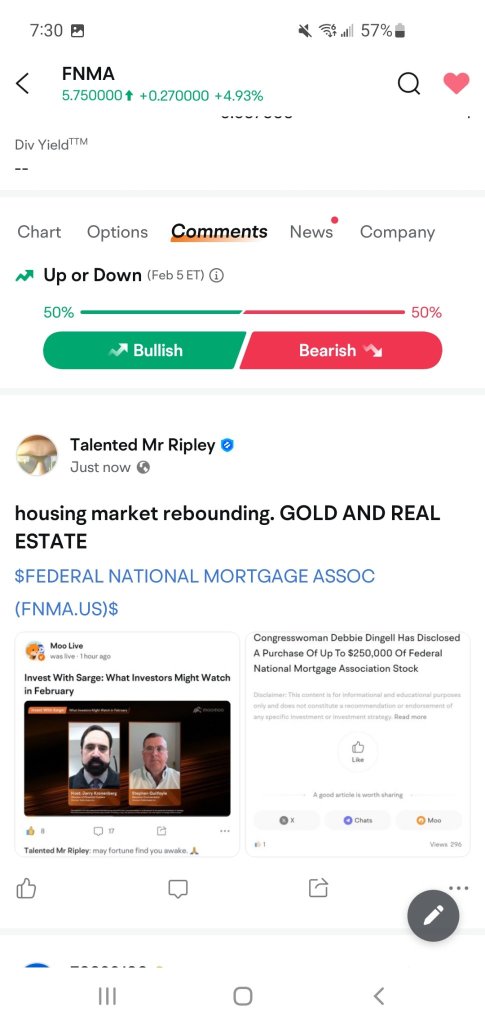

FNMA FEDERAL NATIONAL MORTGAGE ASSOC

- 6.080

- -0.290-4.55%

15min DelayTrading Apr 25 11:02 ET

7.04BMarket Cap6080.00P/E (TTM)

6.320High6.045Low2.43MVolume6.290Open6.370Pre Close15.03MTurnover0.21%Turnover Ratio6080.00P/E (Static)1.16BShares8.00052wk High-0.16P/B7.04BFloat Cap1.02052wk Low--Dividend TTM1.16BShs Float8.000Historical High--Div YieldTTM4.32%Amplitude0.351Historical Low6.193Avg Price1Lot Size

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

The economic uncertainty is too great, and Americans are afraid to buy houses now.

High interest rates continue to stifle market demand, coupled with tariffs increasing economic uncertainty, leading to a collapse in USA home sales in March, reaching the worst level since the financial crisis.

Housing Market Stalls as Homeowners Struggle to Sell - 'We're Really Bleeding'

Home Sales in March Fell 5.9%, Biggest Drop Since 2022 -- 4th Update

Existing-Home Sales Fall More Than Projected as Prices Hit March Record

US Existing Home Sales Fall More Than Expected in March

March US Existing Home Sales Decline More Than Expected, Largest Monthly Drop Since November 2022

Comments

Before the Bell U.S.

U.S. stock index futures for the three major indices rise; Bitcoin gains nearly 3%, approaching the $88,000 mark.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ rose 1.1%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went up by 1.32%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went up 364 points, or 0.86%.

Top News

Weaker Dollar May Boost US Stocks, Says Morgan Stanley

Morgan Stanley's...

U.S. stock index futures for the three major indices rise; Bitcoin gains nearly 3%, approaching the $88,000 mark.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ rose 1.1%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went up by 1.32%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went up 364 points, or 0.86%.

Top News

Weaker Dollar May Boost US Stocks, Says Morgan Stanley

Morgan Stanley's...

25

5

14

$FEDERAL NATIONAL MORTGAGE ASSOC (FNMA.US)$ The price will go up again..like Bank America...

2

I could only lose so much money on this. I was hopeful for some momentum this pm, and it continued down. So, like any rational person, I sold. Now it is back in compliance, coupled with yesterday's earnings release, and will soar. I could buy back in, but I'm so mad right now, I think I'm taking a break from pennies for a bit. If anyone is interested, FNMA just released their earnings, today, and it's set to do well.

$Phoenix Motor (PEV.US)$

$FEDERAL NATIONAL MORTGAGE ASSOC (FNMA.US)$

$Phoenix Motor (PEV.US)$

$FEDERAL NATIONAL MORTGAGE ASSOC (FNMA.US)$

3

2

Read more

10baggerbamm : it never cease to do amaze me the level of stupidity that exists with these major wire houses.

a strong dollar hurts the US stock Market that's a fact.

a weak dollar benefits US stocks that is 100% guaranteed.. you want the US dollar week because it permits your exports to increase and of course if we had fair trade it would make the USA generating mass of surplus and not trade deficits but that's a subject for different matter. the same thing exists with us stocks when the dollar is strong other countries other people other investors don't buy US stocks because they lose their purchasing power and if the dollars only going up when they convert back to their currency they get a double hit so their losses are compounded and their gains are reduced.

that's why he won a weak dollar relative to other currencies.

well what happened at the end of fourth quarter last year the dollar went on this parabolic run straight up compared to other currencies. you had a mass Exodus of money leave the US market chasing European stocks for the same reason that these bobbleheads buy small caps in this country because they think it represents a value because European stocks haven't done crap in years and it's about time they play catch up that's the logic. well now you have the dollar dropping. and foreign monies that were investing in Europe are now going to come back to the US marketplace because their currency buys them more of US stocks.

so to have this investment banker say that a week or dollar May benefit US stocks it's asinine it's a horrible statement because anybody with a brain in your head understands why people buy and why people leave a market when currency is strong or weak there's 100% correlation

美丽的泡沫 : cool

Warren Buffed 10baggerbamm : amazing

Annoynimous : Jerome Powell defied Trump's policy that NEEDS a lower interest rate to work. Inflation this time is not because people have more money to spend, but because borrowing is expensive and imports are more expensive. Lowering interest rate is the last piece of the puzzle because it makes American goods cheaper to foreign importers.

PAUL BIN ANTHONY : https://www.tipranks.com/news/general-motors-nysegm-and-dodge-owner-stellantis-rally-on-tariff-flexibility-hopes?utm_source=moomoo.com&utm_medium=referral