No Data

EETH250516C36000

- 1.29

- 0.000.00%

- 5D

- Daily

News

What is a reciprocal tariff? How does it affect the cryptocurrency Industry?

When governments of various countries start imposing tariffs on each other, it sends a signal of instability - and financial markets dislike uncertainty. When Global trade flows are disrupted, Stocks, Bonds, and Cryptos will react.

Wall Street is frantically increasing its Bitcoin positions, Ethereum has surged by 2400, a massive short squeeze for OZK is coming, and the SOL Indicators have exploded. It will rise to 180U next week.

Bitcoin continues to hover between 94,000 and 95,000, with small fluctuations and an upward trend; a top structure has not yet appeared. After reaching 90K this time, there hasn't been a significant pullback, but instead, many smaller assets have started to rise as well. If it doesn't fall back below 90K during this wave, it will aim for the 100K milestone.

Bitcoin ETF Inflows Hit $442M on April 24 as IBIT Leads – Institutional Demand Fuels BTC Rally

Fed Greenlights Crypto Banking Support – Is Bitcoin Set to Benefit?

The cryptocurrency sector welcomes Bullish news! The Federal Reserve announces the withdrawal of cryptocurrency regulatory guidelines.

① On April 25, the Federal Reserve announced the withdrawal of two regulatory guidelines related to Crypto activities and updated the relevant Business expectations standards; ② This move means that Banks do not need to obtain prior approval from regulatory Institutions before engaging in Crypto and stablecoin activities; ③ This reflects the latest initiative of the Trump administration to take a more friendly stance toward Cryptos, resulting in a rise in Bitcoin.

Avail Joint Creation: Ethereum may achieve high throughput chains through the expansion of multiple L2s.

Anurag Arjun, the co-founder of Avail, stated that multiple execution layers with different block times provide Ethereum with a unique value proposition.

Comments

In today's discussion, I would like to share with you a few groups of ETFs that are either on my watchlist and/or portfolio and, at the same time, would like to hear from your comments and opinions.

In my previous post on 11 approved bitcoin ( $Bitcoin (BTC.CC)$ ) ETFs that will start trading on January 11, 2024, 90% voted that they will definitely trade these bitcoin ETFs. The survey...

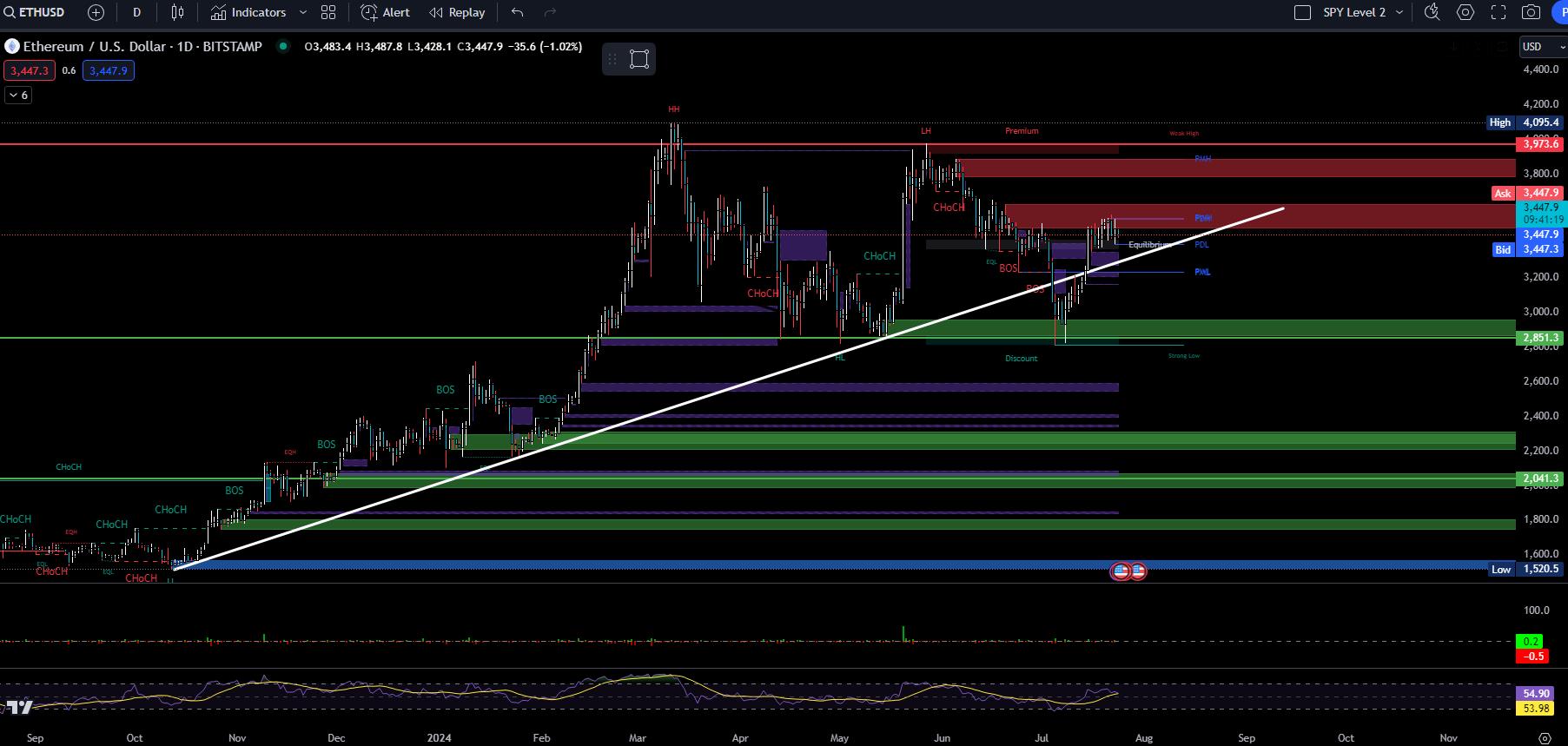

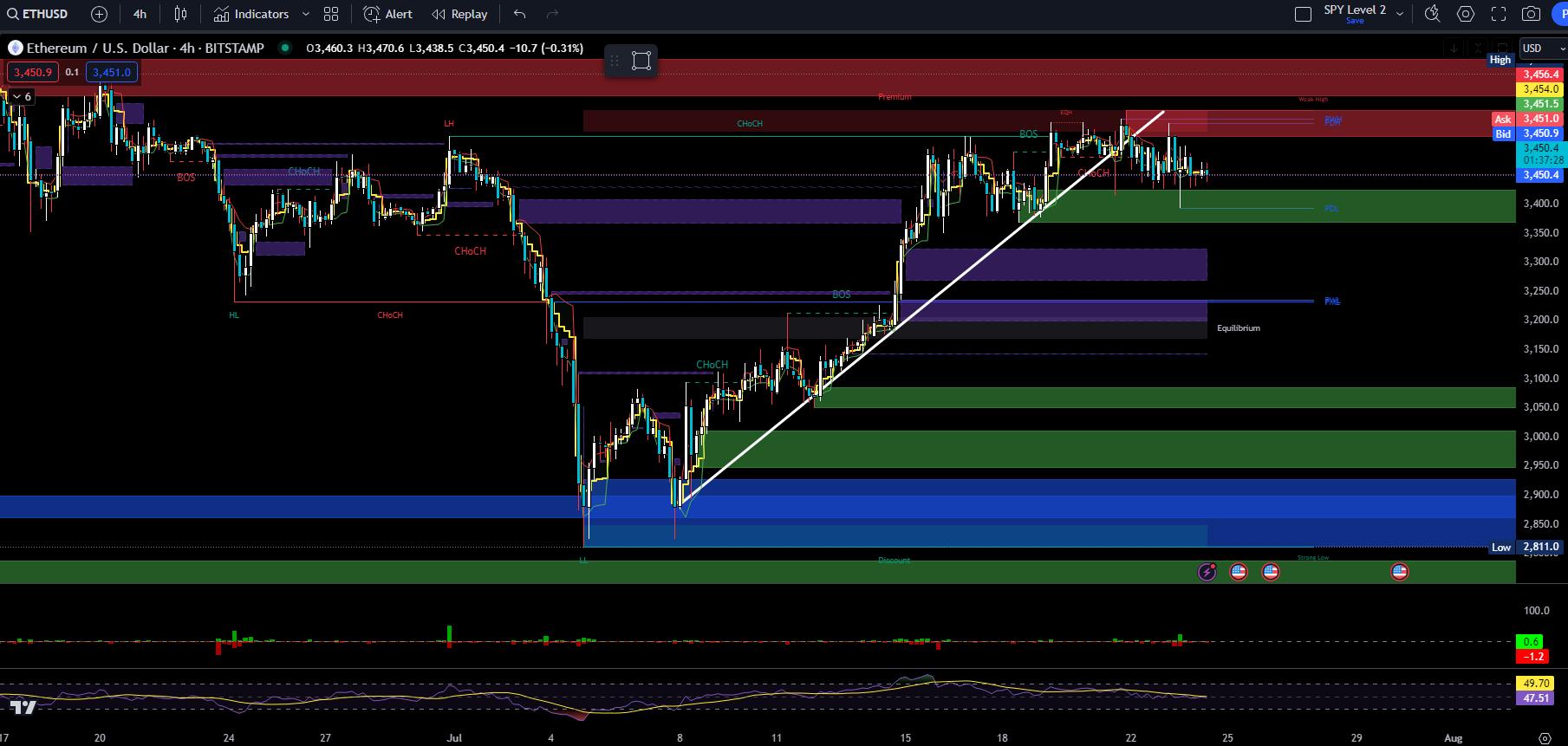

First and foremost, I have to apologize once again for the lack of articles this week and the previous week. Between the IT outage, personal events, and work related assignments; I have not had the time to write an article the way that I want to. However, I have some free time this morning and so lets go over the charts and Market news!

Before we begi...

These are for $Ethereum (ETH.CC)$

$ProShares Ether ETF (EETH.US)$ $ProShares Ultra Ether ETF (ETHT.US)$ $ProShares UltraShort Ether ETF (ETHD.US)$ $Volatility Shares 2x Ether ETF (ETHU.US)$

while these are for $Bitcoin (BTC.CC)$

$ProShares UltraShort Bitcoin ETF (SBIT.US)$ $ProShares Ultra Bitcoin ETF (BITU.US)$ $ $2x Bitcoin Strategy ETF (BITX.US)$ $T-Rex 2X Inverse Bitcoin Daily Target ETF (BTCZ.US)$ $T-Rex 2X Long Bitcoin Daily Target ETF (BTCL.US)$

���������...