No Data

US OptionsDetailed Quotes

BAC250404C40500

- 0.01

- 0.000.00%

15min DelayTrading Apr 4 16:00 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume492 Open Interest40.50Strike Price0.00Turnover0.00%IV13.22%PremiumApr 4, 2025Expiry Date0.00Intrinsic Value100Multiplier-6DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma3578.00Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Intraday

- 5D

- Daily

News

Express News | Goldman Sachs Down 1.1%, Citigroup Down 1.2%, Bank of America Falls 0.4%

Express News | Shares of Major U.S. Banks Fall After Big Bank Results

Wells Fargo & Co (WFC.US) Q1 cost control and Crediting loss provision exceeded expectations, loan demand is weak under the shadow of tariffs.

The Earnings Reports show that the bank successfully controlled overall expenses in the first quarter, and the Crediting loss provisions were lower than the general expectations of Wall Street Analysts.

Bank of America Q1 2025 Earnings Conference Call

Is Bank of America Corporation (BAC) Among the Best Digital Payments Stocks to Buy According to Analysts?

Is a Recession Looming? Big Banks' Earnings Could Be an Early Indicator of Financial Strain.

Comments

$JPMorgan (JPM.US)$ $Bank of America (BAC.US)$ $Bitcoin (BTC.CC)$ Why is JP Morgan not up $10?

If today was another day in another time JP Morgan would be up double digits

the initial inclination by some people might be consumers credit is potentially a risk and consumers are tapped and they might start defaulting and that would potentially impact the bank.

it's really not the problem in my opinion

the problem is MBS

it's mortgage-backed securities China owns $750 billion in treasuries but holds...

If today was another day in another time JP Morgan would be up double digits

the initial inclination by some people might be consumers credit is potentially a risk and consumers are tapped and they might start defaulting and that would potentially impact the bank.

it's really not the problem in my opinion

the problem is MBS

it's mortgage-backed securities China owns $750 billion in treasuries but holds...

7

2

1

$Bank of America (BAC.US)$ Time to chip in once the market open for trade sooner will hit around 37-40

Bank of America Q1 2025 earnings conference call is scheduled for April 15 at 8:30 AM ET /April 15 at 8:30 PM SGT/April 15 at 11:30 PM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Bank of America's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Bank of America's management has to say!

Disclaimer:

This presentation is for ...

Beat or Miss?

What do you expect from Bank of America's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Bank of America's management has to say!

Disclaimer:

This presentation is for ...

Bank of America Q1 2025 earnings conference call

Apr 15 07:30

Book

Book 4

$Bank of America (BAC.US)$ going down

2

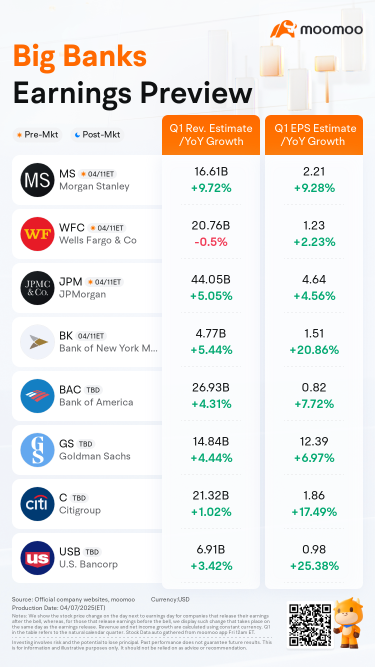

The Q1 2025 earnings season is here, with top U.S. banks ready to share their results. $JPMorgan (JPM.US)$, $Wells Fargo & Co (WFC.US)$, and $Morgan Stanley (MS.US)$ report this Friday, April 11. $Goldman Sachs (GS.US)$ follows on Monday, April 14, with $Bank of America (BAC.US)$ and $Citigroup (C.US)$ wrapping up on Tuesday.

Bank Stocks Wobble Amid Tariff Jitters

Bank stocks have been on a tear in recent months, riding hopes of lighter regulation und...

Bank Stocks Wobble Amid Tariff Jitters

Bank stocks have been on a tear in recent months, riding hopes of lighter regulation und...

+3

27

3

5

Read more

JoeskiTheRookie : what do you think the end goal wimwill be between US and China whth the tarriffs and trade war? just curuous. it doesn’t seem like china is gonna budge but i also think it would be weak as fuck if trump now gave into them because they are pushing back. i dont see why so many investors are so relieved about the 90 day pause but i feel like this is still inevitable going to get much worse before it gets better.

10baggerbamm OP JoeskiTheRookie : China's going to budge and Trump's going to be budging there's going to be a concession made China has more to risk because they export 15% of their total economy to the United States what the US exports to China is like 1% of GDP it's piss it's nothing so from a risk reward China is the one that has the greatest amount to lose not the United States.

that being said there has to be stabilization on a global level the fact that Trump wants world Peace he wants to end the wars between Hamas and Israel which is really Iran and Israel and it's a two-step process it's having Iran sign a piece of paper saying no nuclear program and it's going to be massive sanctions against Iran which is very simply if you do business with Iran if you buy oil from Iran I'm going to have 75 countries abandon your country's products your company's economy collapses that's leverage that's where all this big picture is going.

Trump's going to have 75 Nations ironclad in agreement not to permit China to dump goods in their country to re export to the US to avoid tariffs. or severe sanctions take place so this is a trade war just as if it's a shooting war that's being negotiated between Trump and XI.

they both know what's going on and in the rule of sales XI blinked first he lost. what's happening now is really just a matter of semantics China has 125% on us nobody in China is buying us goods with that rate and the reality is an iPhone that was $1,000 according to Dan Ives ultimately would be $3,000 if it's made in the US I got news for you Apple screwed their Market will drop dramatically people just buy Android or they'll just hold on to their older iPhone.

I think we're reaching a Apex event a climactic event real soon that's why China came out and said we're not going to retaliate anymore against the US it's laughable

there's no market for us products in China alternatively you'll see a US shift in consumption if manufacturers think that they're going to pass on $125% increases to the customer customers aren't going to buy it a few will but most won't well what does that do to the manufacturing business in China you're going to millions of unemployed people.

that's why we're coming to A capitulation event with these trade negotiations we're basically right there it's just what will the final numbers be and they're going to be at lower levels China's not going to be 125 us isn't going to be 125 that's last night it's going to be at a reduced level we'll see what happens