US ETFDetailed Quotes

ASHS db X-trackers Harvest CSI 500 China A-Shares Small Cap Fund

- 27.624

- +0.030+0.11%

Close Apr 25 16:00 ET

27.630High27.530Low

27.630High27.530Low3.69KVolume27.610Open27.594Pre Close101.90KTurnover0.39%Turnover Ratio--P/E (Static)950.00KShares40.75952wk High--P/B26.24MFloat Cap22.54052wk Low0.19Dividend TTM950.00KShs Float67.664Historical High0.69%Div YieldTTM0.36%Amplitude20.301Historical Low27.600Avg Price1Lot Size

$Hang Seng Index (800000.HK)$

Silver Lining?

The market is beginning to look more and more bearish lately. But stocks can't fall forever. Typically, after a major selloff, you could expect a slight rebound in price as short swing traders take up profit and investors buy up shares at a relative discount.

This might be what is happening in the Hang Seng Index today as we have a possible silver lining in the technical picture.

Technical Outlook

In the...

Silver Lining?

The market is beginning to look more and more bearish lately. But stocks can't fall forever. Typically, after a major selloff, you could expect a slight rebound in price as short swing traders take up profit and investors buy up shares at a relative discount.

This might be what is happening in the Hang Seng Index today as we have a possible silver lining in the technical picture.

Technical Outlook

In the...

+1

14

19

$Hang Seng TECH Index (800700.HK)$

If you followed my previous post about bearish patterns popping up around the market, then I've got another one for you. Check out the previous post in the link below.

Another Bearish Technical Development

When sentiment in equity marktes worldwide is turning bearish, then you will see a lot of the more bearish technical patterns showing up in the charts. Here is an example below with the Hang Seng Index. A head and s...

If you followed my previous post about bearish patterns popping up around the market, then I've got another one for you. Check out the previous post in the link below.

Another Bearish Technical Development

When sentiment in equity marktes worldwide is turning bearish, then you will see a lot of the more bearish technical patterns showing up in the charts. Here is an example below with the Hang Seng Index. A head and s...

24

24

6

Why has BABA's price remained stagnant for the majority of this year? After the Chinese stimulus rally near the beginning of this year. Alibaba's share price has had trouble climbing out of the long-term bear market it has been in for quite a while.

$Alibaba (BABA.US)$

Macro

Currently, the chinese economy is not exactly the strongest economy, but it has been showing signs of slight expansion based on some of the more recent data.

Investors are mostly worried about the chines...

$Alibaba (BABA.US)$

Macro

Currently, the chinese economy is not exactly the strongest economy, but it has been showing signs of slight expansion based on some of the more recent data.

Investors are mostly worried about the chines...

+2

14

6

3

$Hang Seng Index (800000.HK)$

Macro Picture

Chinese economic data continues to come in stagnant. So far, I dont see anything major within the data recently that looks dovish for Chinese markets. Sometimes, the stock market will defy the economic data, but at the moment, the Hang Seng Index looks stagnant, just like the economic data.

It seems like everybody is waiting for a big stimulus announcement before the market can go bullish again. The last major stimulus package sent chine...

Macro Picture

Chinese economic data continues to come in stagnant. So far, I dont see anything major within the data recently that looks dovish for Chinese markets. Sometimes, the stock market will defy the economic data, but at the moment, the Hang Seng Index looks stagnant, just like the economic data.

It seems like everybody is waiting for a big stimulus announcement before the market can go bullish again. The last major stimulus package sent chine...

+3

16

9

3

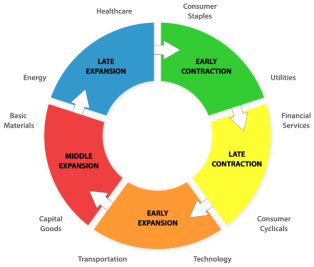

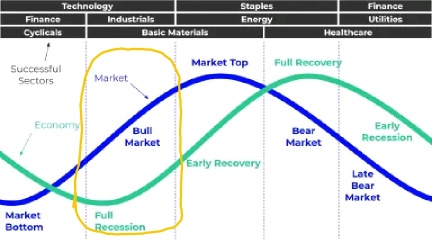

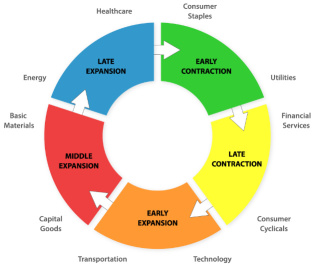

Sector Rotation

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

+2

109

36

54

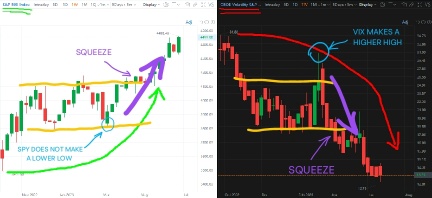

$CBOE Volatility S&P 500 Index (.VIX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$

VIX had a major gap up overnight with a big spike in volume. SPY opened up today with a big gap down in price as investors shorted the market.

Is it a good time to short the market after this huge rally? Or will the shorts that pushed the VIX up overnight get squeezed again like they did last April.

Don't fomo or pan...

VIX had a major gap up overnight with a big spike in volume. SPY opened up today with a big gap down in price as investors shorted the market.

Is it a good time to short the market after this huge rally? Or will the shorts that pushed the VIX up overnight get squeezed again like they did last April.

Don't fomo or pan...

16

1

1

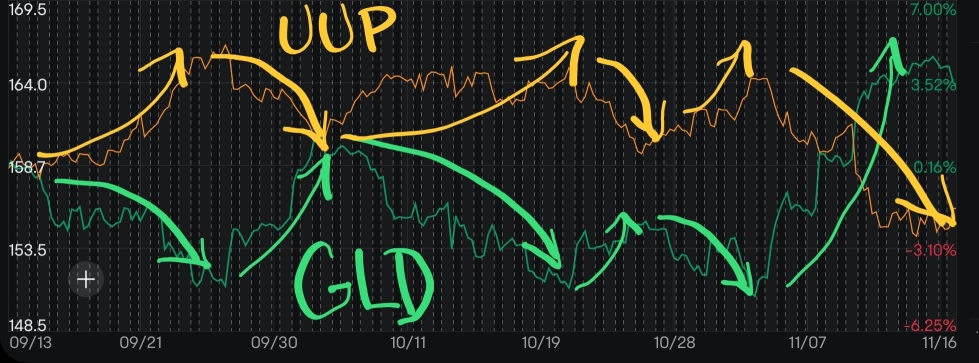

Narrative vs. Sentiment

The narrative in world markets changes regularly. These narratives control market sentiment and essentially direction of price action within the markets.

Market narratives range from a global pandemic, war, skyrocketing inflation or interest rates, slowing economic data, recession fears, or even improving economic data. Instances like these occur on a regular basis, and they can change the direction in markets. Ge...

The narrative in world markets changes regularly. These narratives control market sentiment and essentially direction of price action within the markets.

Market narratives range from a global pandemic, war, skyrocketing inflation or interest rates, slowing economic data, recession fears, or even improving economic data. Instances like these occur on a regular basis, and they can change the direction in markets. Ge...

23

22

3

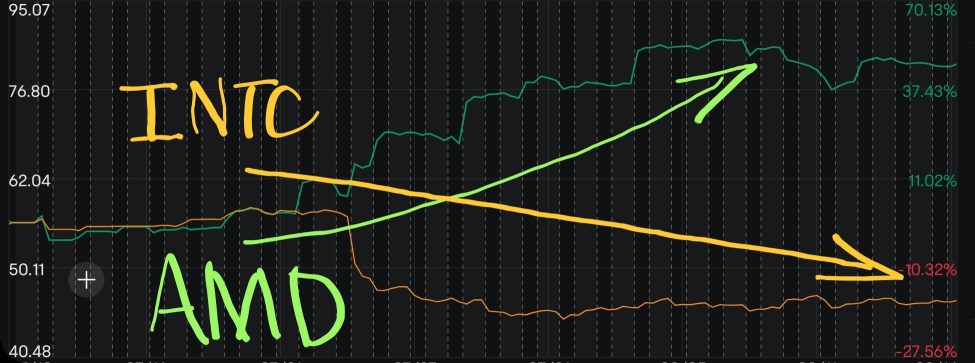

There are several instances when a positive catalyst for one security can be a negative catalyst for another type of security. This can happen for many reasons, such as macroeconomic factors, competition, or intra market mechanics. Here are a few examples of inverse trade pairings.

Competition

Go Long: $ $Advanced Micro Devices (AMD.US)$

Go Short: $ $Intel (INTC.US)$

These two are in the semiconductor space. This sector is in full rally mode, so going short on either of t...

Competition

Go Long: $ $Advanced Micro Devices (AMD.US)$

Go Short: $ $Intel (INTC.US)$

These two are in the semiconductor space. This sector is in full rally mode, so going short on either of t...

52

12

8

When Is a Good Time To Buy IMPP?

IMPP had its IPO during the time when energy and commodity markets were in a massive rally due to the Russian war and supply chain challanges. This ticker symbol had one of the best spikes in price compared to the entire energy sector. It was trading like a meme stock on certain days. The hype and euphoria seem to be lingering with this stock even though the share price has been falling for quite a while, and the energy bull run seems...

IMPP had its IPO during the time when energy and commodity markets were in a massive rally due to the Russian war and supply chain challanges. This ticker symbol had one of the best spikes in price compared to the entire energy sector. It was trading like a meme stock on certain days. The hype and euphoria seem to be lingering with this stock even though the share price has been falling for quite a while, and the energy bull run seems...

+3

7

8

2

$NVIDIA (NVDA.US)$

NVDA is currently one of the strongest equities in the stock market. Last week, after printing all-time highs, the ticker closed in the red. Will there be more selling this week for the semiconductor company? Or will NVDA climb to new all-time highs next week?

It appears that NVDA is forming a consolidating ranging pattern. The pattern is not quite confirmed yet, but if this week starts off with strong selling, then the resistance of this ...

NVDA is currently one of the strongest equities in the stock market. Last week, after printing all-time highs, the ticker closed in the red. Will there be more selling this week for the semiconductor company? Or will NVDA climb to new all-time highs next week?

It appears that NVDA is forming a consolidating ranging pattern. The pattern is not quite confirmed yet, but if this week starts off with strong selling, then the resistance of this ...

7

4

2

No comment yet

SpyderCall OP : @102640653

I'm still bearish at the moment. I need to see more upside. But if there was a solid technical level to buy in, then the fib levels are great for that. I still need to see more upside

SpyderCall OP SpyderCall OP : I'm checking out tencent and baba. give me a few minutes for those

102640653 : Agreed I’m also waiting for the first zone to be broken 18550-18620. I am also looking at sse index as hangseng just closely follow its movement. It’s just like sse is leading its way n the rest of the index mainly china a50, hangseng follows together . Thanks .

102640653 : Just look at sse movement . Good movement with China a50 but hongkong slow to follow in afternoon .

102640653 : Usually in afternoon trade hangseng would be consolidating n after 3 will make some moves but today is exceptional. Something more is there . All the heavyweight r picking up again after lunch . Just keep. An eye open.

View more comments...