No Data

7741 Hoya

- 16615.0

- +70.0+0.42%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average rose significantly by 666 yen for three consecutive days, supported by reduced concerns over the US-China trade friction = Afternoon session on the 25th.

On the 25th, the Nikkei average stock price in the afternoon session rose significantly by 666.59 yen to 35,705.74 yen, marking its third consecutive day of gains. The TOPIX (Tokyo Stock Price Index) also increased by 35.47 points to 2,628.03 points. In the U.S. market on the 24th, expectations for trade normalization continued due to a significant reduction in tariffs on China, with both the Dow Inc and the Nasdaq Composite Index rising for three consecutive days. Japanese stocks also saw buying leading.

Earnings Preview: Hoya (ADR) to Report Financial Results Post-market on April 30

The Nikkei average rebounded significantly by 588 yen, marking a major rise for the first time in three days, with buybacks dominating and over 80% of Main Board rising stocks.

On the 23rd, the Nikkei average in the morning session rebounded significantly for the first time in three days, rising by 588 yen and 20 sen to 34,808 yen and 80 sen. The TOPIX (Tokyo Stock Price Index) also continued to rise, increasing by 44.08 points to 2,576.20 points. At 9:07 AM, the Nikkei average reached 35,142 yen and 12 sen, climbing 921 yen and 52 sen, marking the first time in about three weeks during trading hours that it crossed the 35,000 yen mark. Due to a weaker yen and reduced concerns over the US-China trade frictions, there was a buyback focused on export stocks. After the buy was settled, there was a wait for a rebound.

The Nikkei average is down about 85 yen, showing a weak trend following the decline in U.S. stocks = pre-market on the 22nd.

On the 22nd at around 10:08 AM, the Nikkei Average was trading at approximately 34,195 yen, down about 85 yen from the previous day. At 9:44 AM, it reached a low of 34,109.85 yen, down 170.07 yen. In the USA market on the 21st, the composite Index ETF for March's leading economic indicators fell below market expectations, and with President Trump continuing to call for interest rate cuts from the Federal Reserve, both the Dow Inc and Nasdaq Composite Index dropped for four consecutive days. As a result, Japanese stocks were also facing Sell pressure.

Sumitomo Electric, Kobayashi Pharmaceutical ETC (Additional) Rating

Target Price Change Code Stock Name Securities Company Previously Changed After-----------------------------------------------<1928> Sekisui House City 4500 yen 3900 yen <2413> M3 GS 2300 yen 2150 yen <3116> Toyota Boshoku GS 2300 yen 2000 yen <3281> GLP Nomura 166000 yen 160000 yen <4151> Kyowa Kirin GS 2500 yen 2400 yen <4483> JMDG GS 47

Rating information (Target Price change - Part 2) = Fuji Oil Group, Elecom, ETC

◎Mizuho Securities (three stages: Buy > Hold > Underperform) Fuji Oil Industry <2607.T> -- "Buy" → "Buy", 3,950 yen → 4,550 yen Cosmos Pharmaceutical <3349.T> -- "Buy" → "Buy", 10,500 yen → 11,200 yen Komeda <3543.T> -- "Buy" → "Buy", 3,300 yen → 3,400 yen Ryohin Keikaku <7453.T> -- "Buy" → "Buy", 4,400 yen → 5,200 yen Saizeriya <7581.T> -- "Buy" → "Buy", 6,800 yen →

Comments

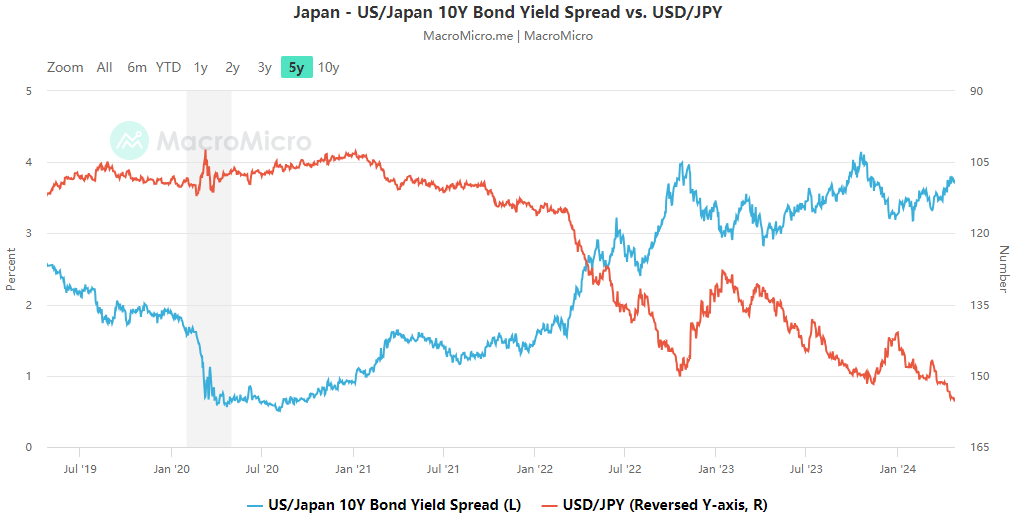

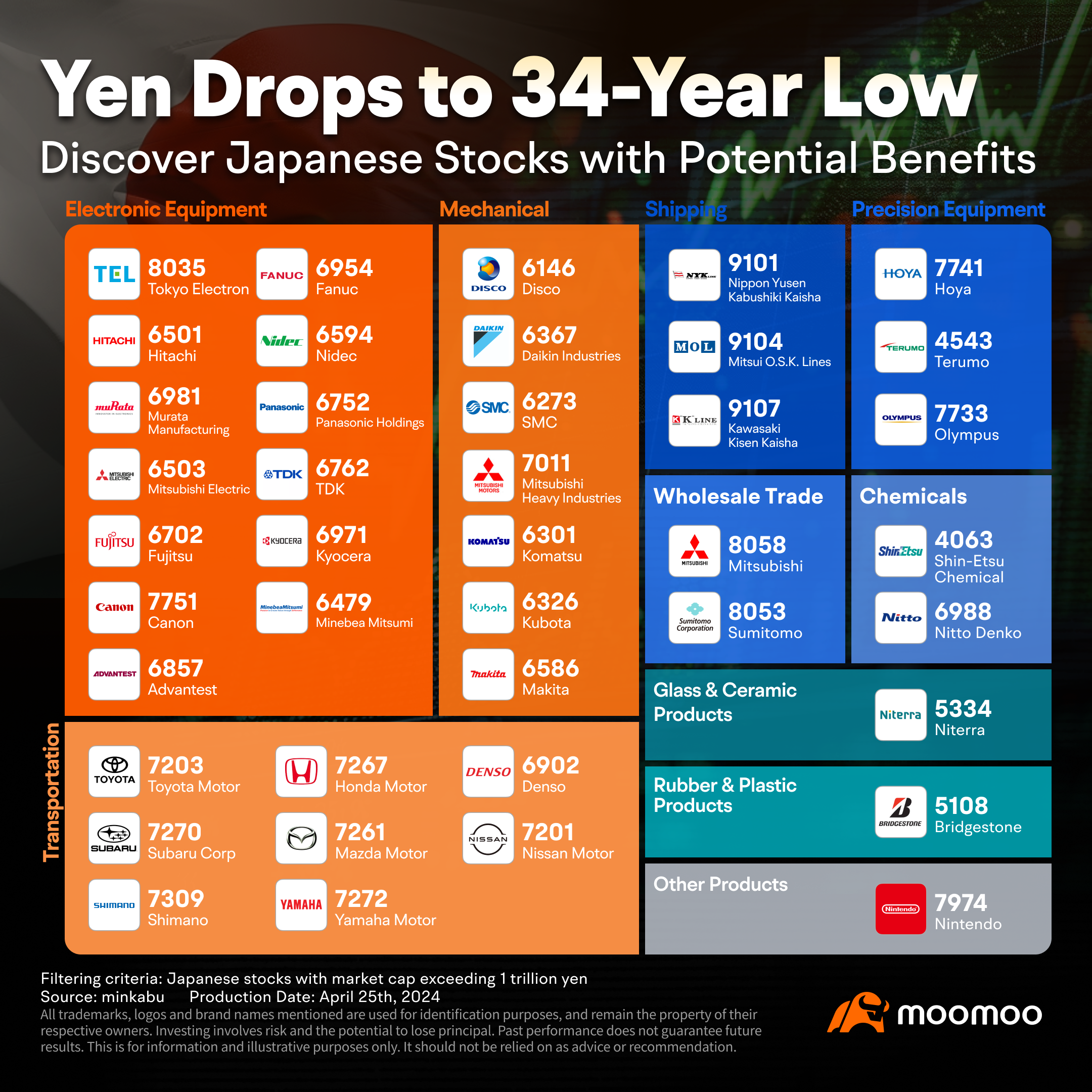

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...