No Data

7012 Kawasaki Heavy Industries

- 8487.0

- +90.0+1.07%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average is up about 110 yen, with trading volumes led by Disco, Mitsubishi Heavy Industries, and Advantest.

On the 28th at around 2:02 PM, the Nikkei Average is fluctuating around 35,820 yen, up about 110 yen from the previous weekend. In the afternoon session, trading started with a slight Sell dominance. The dollar-yen exchange rate is at 143.30 yen per dollar, indicating a stronger yen recently, leading to a continuation of heavy upward movement. The top Volume stocks at 2:02 PM (Main Board) are: JDI <6740.T>, NTT <9432.T>, Mitsubishi Heavy Industries <7011.T>, Toyota <7203.T>, and SoftBank <9434.T>.

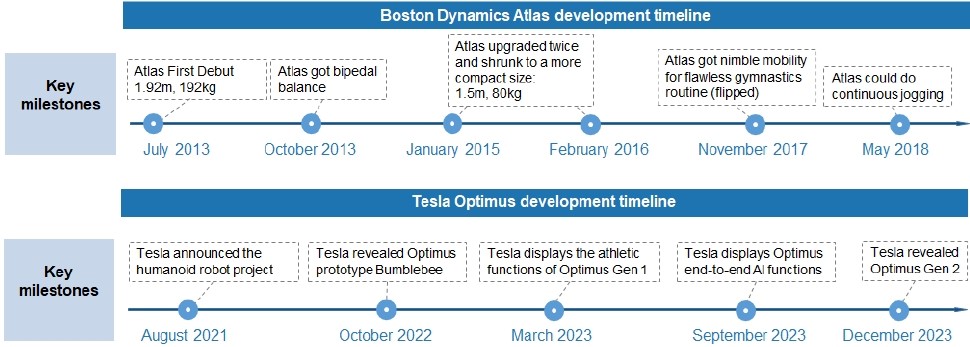

Hot Stocks selected based on technical analysis = Kawasaki Heavy Industries: Formation of a mini Golden Cross between the 5-day and 25-day moving averages is approaching.

On the 24th, the stock price of Kawasaki Heavy Industries <7012.T>, ranked second in comprehensive heavy equipment, recovered to the 8,000 yen range for the first time in five business days. On the following day, the 25th, it continued to rise with a trading volume of 22.46 million shares, increasing by 384 yen compared to the previous day. It has surpassed the 25-day moving average at the closing price, and the deviation between the 5-day and 25-day moving averages has narrowed to approximately 128 yen. As the mini golden crossover (GC) formation of the 5-day and 25-day moving averages, the first since February 5, is approaching, it seems likely to aim for higher prices in the near term.

<Today's materials and promising stocks> The U.S. government is requesting shipbuilding investments from Japan - check related stocks.

It has been reported that the U.S. government is requesting investment in shipbuilding on the West Coast of the U.S. from Japanese companies, as well as seeking to jointly construct commercial vessels that can be converted for military use. U.S. Navy Secretary Frank Kendall will visit Japan and convey this in meetings with Defense Minister Nobuo Kishi and others. Companies involved in naval vessels such as Mitsubishi Heavy Industries <7011.T>, Kawasaki Heavy Industries <7012.T>, and IHI <7013.T>, which has shares in JM, along with shipbuilding-related Mitsui E&S <7003.T>, J-Engine <6016.T>, Hanshin <6018.T>, and others.

SBI Securities (before the close) Kawasaki Heavy Industries Sell over, Mitsubishi Heavy Industries Buy over.

Sell Code Stock Name Trading Amount (6146) Disco 34,163,726,360 (7012) Kawasaki Heavy Industries 29,061,472,444 (5803) Fujikura 28,577,658,210 (7011) Mitsubishi Heavy Industries 23,500,889,790 (1570) NEXT FUNDS Nikkei Average Leverage ETF 13,479,845,291 (6920) Lasertech 9,1

Japan Steel Works, Horiba Manufacturing ETC.

*Japan Steel Works Ltd. (5631) is deepening its presence in India and has established a maintenance base for pelletizing machines (Nikkai Kogyo page 1) - ○ *Daiichi Hokuetsu Financial Group (7327) has reached an agreement to merge with Gunma Bank, aiming to be top class in scale and quality (Nikkai Kogyo page 3) - ○ *NTT Data Group (9613) has partnered with OpenAI to become a development and sales dealer (Nikkai Kogyo page 3) - ○ *Tokyo Electron Ltd. Unsponsored ADR (8035) has developed a new etching equipment building in Miyagi to support high-performance Semiconductors (Nikkai Kogyo page 3) - ○ *LIXIL (5938) has high-performance Aluminum windows.

FANUC CORP, Shimano Inc Unsponsored ADR ETC (additional) Rating

Downgrade - Bearish Code Stock Name Securities Company Previous Change After ----------------------------------------------------------- <7752> Ricoh JPM "Overweight" "Hold" <8984> House REIT Mizuho "Buy" "Hold" Target Price Change Code Stock Name Securities Company Previous Change After ------------------------------------------------

Comments

Deckers Outdoor Corporation (DECK US) $Deckers Outdoor (DECK.US)$

Daily Chart -[BULLISH ↗ **]DECK US is currently moving towards an uptrend. We maintain a bullish directional bias as long as price holds above 199.15 support level. We expect price to push towards 217.13 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 199.15 support level would open drop ...

Polaris, Honda, Kawasaki, CanAm, etc. Pinnacle off-road toy makers.

they won't build affordable electric ATVs because they are scared of the Tesla ATV, e-bike companies, e- scooter companies doing it better, so they instead turn to OVER PRICED UTVs

E- bike, scooter, Tesla, etc won't build one !

why?

They are scared that the Pinnacle off-road toy companies w...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

Defense Stocks

Hanhwa Aerospace

KAI

Victek

Firstec

Kawasaki Heavy Industries

Mitsubishi Heavy Industries

IHI

Hosoya Pyro-Engineering

Hosoya Pyro-Engineering

Buy n Die Together❤ :