No Data

399006 Chinext Price Index

- 1947.19

- +11.33+0.59%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Contemporary Amperex Technology and other Battery manufacturers compete with new products as the supercharging and fast charging storm approaches | New forces at the auto show.

① Battery manufacturers took center stage at the auto show, with Contemporary Amperex Technology, Sunwoda Electronic, and Eve Energy Co., Ltd. competing with new products at the Shanghai Auto Show; ② A storm of ultra-fast charging has arrived, with megawatt fast-charging products from companies like BYD, Huawei, and ZEEKR showcased at the auto show.

After heavily investing in AI, Kunlun Tech turned from profit to loss last year.

The period of profitability will begin after 2027.

When Autos "roll" towards the sky: Xpeng Huitian, Fengfei, GAC and others showcase eVTOL for the first time at the Shanghai Auto Show | New Forces in the Auto Show.

① The 2-ton level eVTOL from Fengfei Aviation, Xiaopeng Huitian's "land aircraft carrier", and GAC high domain's GOVY-Aircar all made their appearance at the Shanghai Auto Show; ② Reports indicate that these manufacturers' eVTOLs/flying cars are making their debut at the Shanghai Auto Show.

The Shanghai Auto Show witnesses the "mutual rush" of Chinese and foreign enterprises: multinational car companies are deeply cultivating the Chinese market while domestic supply chain enterprises are accelerating their move towards Global.

① The 2025 Shanghai Auto Show focuses on smart electric vehicles, with foreign car companies accelerating their integration into the China supply chain, and local innovative forces rising; ② Under the pressure of transformation, Toyota deepens its local layout by establishing a wholly-owned factory in Shanghai, betting on localization and supply chain synergy; ③ Joint venture brands strengthen collaboration in local innovation chains, as China supply chain companies accelerate their dominance in the Global smart electric vehicle industry.

Everwin Lithium heavily invested in large cylindrical Batteries.

The optimal solution.

Sungrow Power Supply has recently reported single-digit revenue growth for the first time, with a sharp decrease in revenue growth in the overseas market | Interpretations

① In 2022 and 2023, the company's revenue growth rates reached 66.79% and 79.47% respectively, while the growth rate for the year 2024 is only 7.76%; ② In 2024, the growth rate of the overseas market plummeted, with a year-on-year increase of only 8.76%. In 2023, the revenue growth rate for this segment reached 75.05%.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

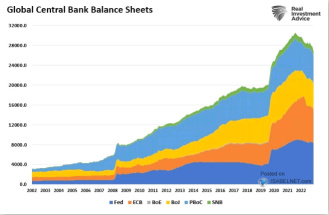

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.

Stock_Drift :