No Data

03188 ChinaAMC CSI 300 Index ETF

- 41.640

- -0.160-0.38%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

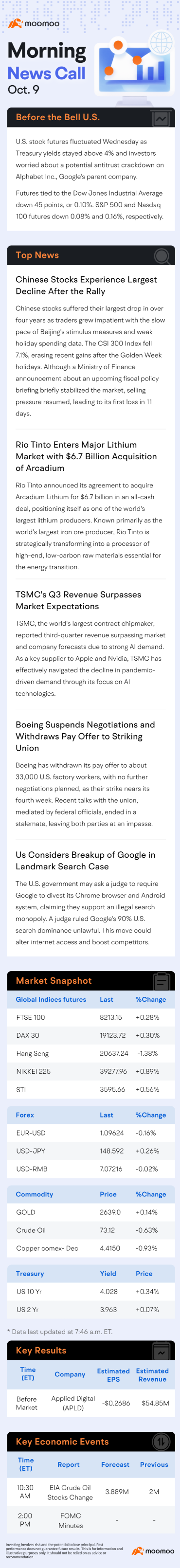

BYD: In Q1, revenue and net profit both saw growth, with the New energy Fund driving record performance.

BYD Q1 revenue and net profit both increased: New energy Fund driven record performance, expanding production to prepare for Global market. Key points: Strong performance growth: Q1...

Hong Kong Stock Morning Report|Trump is considering a tiered tariff plan for China. Aluminum Corporation Of China reported nearly 60% year-on-year increase in Net income for the first quarter.

① Trump is considering a tiered tariff plan for China. ② Canadian Prime Minister Carney: There is no rush to reach an agreement with Trump; we have enough leverage in the negotiations. ③ Seven departments: Launching a pilot application for 'AI Empowering the Entire Industry Chain of Medicine.' ④ The Commercial Space Innovation Consortium was established yesterday, and relevant industry standards will be accelerated for formulation.

Humanoid robot competition: a "technical coming-of-age ceremony" where "flops" and "evolution" occur simultaneously.

① The champion team from Tian Gong, CTO Tang Jian of the Peking Humanoid Robot Innovation Center, told the Star Daily reporter, "The half marathon competition is mainly a limit test for the robot's Hardware and Software motion algorithm, or the stability and reliability of the robot's 'little brain'." ② The Wuxi embodied intelligence sports event opening tomorrow, along with the upcoming robot combat competition held by Yushu, will undoubtedly attract more attention for 'inspection.'

Hong Kong stock morning report | John Lee Ka-chiu engaged in in-depth exchanges with representatives of the "Hangzhou Six Little Dragons" companies. Trump is considering exempting Auto Manufacturers from some tariffs.

① John Lee Ka-chiu had in-depth discussions with representatives from the 'Six Little Dragons of Hangzhou.' ② The Inner Mongolia Ministry of Industry and Information Technology reported that the computing power scale of Inner Mongolia has reached around 0.12 million P, ranking first in the country. ③ USA President Trump is considering exempting Auto Manufacturers from certain tariffs. ④ NIO's Li Bin predicts that China's share of the Global auto industry will exceed 40%.

Hong Kong stock morning report | E-commerce platforms have completely canceled "refund only" policy. Wei Long Mei Wei plans to invest 1 billion yuan to build a new factory.

① E-commerce platforms fully cancel "refund only" policy. ② The IMF lowers the 2025 global economic growth forecast from 3.3% at the beginning of the year to 2.8%. ③ The Ministry of Industry and Information Technology solicits public opinions on the "Guide to the Construction of Comprehensive Standardization System for Cloud Computing (2025 Version)." ④ The Ministry of Industry and Information Technology: More than 100 national and industry standards will be developed and revised to establish a standard system for Intelligent Manufacturing that adapts to the development of new industrialization by 2026.

Shengfeng Development Enters Multi-Year Strategic Partnership With Contemporary Amperex Technology. Collaboration Is Expected To Be Valued At ~$42M

Comments

Firstly, you might be asking yourself is it too late to invest? The answer is ...