No Data

02331 LI NING

- 14.620

- -0.380-2.53%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Jianyin International maintains a neutral rating for LI NING (02331) as sales uncertainties overshadow the company's outlook.

Golden Wealth News | Jianyin International Research indicates that LI NING (02331) retail sales in the first quarter of 2025 experienced a slight year-on-year increase, with a growth rate in the low single digits (LSD), which is generally in line with the bank's and the market's expectations. By channel type, offline channels recorded low single-digit growth, while direct sales retail store sales fell in low single digits, franchise store sales increased in low single digits, and online channels recorded low double-digit growth. The company net closed 29 LI NING stores and 15 LI NING youth stores in the first quarter of 2025, indicating potential improvements in store efficiency in the future. The bank noted that LI NING's sales in the first quarter of 2025.

LI NING (02331) released the 2024 ESG report: driving a green and sustainable future through innovation.

On April 29, 2025, LI NING Company (02331) officially released the "2024 Environmental, Social, and Governance (ESG) Report."

Nomura Adjusts Li Ning's Price Target to HK$16.20 From HK$17.40, Keeps at Neutral

ANNUAL REPORT 2024

DBS Remains a Buy on Li Ning Company (LNNGF)

Li Ning's Sales, Profitability Face Headwinds Ahead -- Market Talk

Comments

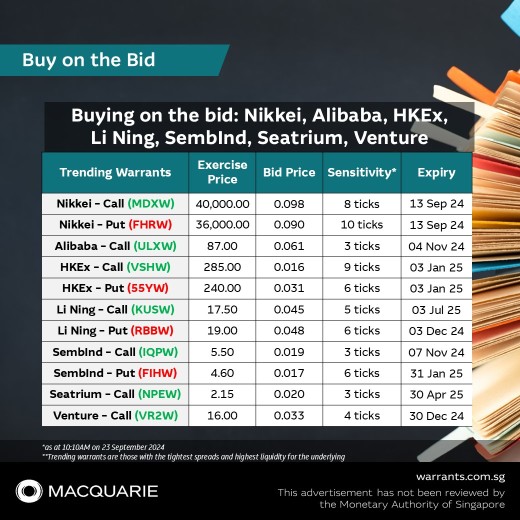

📌 Nikkie Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkie Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 HKEx Call, VSHW

$HKEx MB eCW250103 (VSHW.SG)$

📌 HKEx Put, 55YW

$HKEx MB ePW250103 (55YW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Li Ning Put, RBBW

$LiNing MBePW241203 (RBBW.SG)$

📌 SembInd Call, IQPW

$SembInd MBeCW241107 (IQPW.SG)$

���������...

📌 S&P Call, XP5W

$S&P 5800MBeCW241220 (XP5W.SG)$

📌 S&P Put, 5B5W

$S&P 5350MBePW241220 (5B5W.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 China Life Call, OHKW

$CLIFE MBeCW250703 (OHKW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Keppel Call, UYEW

$KeppelMBeCW250328 (UYEW.SG)$

���������...

📌 NASDAQ Call, IHJW

$NASDAQ 22000MBeCW241220 (IHJW.SG)$

📌 NASDAQ Put, UUZW

$NASDAQ 18500MBePW241220 (UUZW.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Baidu Call, ULNW

$Baidu MB eCW250204 (ULNW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 JD .com Call, RYOW

$JD MB eCW250103 (RYOW.SG)$

���������...