No Data

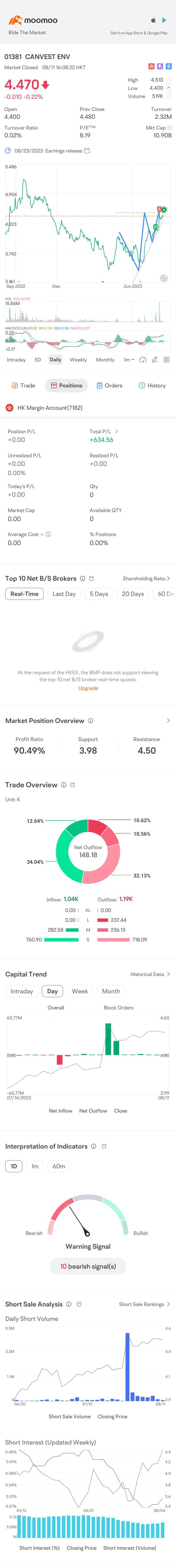

01381 CANVEST ENV

- 4.750

- -0.010-0.21%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Deutsche Bank is bullish on Chinese Stocks: Strongly driven by AI confidence and policy support, these Industries particularly benefit.

① The Chief Investment Officer Office (CIO) of Deutsche Bank's Private Banking Division released a research report, pointing out that the rapid development of AI technology and policy support are driving the rise of China Stocks; ② Deutsche Bank believes that the valuation of China Stocks is low, and it expects that long-term overseas capital inflow will support a market rebound, being Bullish on IT, Consumer discretionary goods, and the NENGYUANHANGYE.

Brokerage morning meeting highlights: It is recommended to focus on the key materials and equipment segments of the Industry Chain related to nuclear fusion.

At today's Brokerage morning meeting, Galaxy Securities believes that with the support of policies, the prospects of the smart health home sector are vast; China Securities Co.,Ltd. stated that electrolytic Aluminum emphasizes the replacement of clean Energy, and the green certificate market is expected to grow rapidly; CITIC SEC proposed to suggest layout around the key materials and device segments of the nuclear fusion Industry Chain.

China Galaxy Securities: New energy installations exceed thermal power, and the decline in thermal power generation is expanding.

During the interest rate down cycle, hydropower and Nuclear Power, which have strong dividend attributes, possess long-term allocation value, while Nuclear Power also has high long-term growth potential.

Brokerage morning meeting highlights: The Agent application is expected to enter its first year of significant growth in 2025.

At today's Brokerage morning meeting, HTSC proposed that Agent applications are expected to enter a period of significant volume in 2025; Tianfeng stated that in the field of AI Medical, attention should be given to directions related to high-quality data, scarce application scenarios, and multimodal integrated data; Silver Securities believes that the demand for green electricity is expected to see stronger catalysts in 2025.

Hong Kong Stock Morning Report | US stocks rebound, China's Golden Dragon Index surges 6.4%, the State Council aims to increase support for Technology enterprises.

① The USA will grant a one month tariff exemption on Autos imported under the USMCA. ② The three major US stock indexes closed higher, with the Nasdaq China Golden Dragon Index rising by 6.4%. ③ The General Office of the State Council stated that efforts should be increased to support equity financing for Technology companies that break through key core technologies. ④ Morgan Asset Management indicates that the process of revaluation of China Assets has just begun.

CANVEST ENV (01381.HK) revenue for the year 2024 dropped by 15.4% to 4.198 billion HK dollars.

On March 5, Gelonghui reported that CANVEST ENV (01381.HK) announced its annual results for the year ending December 31, 2024. The group's revenue from continuing Business operations decreased by 15.4% from last year to 4.1983 billion HKD. The total revenue decline was mainly due to the majority of the group's waste-to-energy projects being put into operation, resulting in a significant reduction in construction revenue generated by the group's project construction. The group's Net income for the year decreased by 13.8% to 0.88 billion HKD, primarily attributed to the decrease in construction revenue. Meanwhile, the gross margin and EBITDA margin from the group's continuing Business operations were both at 41.9.

Comments

Be carfull

Looks like another pump and dump scam

Look into Bozza and you will understand is someone is telling you to buy thta stock froma whatts app group