No Data

00688 CHINA OVERSEAS

- 13.580

- +0.160+1.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nomura Adjusts China Overseas Land & Investment's Price Target to HK$12.20 From HK$12.30, Keeps at Neutral

Nomura: Slightly lowers CHINA OVERSEAS Target Price to HKD 12.2, maintains "Neutral" rating.

Nomura released a Research Report stating a slight decrease in the Target Price for CHINA OVERSEAS (00688) by 0.8%, from 12.3 HKD to 12.2 HKD, maintaining a "neutral" rating. CHINA OVERSEAS's fiscal performance for 2024 is below expectations (Nomura indicates that its expectations were already low), but the health of the balance sheet has improved, with revenue down 9% to 185 billion yuan (same as below), mainly due to a significant decline in property development revenue; the gross margin decreased to 17.7%; core net profit fell 4% to 15 billion yuan, which is 8% lower than Nomura's expectations. However, the positive aspect identified by the firm is that the company's balance sheet has improved, net assets...

[Brokerage Focus] Tianfeng maintains a "Buy" rating for CHINA OVERSEAS (00688). Institutions indicate that the company is expected to continue leading Industry development.

Jingu Finance News | Tianfeng's Research Report indicates that CHINA OVERSEAS (00688) will achieve an income of approximately 185.154 billion yuan in 2024, a decrease of 8.58% year-on-year; the net income attributable to the parent company will be 15.636 billion yuan, down 38.95% year-on-year, and core profit will be 15.72 billion yuan, a decrease of 33.5% year-on-year; basic earnings per share will be 1.43 yuan, down 38.9% year-on-year. In 2024, the company's gross margin will be 17.7%, a decline of 2.6 percentage points compared to 2023; the net margin will be 9.6%, down 3.8 percentage points from 2023. The company plans to declare a final dividend of 30 Hong Kong cents per share, totaling 60 Hong Kong cents for the year, with a payout ratio increased.

China International Capital Corporation: Maintain CHINA OVERSEAS "outperform industry" rating with a Target Price of HKD 15.65.

CITIC released a Research Report stating that due to the certain pressure on the gross margin of CHINA OVERSEAS (00688), the bank has lowered the Net income for 2025/2026 by 12% and 11% to 15 billion and 16 billion yuan, year-on-year -4%/+6%. The current stock price corresponds to 0.4/0.3 times the PB for 2025/2026. It maintains an outperform rating for the Industry and keeps the Target Price at 15.65 Hong Kong dollars, corresponding to 0.4/0.4 times the PB for 2025/2026. The bank indicated that the company's 2024 performance is below expectations, and the company declared a full-year dividend of 0.6 Hong Kong dollars per share, with a payout ratio increasing by 5 percentage points year-on-year to 38.

China Overseas Land & Investment Limited Just Missed Earnings - But Analysts Have Updated Their Models

DBS: Raise the Target Price of CHINA OVERSEAS (00688) to HKD 15.9, maintain a Buy rating.

It is expected that the group will maintain stable pre-sales due to having ample and well-located sellable resources, resulting in a more stable profit and loss statement, primarily due to a considerable scale of unrecorded sales and reasonable profits.

Comments

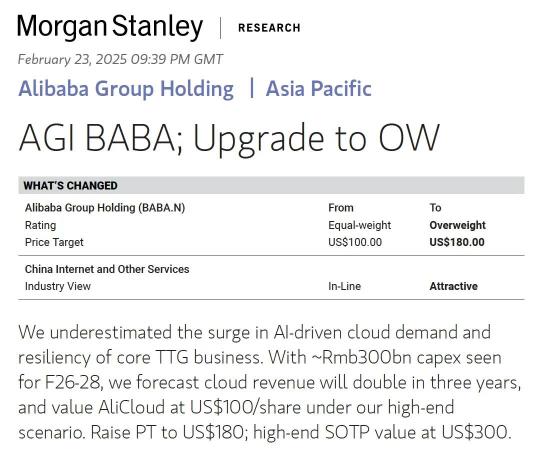

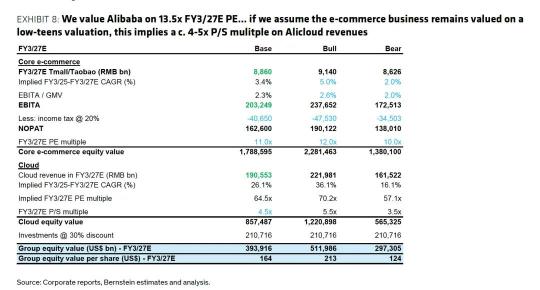

Bullish Sentiment on Alibaba: Major financial analysts have raised Alibaba's target prices, signaling strong optimism about its future market performance.

Growing Confidence in Chinese Markets: Financial institutions like Goldman Sachs and J.P. Morgan express increasing confidence in the Chinese markets, using bullish language and supportive market actions.

Rally in Hong Kong Stocks: The Hong Kong stock market co...

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...

Electric car stocks $LI AUTO-W (02015.HK)$ , $NIO-SW (09866.HK)$ and $XPENG-W (09868.HK)$ opened lifting 2.5% to 3.6%, while $BYD COMPANY (01211.HK)$ opened di...

Many Chinese cities lowered their down payment ratios and interest rate floors, including T1 cities, Guangzhou and Shenzhen. Chinese property developers $CHINA OVERSEAS (00688.HK)$ and $CHINA RES LAND (01109.HK)$ ebbed 1.8% and 1.5%.

$EVERG VEHICLE (00708.HK)$ announced potential transfer of its 29% stake with credit aid, having the trading in its shares resumed and opened 94.7% higher at $0.74. $EVERG SERVICES (06666.HK)$ , under the same series, opened 12.7% higher at $0.89. Hainan and Chon...