No Data

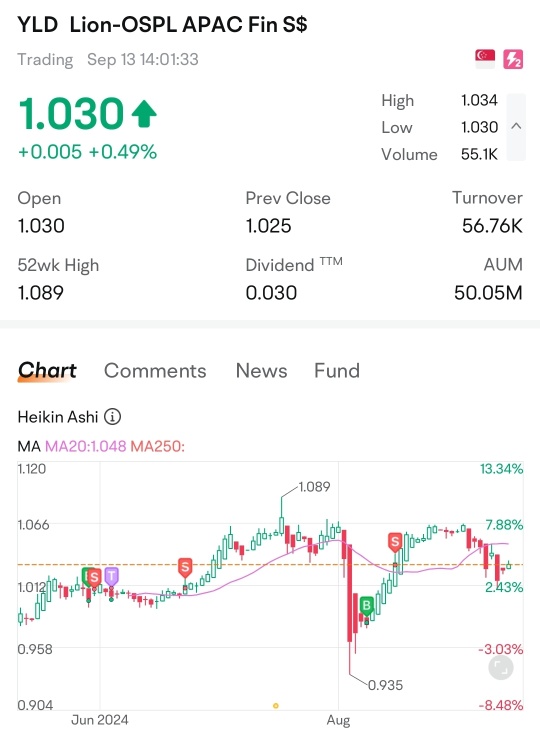

YLD Lion-OSPL APAC Fin S$

- 1.128

- +0.010+0.89%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

HSBC Holdings Plc (HSBC) Q1 2025 Earnings Call Transcript Summary

China Construction Bank Corporation: In the first quarter of 2025, Net income slightly decreased by 3.64%, with Technology finance and green development becoming the highlights.

China Construction Bank Corporation's performance analysis for the first quarter of 2025: stable operation facing a slight decrease in profits, with Technology finance and green development as highlights. Key points of performance: net income for the first quarter was 83.742 billion yuan, a year-on-year decrease of 3.64%; net income attributable to shareholders was 83.351 billion yuan, a year-on-year decrease of 3.99%. Asset scale: total assets reached 42.79 trillion yuan, an increase of 5.48% compared to the end of last year; total loans were 27.02 trillion yuan, an increase of 4.55%. Asset quality: non-performing loan rate at 1.33%, a decrease of 0.01 percentage points compared to the end of the year; provision coverage ratio at 236.81%, an increase of 3.21 percentage points.

China Construction Bank Corporation: Q1 Net income 83.35 billion yuan, total Assets increased by 5.48%, non-performing loan rate decreased to 1.33%.

China Construction Bank Corporation's Q1 net income is 83.35 billion yuan: total assets increased by 5.48%, the non-performing loan rate decreased to 1.33%. Highlights of performance overview:...

HSBC 2025 Outlook: Targets Mid-Teens RoTE, $42B NII, $0.3B Cost Cuts, Expected Credit Losses Charges 30–40bps, Muted Lending, Strong Wealth Growth, And Stable CET1

HSBC Holdings Q1 Adj. EPS $1.95 Up From $1.70 YoY, Sales $17.65B Down From $20.75B YoY

HSBC Holdings Non-GAAP EPS of $0.39, Revenue of $17.65B Beats by $1.35B

Comments

easiest way to own a basket of shares at low cost.

good for new investors or investors with no time to track their investment.

I started with $LION-PHILLIP S-REIT (CLR.SG)$ . sreits is known for good dividend. with time and knowledge, I study its holding and pick up the strongest stocks to hold individually.

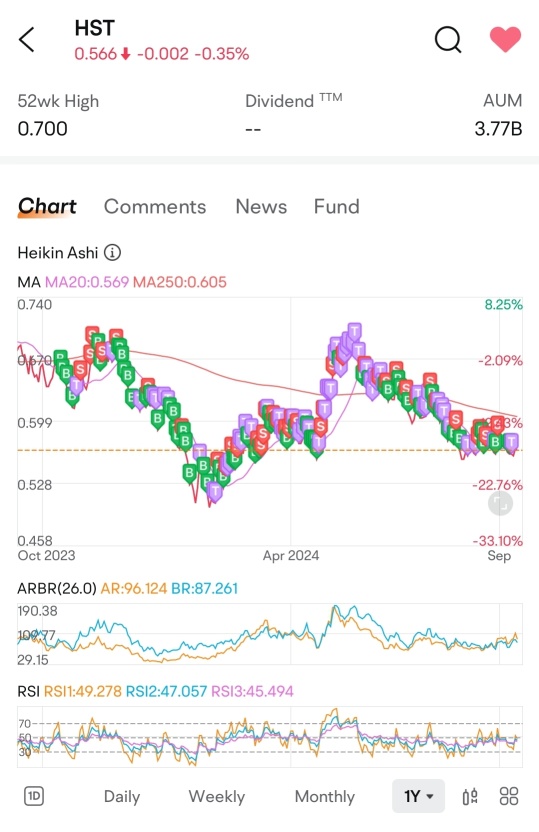

next up $Lion-OCBC Sec HSTECH S$ (HST.SG)$ which I trade almost daily, a basket of china/hk tech stocks. no ability to hold on my own.

for us stocks I started with $ProShares UltraPro QQQ ETF (TQQQ.US)$ , �������...

banks can loan more. besides sg top 3, $Lion-OSPL APAC Fin S$ (YLD.SG)$ is my latest addition.

I expect most of my sreits to run. these are the ones yet to see their share price increase... $Mapletree Log Tr (M44U.SG)$ $Frasers L&C Tr (BUOU.SG)$ $Lendlease Reit (JYEU.SG)$

I'm also buying into bond fund.