US OptionsDetailed Quotes

XLE250502P77000

- 0.09

- -0.09-50.00%

15min DelayClose Apr 28 16:15 ET

0.12High0.07Low

0.12Open0.18Pre Close106 Volume1.14K Open Interest77.00Strike Price1.20KTurnover45.99%IV7.30%PremiumMay 2, 2025Expiry Date0.00Intrinsic Value100Multiplier4DDays to Expiry0.09Extrinsic Value100Contract SizeAmericanOptions Type-0.0542Delta0.0285Gamma921.89Leverage Ratio-0.0496Theta-0.0004Rho-49.93Eff Leverage0.0092Vega

Energy Select Sector SPDR Fund Stock Discussion

April 28 , 2025

☀️ Morning Scan

---

#global sentiment

VIX : 25.33

VIX1D : 23.18

VVIX : 103.27

Fear & Greed Index (Stocks) : 35 (Fear) ⚠️

Crypto Fear & Greed Index : 54 (Neutral) ⚖️

Analysis :

Stocks sentiment = "controlled fear" mode despite slight technical rebound.

Crypto sentiment = neutral, neither euphoria nor panic.

High overall volatility = increased latent risks.

---

#stress test

S&P500 Futures : +0.74% 📈

Nasdaq Futures : +1.26% 🚀

Dow Jones Futures : +0.05% ☑️

Ru...

☀️ Morning Scan

---

#global sentiment

VIX : 25.33

VIX1D : 23.18

VVIX : 103.27

Fear & Greed Index (Stocks) : 35 (Fear) ⚠️

Crypto Fear & Greed Index : 54 (Neutral) ⚖️

Analysis :

Stocks sentiment = "controlled fear" mode despite slight technical rebound.

Crypto sentiment = neutral, neither euphoria nor panic.

High overall volatility = increased latent risks.

---

#stress test

S&P500 Futures : +0.74% 📈

Nasdaq Futures : +1.26% 🚀

Dow Jones Futures : +0.05% ☑️

Ru...

13

2

Friday, April 25, 2025

Global Sentiment

🌎 Global markets remain optimistic after a week of strong earnings reports, particularly in tech. Alphabet jumped 5% after beating expectations. The VIX is around 25, reflecting moderate volatility. Still below panic thresholds, but higher than usual for a calm market. The Crypto Fear & Greed Index is up to 64 (Greed zone).

Stress Test

⚠️ No systemic stress detected. Credit spreads are stable, the bond market is calm. ETF flows are mostly...

Global Sentiment

🌎 Global markets remain optimistic after a week of strong earnings reports, particularly in tech. Alphabet jumped 5% after beating expectations. The VIX is around 25, reflecting moderate volatility. Still below panic thresholds, but higher than usual for a calm market. The Crypto Fear & Greed Index is up to 64 (Greed zone).

Stress Test

⚠️ No systemic stress detected. Credit spreads are stable, the bond market is calm. ETF flows are mostly...

12

6

1

A Quick Review of my Trading Activities in this week ( 14 - 18 Apr 2025 )

Market Overview

- Following strong gains last week, the $S&P 500 Index (.SPX.US)$ and $NASDAQ 100 Index (.NDX.US)$ experienced a pullback this week, declining by 1.5% and 2.3% respectively. Market sentiment remains cautious due to uncertainty surrounding potential escalations in US tariffs, particularly those targeting China.

- Spot gold continued its strong ascent this week, with the $Spdr Gold Minishares Trust (GLDM.US)$ gaining 2...

Market Overview

- Following strong gains last week, the $S&P 500 Index (.SPX.US)$ and $NASDAQ 100 Index (.NDX.US)$ experienced a pullback this week, declining by 1.5% and 2.3% respectively. Market sentiment remains cautious due to uncertainty surrounding potential escalations in US tariffs, particularly those targeting China.

- Spot gold continued its strong ascent this week, with the $Spdr Gold Minishares Trust (GLDM.US)$ gaining 2...

+2

loading...

16

Market Re-Cap: What Happened Last Week (For 17th Mar week)

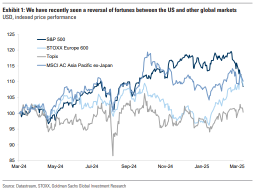

US Market

US equity markets staged their first rebound in four weeks, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ gaining 1.63% and 1.49% respectively. While the Fed held kept interest rates unchanged at 4.25%–4.50%, policymakers remained inclined toward rate cuts, expecting the probability of 2 rate cuts by year-end. This is due to a...

US Market

US equity markets staged their first rebound in four weeks, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ gaining 1.63% and 1.49% respectively. While the Fed held kept interest rates unchanged at 4.25%–4.50%, policymakers remained inclined toward rate cuts, expecting the probability of 2 rate cuts by year-end. This is due to a...

6

2

3

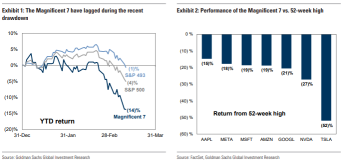

Key Takeaways:

1. Market Shift: Tech stocks falling, energy potentially undervalued.

2. Policy Pressure: Fed hawkishness and tariffs reshaping investments.

3. Sector Opportunities: Energy and industrials promising; tech facing challenges.

4. Strategy: Rotate to fundamentals-driven sectors, be selective in tech.

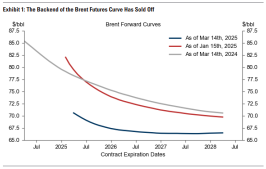

As the S&P 500 teeters near correction territory and oil prices slump to $70/bbl, investors scramble to ...

1. Market Shift: Tech stocks falling, energy potentially undervalued.

2. Policy Pressure: Fed hawkishness and tariffs reshaping investments.

3. Sector Opportunities: Energy and industrials promising; tech facing challenges.

4. Strategy: Rotate to fundamentals-driven sectors, be selective in tech.

As the S&P 500 teeters near correction territory and oil prices slump to $70/bbl, investors scramble to ...

+1

24

1

16

Hey Mooers! 🚀 ![]()

Here is the power of how I leveraged on AI and make it show my direct opinions. Let's have a look at what is happening in the Macro factors. Before I say anything here is a disclaimer.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own research or consult a...

Here is the power of how I leveraged on AI and make it show my direct opinions. Let's have a look at what is happening in the Macro factors. Before I say anything here is a disclaimer.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own research or consult a...

+1

17

15

6

We saw the news reporting that President Trump is eyeing a bigger, better trade deal with China, there is also plan to have wide-ranging agreement with President Xi.

In this article I would like to examine arguments for and against a bigger, better trade deal with China, and where could be opportunities we can look at.

Arguments for a Bigger, Better Trade Deal

There are various perspectives and potential outcome we can consid...

In this article I would like to examine arguments for and against a bigger, better trade deal with China, and where could be opportunities we can look at.

Arguments for a Bigger, Better Trade Deal

There are various perspectives and potential outcome we can consid...

20

$Energy Select Sector SPDR Fund (XLE.US)$

Some companies that are included in XLE appear great….

I have added:

Just a few shares but I think it will go up…

lets see.

Some companies that are included in XLE appear great….

I have added:

Just a few shares but I think it will go up…

lets see.

loading...

5

$Tesla (TSLA.US)$

🚨🚨🚨🚨🚨🚨🚨🚨🚨

“Stagflation Squeeze: Inflation Heats Up as Consumer Demand Cools”

The combination of weaker retail sales (-0.9%) and stronger-than-expected inflation (PPI +0.4%, Core CPI +0.4%) presents a stagflationary signal—economic activity slowing while inflation remains persistent.

1. Inflation Takeaways: Sticky & Broad-Based

• Producer Prices (PPI) rose 0.4% MoM, above forecasts (0.3%), with goods inflation driven by food (+chicken eggs, beef, veal) and energy (+diesel, gas, ...

🚨🚨🚨🚨🚨🚨🚨🚨🚨

“Stagflation Squeeze: Inflation Heats Up as Consumer Demand Cools”

The combination of weaker retail sales (-0.9%) and stronger-than-expected inflation (PPI +0.4%, Core CPI +0.4%) presents a stagflationary signal—economic activity slowing while inflation remains persistent.

1. Inflation Takeaways: Sticky & Broad-Based

• Producer Prices (PPI) rose 0.4% MoM, above forecasts (0.3%), with goods inflation driven by food (+chicken eggs, beef, veal) and energy (+diesel, gas, ...

8

No comment yet

SnowVested : referring to your title intro,

what system are you running? likely won't find it now or missed that boat.

as would not mind getting a read out like this and learning enough to quickly use it.

quite effective from what little I took from it (quick scroll)

Kevin Matte OP SnowVested : Hello and thank you very much for your message!

The system I use is a custom market analysis method based on Artificial Intelligence with API keys.

Recently, I have created a free Facebook group called "AI Trading Mastery Guide" where I share all my AI trading tools.

It doesn't matter your level: whether you use the free version of GPT, the paid version, or you are a pro using API keys, everything is adapted!

I also provide advanced AI tools that I have developed to scan markets quickly and efficiently — even accessible for beginners.

In addition, I am an official partner with Nansen.AI!

If you want to purchase an API key from them to track crypto whale activity in real-time, you can get a 10% discount by mentioning my name!

Feel free to join my free Facebook group.

See you there and thank you again for your support!