No Data

US Stock MarketDetailed Quotes

VG Venture Global

- 8.630

- -0.080-0.92%

Close Apr 25 16:00 ET

- 8.550

- -0.080-0.93%

Post 20:01 ET

20.88BMarket Cap14.15P/E (TTM)

8.630High8.250Low6.04MVolume8.540Open8.710Pre Close51.26MTurnover8.64%Turnover Ratio14.15P/E (Static)2.42BShares25.45452wk High7.21P/B604.10MFloat Cap6.75052wk Low--Dividend TTM70.00MShs Float25.454Historical High--Div YieldTTM4.36%Amplitude6.750Historical Low8.480Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

SA Asks: When Will the IPO Market Finally Pick Up?

Express News | JP Morgan Maintains Overweight on Venture Global, Lowers Price Target to $15

Venture Global Analyst Ratings

J.P. Morgan Remains a Buy on Venture Global, Inc. Class A (VG)

Venture Global Announces Closing of $2,500,000,000 Senior Secured Notes by Venture Global Plaquemines LNG, LLC

Press Release: Venture Global, Inc. Announces Timing of First Quarter 2025 Earnings Release and Conference Call

Comments

$Venture Global (VG.US)$ April 23, 2025

📊 Overview

Current price: $8.97

Daily change: +$0.37 (+4.30%)

Intraday range: $8.68 – $9.41

Volume: 3,303,771 shares

Market capitalization: $20.81 billion

Beta: 2.45 (very high volatility compared to the market)

---

🗓️ Monthly Analysis

Moving averages:

200 MA: $9.63 (the price is currently below it, indicating a long-term bearish trend)

Technical indicators:

RSI (14): 55.93 – in neutral territory, showing no extreme m...

📊 Overview

Current price: $8.97

Daily change: +$0.37 (+4.30%)

Intraday range: $8.68 – $9.41

Volume: 3,303,771 shares

Market capitalization: $20.81 billion

Beta: 2.45 (very high volatility compared to the market)

---

🗓️ Monthly Analysis

Moving averages:

200 MA: $9.63 (the price is currently below it, indicating a long-term bearish trend)

Technical indicators:

RSI (14): 55.93 – in neutral territory, showing no extreme m...

6

4

$Venture Global (VG.US)$

April 16, 2025

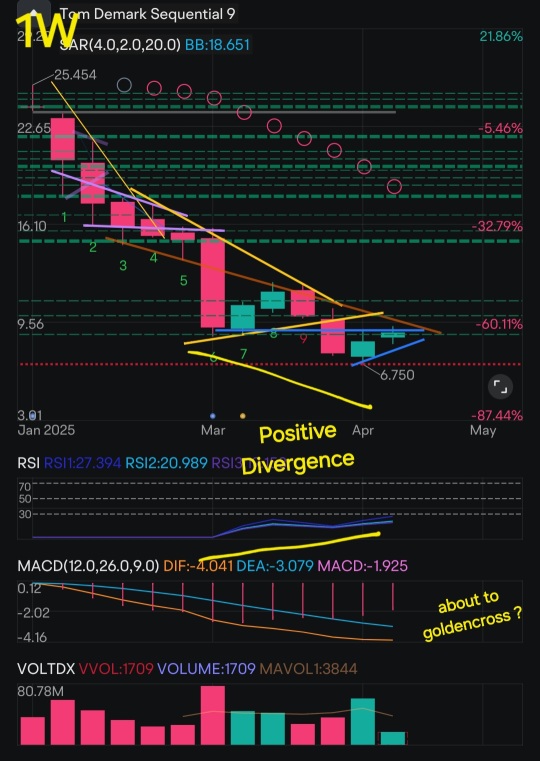

Multi-Timeframe Technical Analysis:

1. MULTI-TIMEFRAME STRUCTURAL CONTEXT

Monthly: Since its IPO at $25, the stock has shown a strong bearish trend. No clear reversal structure has formed. The monthly chart shows a series of red candles with no significant rebound, indicating an ongoing distribution cycle.

Weekly: The stock is evolving within a descending channel. Rebounds are consistently rejected ...

April 16, 2025

Multi-Timeframe Technical Analysis:

1. MULTI-TIMEFRAME STRUCTURAL CONTEXT

Monthly: Since its IPO at $25, the stock has shown a strong bearish trend. No clear reversal structure has formed. The monthly chart shows a series of red candles with no significant rebound, indicating an ongoing distribution cycle.

Weekly: The stock is evolving within a descending channel. Rebounds are consistently rejected ...

22

6

$Venture Global (VG.US)$ dun understand how VG can lose so much ground... Does it even have a bottom???

Read more

Keiith : Given that the long - term technical trend for Venture Global is bearish but short - term signals are bullish, how do you balance these conflicting indicators when deciding on an investment strategy?

Handiyanan : I really appreciate how comprehensive this analysis is.

But I'm curious about how the author weights different factors when making an overall assessment. For example, are the legal disputes more of a concern than the competition in the long run?

Kevin Matte OP Keiith : The long-term trend is down, but short-term signals are positive… what does that mean?

It depends on your goal: If you’re a long-term investor, better wait until the stock clearly shows a real recovery (for example, if it breaks above $11.78 with strong volume).

If you’re a short-term trader, you can take advantage of the current bounce, but do it carefully with a stop-loss and clear profit target. In short: short term = possible opportunity / long term = caution until confirmed.

Kevin Matte OP Handiyanan : Are legal issues more serious than competition? Yes, right now, the lawsuits are the bigger concern—they can delay shipments, hurt reputation, and impact cash flow. Competition is more of a long-term risk, but Venture Global is already expanding and signing big contracts to deal with that.

So for now, legal risks are more urgent, but competition is still important over the long run.