No Data

USDindex USD

- 109.650

- +0.482+0.44%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Bond Yields Are Nearing 5%. What That Means for the Stock Market.

Risk aversion sentiment sweeps through! Unexpected non-farm data cannot stop the strong rise of Gold.

Gold prices rose further on Friday, marking a strong end to the week.

Options Market Statistics: WBA Stock Soared on Big Earnings Beat; Options Pop

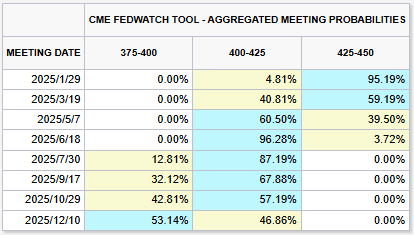

The "New Federal Reserve News Agency": The employment report closes the door on rate cuts in January, and Fed officials say they can wait before taking further action.

Timiraos stated that the possibility of the Federal Reserve cutting interest rates this month is very low, and the employment report for December completely eliminated that possibility. The Federal Reserve's voting member this year, St. Louis Fed President Bullard, mentioned that the situation has changed since last September, with a stronger economy and inflation being higher than expected, making it appropriate to adopt a more cautious approach to rate cuts, rather than the more gradual reductions thought in September.

After the non-farm payroll report hit hard, Wall Street is "dizzy": Is the Federal Reserve pausing rate cuts or completely not cutting at all?

① The unexpectedly high figures have prompted Wall Street Analysts to adjust their determinations on the USA Federal Reserve's interest rate cuts; ② A relatively unified opinion is that there is no possibility of an interest rate cut in this month's meeting, nor is it very likely in March, with significant differences in determinations afterward; ③ At this critical moment, USA Consumer inflation expectations have sharply risen, and Biden has again demonstrated the White House's ability to stir up the Energy market before leaving office.

Long-term inflation expectations in Michigan, USA reached the highest level since 2008, while the Consumer confidence preliminary value declined.

The 5-10 year inflation expectations have risen to 3.3%, matching the peak of inflation in the USA in June 2022, reaching a new high since 2008, significantly above the expected 3.0%, with the previous value in December being 3.0%. The current Index and expected Index show a clear divergence, with the expected Index dragging down the consumer confidence reading this time, as half of the respondents indicated they expect the unemployment rate to rise in the coming year, while the current Index continues to be driven by optimistic sentiment following Trump's election.

Comments

U.S. stock market trading will resume as usual today.

Bursa Malaysia remains cautious ahead of Trump's inauguration.

Stocks to watch: PBBANK, GAMUDA.

- Moomoo News MY

Wall Street Summary

U.S. stock markets were closed yesterday in observance of a National Day of Mourning for former President Jimmy Carter.

A major wildfire in Los Angeles has spread across...

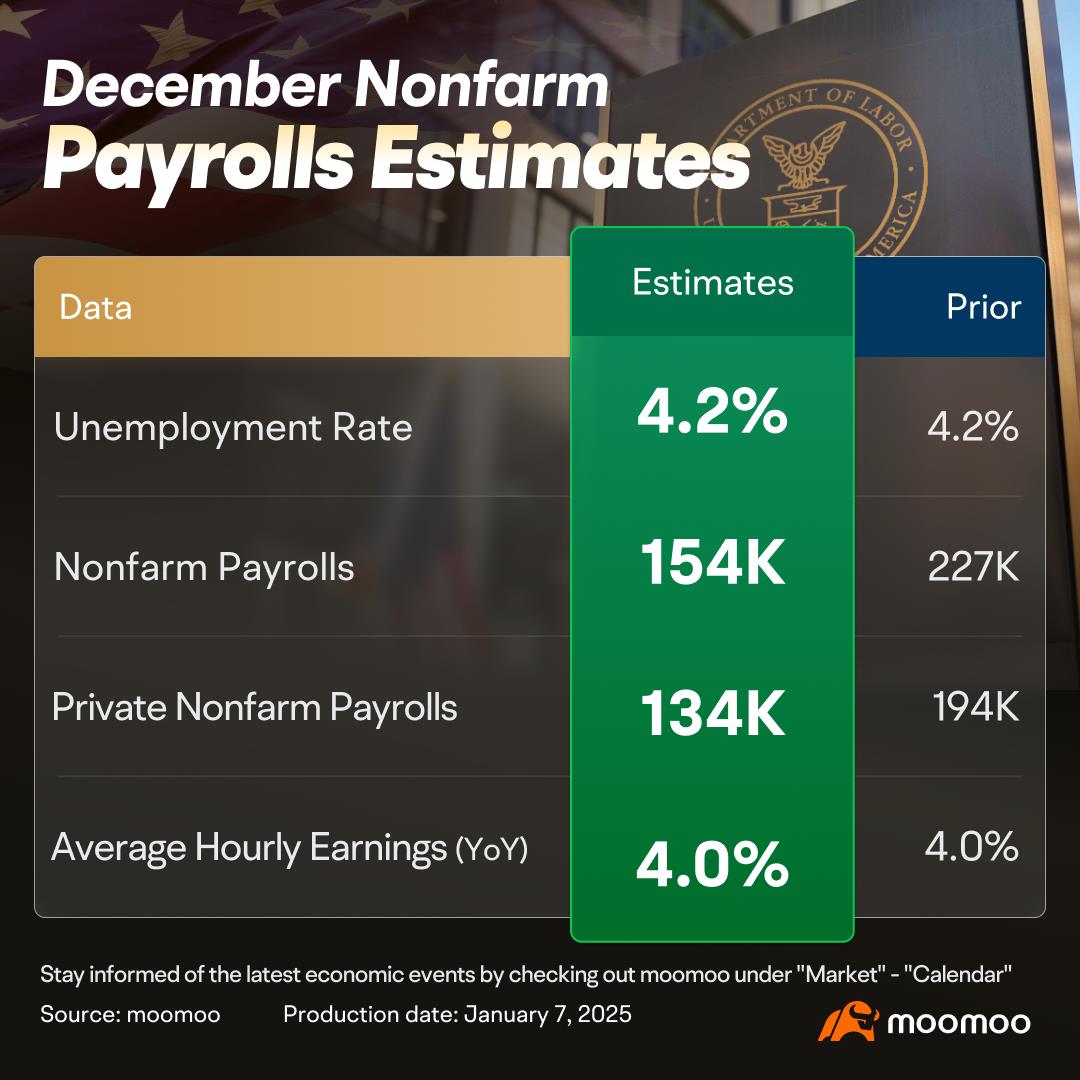

Benefiting from the dissipation of the negative impacts of hurricanes and strikes, the November US nonfarm payrolls data indicated a robust growth in the labor market. The US Bureau of ...

Benefiting from the dissipation of the negative impacts of hurricanes and strikes, the November US nonfarm payrolls data indicated a robust growth in the labor market. The US Bureau of ...

PGGGLMMM OP : Take a look previous what issues on 1985 and 2000, dollar hike in crazy then what were happened?

thoughtful Bat_8163 : Actually economy is great right now. Hopefully it is not at the peak![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Ghost2737 thoughtful Bat_8163 : Nope