No Data

SVXY250502P39000

- 1.30

- +0.05+4.00%

- 5D

- Daily

News

A JPMorgan survey indicates that the S&P 500 Index has peaked this year, but investors remain bullish on the Magnificent 7.

① A JPMorgan survey shows that 93% of investors believe the S&P 500 Index will hover around 6000 points or lower in the next 12 months, with 40% expecting it to remain within the 5000-5500 points Range; ② Respondents unanimously believe that trade wars and tariff uncertainties will trigger economic consequences, with 61% expecting the USA economy to face stagflation in the next 12 months.

Market Update | Most Autos stocks rose, NIO increased by over 5%, Li Auto grew by 2%, and Trump plans measures to mitigate the impact of car tariffs.

According to market news, President Trump of the USA will announce measures on Tuesday (April 29) to mitigate the impact of auto tariffs.

The sell-off is not over yet! USA Assets are still being "disdained" by overseas investors…

① According to data provided by Deutsche Bank, despite the market recovering over the past week, foreign investors' willingness to invest in USA assets continues to decline; ② Deutsche Bank's Forex research director George Saravelos believes that the recent data on USA capital flows is concerning.

JPMorgan traders are becoming bullish on U.S. stocks, but believe that the upward trend will fade in a few weeks.

Andrew Tyler, the Global Markets Intelligence Head at JPMorgan, believes that with the easing of trade tensions, there is still room for the US stock market to rise and predicts that the upcoming Earnings Reports from tech giants this week are likely to drive the stock market higher. However, he warns that this rebound momentum may weaken in the coming weeks, and the negative impact of US tariffs will begin to drag down the economy in the coming months.

U.S. stocks closed mixed: the three major Indexes showed different trends as investors focused on Technology stock Earnings Reports.

① Most China Concept Stocks rose, with the Nasdaq China Golden Dragon Index up 0.68%; ② IBM announced a 150 billion dollar investment plan; ③ Sony Group is reportedly considering splitting its Semiconductors business; ④ NXP Semiconductors Q1 revenue was 2.84 billion dollars, higher than market expectations.

Big buyers are returning to the US stock market, and Goldman Sachs expects that about 65% of companies will enter the buyback open window by the end of this week.

After experiencing a month of buyback silence in the U.S. stock market, according to Goldman Sachs, U.S. companies have re-entered the buyback open window period, which will last until June 13.

Comments

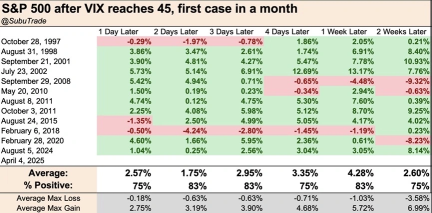

Let's be real, I'm getting cold feet about diving in to catch this falling knife. But thank my lucky stars, I'm not in too deep! So if this rollercoaster keeps plummeting, I reckon it might just cough up a golden opportunity. As for my dip-buying strategy? I've got my eagle eyes on these 2key areas

1.Dollar-Cost Averaging into US Stocks

Doll...

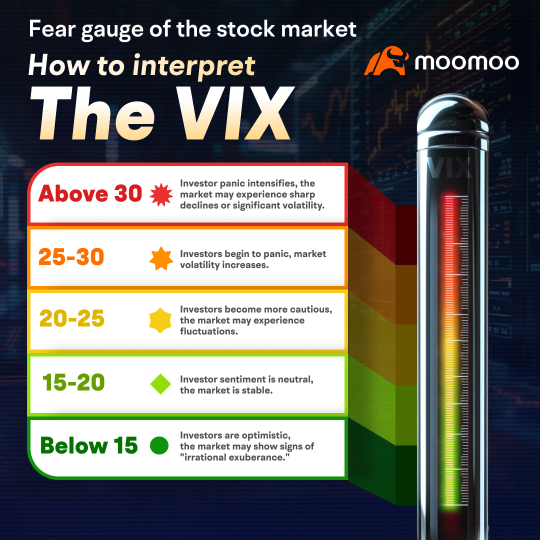

* VIX (Cboe Volatility Index):

* This is not a stock or company. It's an index that measures the market's expectation of volatility over the next 30 days. It's often referred to as the "fear index." When the VIX rises, it generally indicates increased market fear and a potential downturn.

* Inverse ETFs:

* These are exchange-traded funds (ETFs) designed to perform inversely to a market inde...

The policy is expected to raise production costs, fuel inflation, and tighten financial conditions. Goldman Sachs has cut its 2025 U.S. GDP growth forecast from 2.4% to 1.7%.

Fears of trade friction and its impact on the economy ha...

What failed:

1. My bet on $ProShares Ultra Bloomberg Crude Oil ETF (UCO.US)$ was crushed by the second day of decline on Friday when the Sauds decided that they are giving up on $100 oil and resuming higher prod...