No Data

SPXW250425C5655000

- 0.03

- 0.000.00%

- 5D

- Daily

News

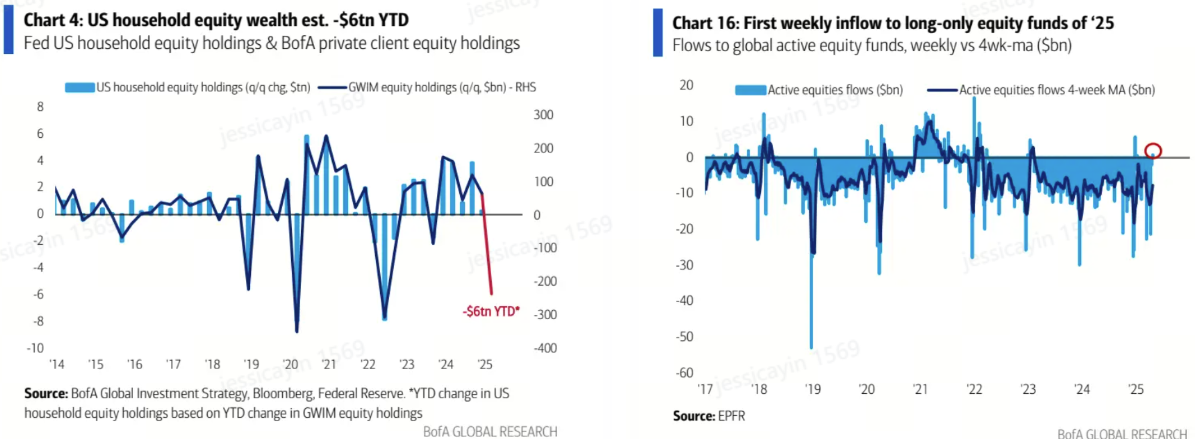

The US stock market is facing a major test with Technology Earnings Reports, but good news is no longer able to lift the market.

Research indicates that in the current macro environment, companies with better-than-expected performance see an average increase of only 50 basis points the next day (T+1), significantly lower than the historical average of 101 basis points. Meanwhile, companies that do not meet expectations experience a drop of 247 basis points, which is more severe than the historical average decline of 206 basis points.

The USD has slightly increased, benefiting from the de-escalation of trade frictions and alleviated concerns about the independence of the Federal Reserve.

The US dollar showed a mild upward trend at the beginning of this week, supported by market expectations of easing global trade tensions and reduced risks to the independence of the Federal Reserve. Last week, President Trump announced progress in trade negotiations with Japan and clearly stated there was no intention to dismiss Federal Reserve Chairman Powell.

Just last week, the US stock market formed the strongest Call pattern.

If within 10 days, the proportion of rising Stocks on the NYSE exceeds 61.5% from less than 40%, it triggers a ZBT signal, which often indicates that the market has rapidly shifted from extreme overselling to extreme overbuying. According to Bank of America analysis, since 1939, every time a ZBT signal appeared, the S&P 500 Index has risen in the following 130 and 190 trading days, with average gains of 17.1% and 19.6% respectively.

As the earnings reports season comes to a close, can the profit growth of technology giants keep up with the expansion of their valuations?

This week, Microsoft, Apple, Meta Platforms, and Amazon will report quarterly results in a market affected by concerns over economic recession caused by trade wars and tariffs.

Be cautious during the Earnings Reports season! Goldman Sachs is urgently applying the brakes: AI support cannot hide the shrinking corporate wallets.

Goldman Sachs' chief US equity strategist warns: next week, 41% of the S&P 500 constituents will disclose their earnings, and corporate investment decisions may hit the brakes due to increasing policy uncertainty.

Economic officials of "Trump 1.0" state that the impact of tariffs will become apparent nationwide by the end of next month, with the poorest suffering the most.

The former director of the White House National Economic Council stated that the "soft data" reflecting future expectations is weakening; before commodity prices rise due to tariffs, those with lower income levels or economic strength will use 100% of their salaries to purchase commodities, while the wealthy will save a higher proportion of their income, with the former being more severely impacted.

Comments

A Rebound with Momentum

The recent rally has been fueled by a confluence of positive...

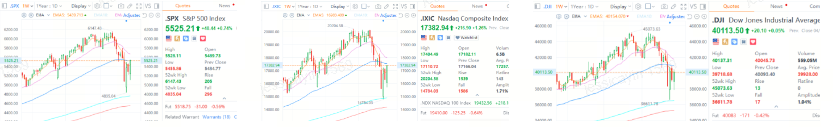

It’s been an eventful week in the markets, with a dramatic shift in sentiment from Monday’s bearish close to a four-day rally starting Tuesday. This change resulted from improving tariff dynamics and slightly better-than-expected earnings reports. As a result, $NASDAQ 100 Index (.NDX.US)$ surged 6.43% for the week, $S&P 500 Index (.SPX.US)$ rose 4.59%, and $Russell 2000 Index (.RUT.US)$ gained 4.09%, reflecting str...

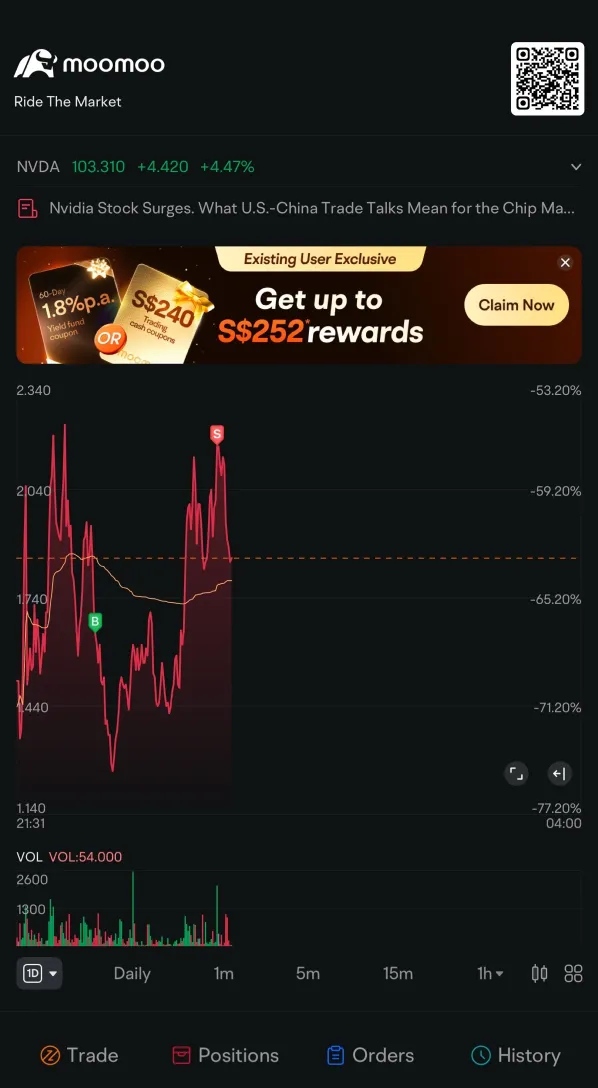

News Corp (NWS US) $News Corp-B (NWS.US)$

Daily Chart - [BULLISH ↗ **] NWS US is holding above support at 29.1 and we expect price to push towards 35.14 resistance level. A daily candlestick close above 35.14 will push price higher to the next resistance at 38.0. Technical indicators are advocating for a bullish scenario as well, with the MACD starting to show a buildup in positive momentum.

Alternatively: A daily candlestick c...