No Data

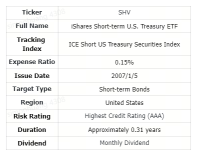

SHV Short-Treasury Bond Ishares

- 110.430

- +0.005+0.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Market Dislocations in U.S. Treasurys Seen Largely Healed -- Market Talk

A JPMorgan survey indicates that the S&P 500 Index has peaked this year, but investors remain bullish on the Magnificent 7.

① A JPMorgan survey shows that 93% of investors believe the S&P 500 Index will hover around 6000 points or lower in the next 12 months, with 40% expecting it to remain within the 5000-5500 points Range; ② Respondents unanimously believe that trade wars and tariff uncertainties will trigger economic consequences, with 61% expecting the USA economy to face stagflation in the next 12 months.

Market Update | Most Autos stocks rose, NIO increased by over 5%, Li Auto grew by 2%, and Trump plans measures to mitigate the impact of car tariffs.

According to market news, President Trump of the USA will announce measures on Tuesday (April 29) to mitigate the impact of auto tariffs.

The sell-off is not over yet! USA Assets are still being "disdained" by overseas investors…

① According to data provided by Deutsche Bank, despite the market recovering over the past week, foreign investors' willingness to invest in USA assets continues to decline; ② Deutsche Bank's Forex research director George Saravelos believes that the recent data on USA capital flows is concerning.

"Debt ceiling" causes trouble! The U.S. Treasury Department's borrowing expectations for Q2 increase threefold, excluding the impact, borrowing decreases instead of increasing.

The U.S. Treasury announced on Monday that the estimated net borrowing for the second quarter is 391 billion dollars higher than expected in February, due to Congress not yet raising the federal debt ceiling, and the initial cash reserves at the beginning of the second quarter being far lower than previously anticipated. The Treasury stated that if the cash balance at the beginning of the season is not taken into account, the estimated borrowing for the second quarter is actually 53 billion dollars lower than the forecast made in February. Some analysts believe this is because DOGE is indeed having an effect, improving the fiscal situation and reducing financing demand.

Besent's new bond issuance strategy: short-term bonds "steady", long-term bonds "gradual", closely monitoring stablecoin "major investors".

On Wednesday, the USA Treasury will announce the bond auction scale for the quarter from May to July. The market expects the Treasury to continue issuing bonds at the established pace, with next week's quarterly redemption auction expected to remain around 125 billion dollars. Some believe the market may interpret this as the Treasury being more inclined to rely on short-term bonds, which is a positive signal for long-term bonds.

Comments

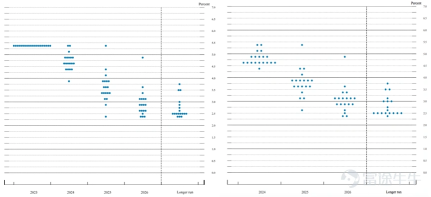

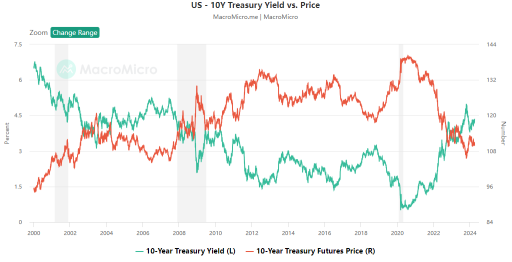

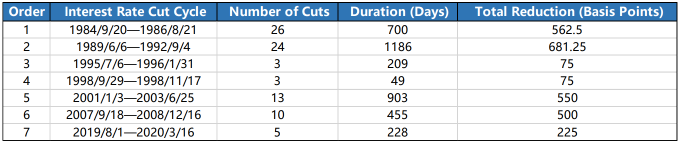

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

When central banks embark on an easing cyc...

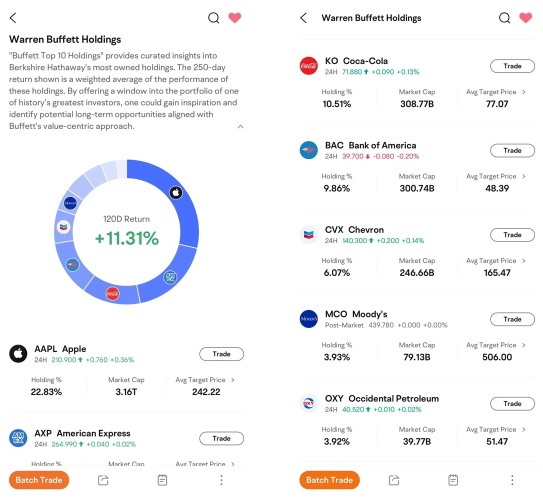

JoanFishers : Buffett loves cash right now — but with stocks rebounding, is holding $334 billion in cash still a smart move?

Hotbuns : Buffett sticks to Apple but avoids AI hype. Is he missing out on tech’s next wave, or is everyone else overvaluing it?

104748096 : Everyone has a past.

NTilly : why aren’t the Japanese stocks showing on his moomoo page?

103459102 JoanFishers : he see something we dont he sell at high last year he saw this crash on tariff