No Data

QLD Proshares Ultra QQQ ETF

- 87.520

- -0.040-0.05%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Treasury Secretary Scott Bessent Says It's Up To China To 'De-Escalate' Trade Tensions, India To Be The 'First Trade Deal' To Be Signed

The sell-off is not over yet! USA Assets are still being "disdained" by overseas investors…

① According to data provided by Deutsche Bank, despite the market recovering over the past week, foreign investors' willingness to invest in USA assets continues to decline; ② Deutsche Bank's Forex research director George Saravelos believes that the recent data on USA capital flows is concerning.

JPMorgan traders are becoming bullish on U.S. stocks, but believe that the upward trend will fade in a few weeks.

Andrew Tyler, the Global Markets Intelligence Head at JPMorgan, believes that with the easing of trade tensions, there is still room for the US stock market to rise and predicts that the upcoming Earnings Reports from tech giants this week are likely to drive the stock market higher. However, he warns that this rebound momentum may weaken in the coming weeks, and the negative impact of US tariffs will begin to drag down the economy in the coming months.

Alexandria Ocasio-Cortez Asks,'How Much Did Majorie Taylor Greene Make When She Bought The Dip?'

U.S. stocks closed mixed: the three major Indexes showed different trends as investors focused on Technology stock Earnings Reports.

① Most China Concept Stocks rose, with the Nasdaq China Golden Dragon Index up 0.68%; ② IBM announced a 150 billion dollar investment plan; ③ Sony Group is reportedly considering splitting its Semiconductors business; ④ NXP Semiconductors Q1 revenue was 2.84 billion dollars, higher than market expectations.

OpenAI Integrates Shopping Features Into ChatGPT

Comments

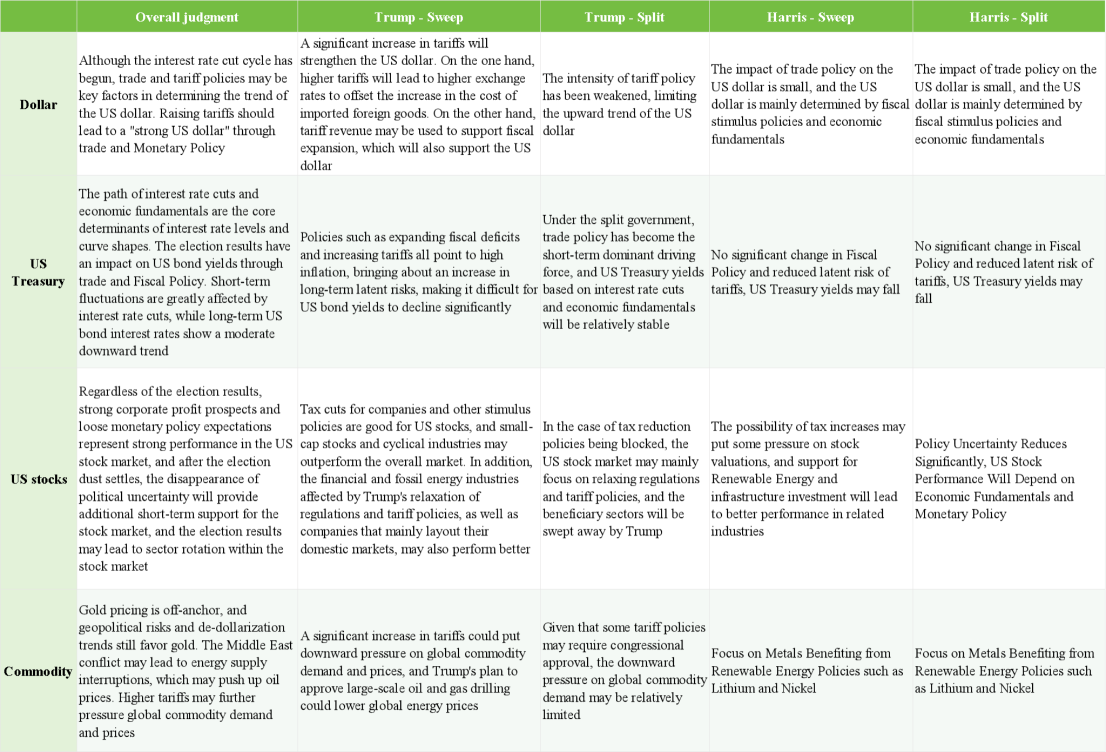

Stanley Druckenmiller, an experienced hedge fund manager, is known for his keen market insights and bold investment style. With important elections approaching in the United States, Druckenmiller recently shared his perspectives, discussing not only the current market conditions but also predicting how different election outcomes might impact the investment environme...

On September 18, 2024, the Federal Reserve announced a 50 basis point rate cut, a decision that came amid significant fluctuations in market expectations regarding the extent of the cut. Compared to historical preemptive rate cuts, this round's expected magnitude and duration are notably longer, resembling the rate-cut cycle from 1984 to 1986, during which the cut reached 562.5 basis points and lasted ...

The Nasdaq-100 Index Fund (QQQ) has outpaced market benchmarks with a growth rate of 155.55% over the past five years.

Despite this, QQQ's valuation is also quite high. According to Morningstar data as of September 4, 2024, its forward P/E ratio is 26.89, and its trailing cash flow P/E ratio is 21.29. Is such a valuation justified? A deeper analysis of QQQ's fundamentals reveals st...

Walmart's stock price has risen significantly in recent years, with a P/E ratio of 42.2 and a price-to-free cash flow ratio exceeding 80, reflecting market optimism about its future. However, given Walmart's already massive scale and intense market competition, its potential for earnings growth does not seem to justify the current high valuation.

In the past few years, Walmart's earnings growth has no...