AU Stock MarketDetailed Quotes

PDN Paladin Energy Ltd

- 6.130

- +0.480+8.50%

20min DelayMarket Closed Apr 29 16:00 AET

2.45BMarket Cap22.87P/E (Static)

6.260High5.710Low7.28MVolume5.730Open5.650Pre Close44.40MTurnover17.98052wk High1.85%Turnover Ratio398.96MShares3.93052wk Low-0.068EPS TTM2.42BFloat Cap108.000Historical High22.87P/E (Static)394.01MShs Float0.080Historical Low0.268EPS LYR9.74%Amplitude--Dividend TTM1.69P/B1Lot Size--Div YieldTTM

Paladin Energy Ltd Stock Forum

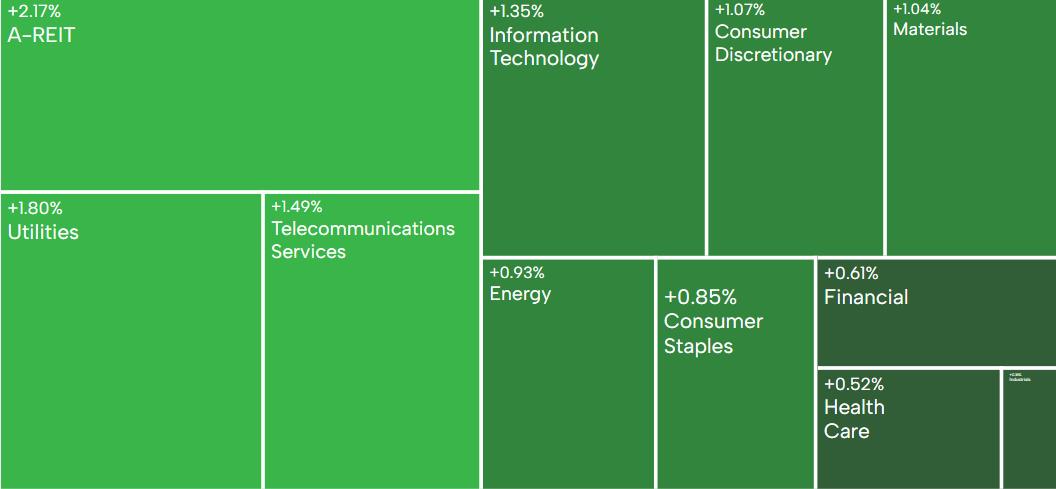

• US markets: The Nasdaq 100 is up 15.9% from its April 7 low. Since then, market fear the VIX has fallen to 25, down from its peak of 60 (which it last hit during COVID).

• Aussie markets: The Australian share market is up 8.9% from its low. Gold producers dim yearly production, implying more upside for gold.

• Stocks to watch: Fortescue, Northern Star and Ramelius, Woodside, Visa, Coca-Cola. And XYZ, Microsoft, Met...

• Aussie markets: The Australian share market is up 8.9% from its low. Gold producers dim yearly production, implying more upside for gold.

• Stocks to watch: Fortescue, Northern Star and Ramelius, Woodside, Visa, Coca-Cola. And XYZ, Microsoft, Met...

From YouTube

17

4

• US markets: The Nasdaq 100 rose 6.4% last week, the S&P 500 gained 4.6%. Tesla gained 18%, Nvidia 9.4%, with big tech businesses affirming they’re still prepared to spend billions on AI GPUs.

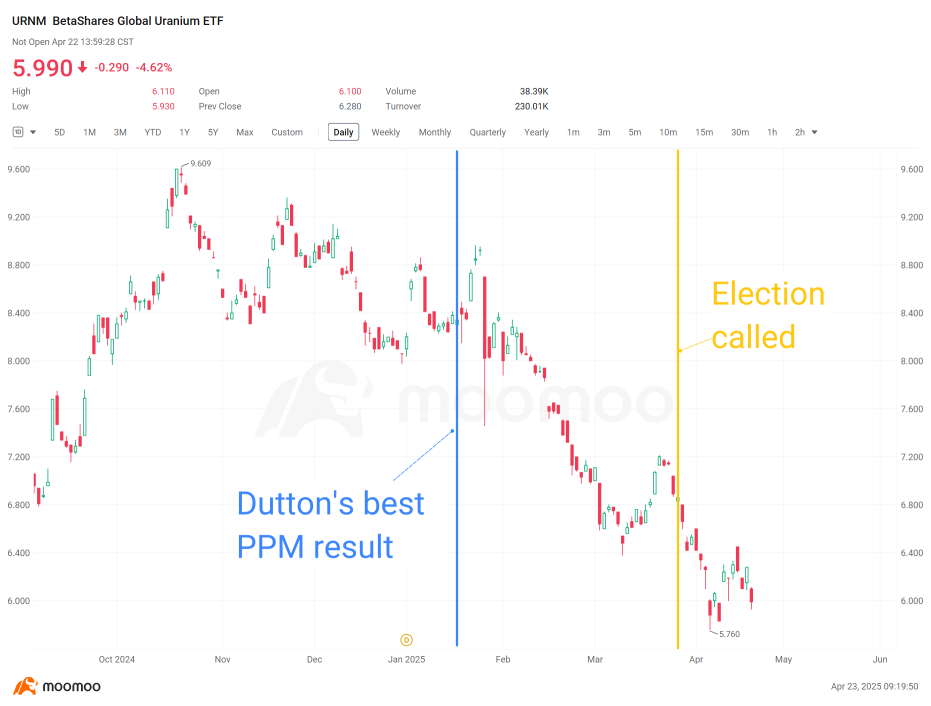

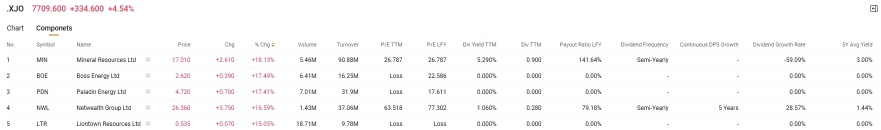

• Aussie markets: Paladin surged 21% last week, Deep Yellow gained 13%, Boss Energy rose 10%. Seems investors are betting the Liberals could win the election in five more sleeps, and usher in a nuclear power policy

• Stocks to watch: Lynas, Yancoal,...

• Aussie markets: Paladin surged 21% last week, Deep Yellow gained 13%, Boss Energy rose 10%. Seems investors are betting the Liberals could win the election in five more sleeps, and usher in a nuclear power policy

• Stocks to watch: Lynas, Yancoal,...

6

• US markets: The world's biggest ETF, the S&P500 $SPY gains US$20 billion in few days. The world's biggest Bitcoin ETF $IBIT gains US$10 billion in 2 weeks. Market fear, the VIX falls to lowest levels in 4 weeks?

• Aussie markets: ASX 200 ETF, VAS now worth about $18 billion again, 3% away from its record all-time high value.

• Stocks to watch: Google, Newmont, Paladin, Telix. ETFs SPY, VAS, URA

Markets are charging, SPY gains US...

• Aussie markets: ASX 200 ETF, VAS now worth about $18 billion again, 3% away from its record all-time high value.

• Stocks to watch: Google, Newmont, Paladin, Telix. ETFs SPY, VAS, URA

Markets are charging, SPY gains US...

From YouTube

21

6

1

$Paladin Energy Ltd (PDN.AU)$ crazy man

6

Uranium investors are delivering a verdict on the Australian federal Election – and its bad news for the Coalition. When the prospects for Peter Dutton’s led conservative party were increasing at the end of 2024 and the beginning of this year there was clear support for uranium stocks. However the turn in political momentum that now favors Labor and The Greens has accompanied a decline in uranium stocks.

Markets are linear – the price of a stock or an index ca...

Markets are linear – the price of a stock or an index ca...

6

8

On Wednesday local time, President Trump announced a 90-day suspension of the imposition of high tariffs. When the government signals an "off-ramp", the market typically interprets it as a positive development, which may indicate a shift in market sentiment. This news has triggered a shift in the global markets from panic to jubilation.

The three major U.S. stock indexes soared, with $Dow Jones Industrial Average (.DJI.US)$closing up 7...

The three major U.S. stock indexes soared, with $Dow Jones Industrial Average (.DJI.US)$closing up 7...

+3

9

2

12

Top gainers: $Mineral Resources Ltd (MIN.AU)$, $Boss Energy Ltd (BOE.AU)$ and $Paladin Energy Ltd (PDN.AU)$

Market summary

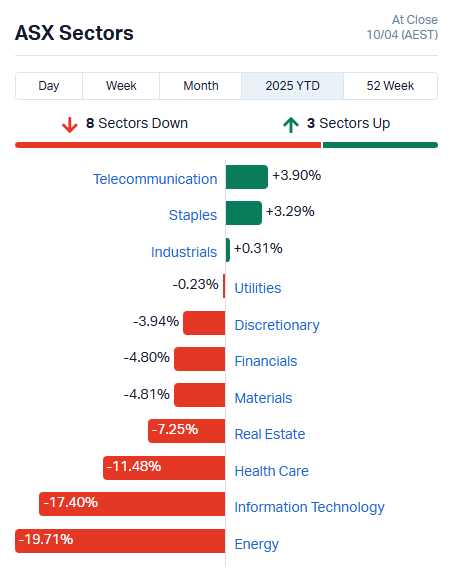

Australian stocks surged on Thursday, mirroring Wall Street's robust performance after President Trump announced a temporary halt on reciprocal tariffs. The $S&P/ASX 200 (.XJO.AU)$ closed up 4.54% at 7709.6, marking its largest single-day gain since March 2020 and adding nearly A$100 billion in market value.

This rally ...

Market summary

Australian stocks surged on Thursday, mirroring Wall Street's robust performance after President Trump announced a temporary halt on reciprocal tariffs. The $S&P/ASX 200 (.XJO.AU)$ closed up 4.54% at 7709.6, marking its largest single-day gain since March 2020 and adding nearly A$100 billion in market value.

This rally ...

+1

5

1

• US markets: US stocks started the quarter on a positive note, while bond yields and the US dollar fell. Tesla +3.6%, marking the biggest gain for most valuable companies overnight. PDD +3.3%. Strategy +6.2%.

• Aussie markets: Futures suggest 79% of a 0.25% RBA rate cut in May, ahead of the Federal Election. Falling building approvals could see bets increase of cut. Uranium stocks suffer as betting agencies sugg...

• Aussie markets: Futures suggest 79% of a 0.25% RBA rate cut in May, ahead of the Federal Election. Falling building approvals could see bets increase of cut. Uranium stocks suffer as betting agencies sugg...

From YouTube

41

3

Columns AU Evening Wrap | ASX 200 gains as investors return; RBA governor Bullock rules out rate cut talks

Top gainers: $Meridian Energy Ltd (MEZ.AU)$, $Charter Hall Group (CHC.AU)$ and $CAR Group Ltd (CAR.AU)$

Top losers: $Liontown Resources Ltd (LTR.AU)$, $Paladin Energy Ltd (PDN.AU)$ and $Pilbara Minerals Ltd (PLS.AU)$

Market summary

$S&P/ASX 200 (.XJO.AU)$ closed up 1 per cent, or 81.8 points, at 7,925.2, recovering most of the previous session's losses. Australian shares gained momentum on Tuesday as the m...

Top losers: $Liontown Resources Ltd (LTR.AU)$, $Paladin Energy Ltd (PDN.AU)$ and $Pilbara Minerals Ltd (PLS.AU)$

Market summary

$S&P/ASX 200 (.XJO.AU)$ closed up 1 per cent, or 81.8 points, at 7,925.2, recovering most of the previous session's losses. Australian shares gained momentum on Tuesday as the m...

+1

3

2

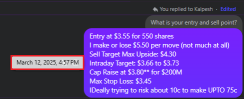

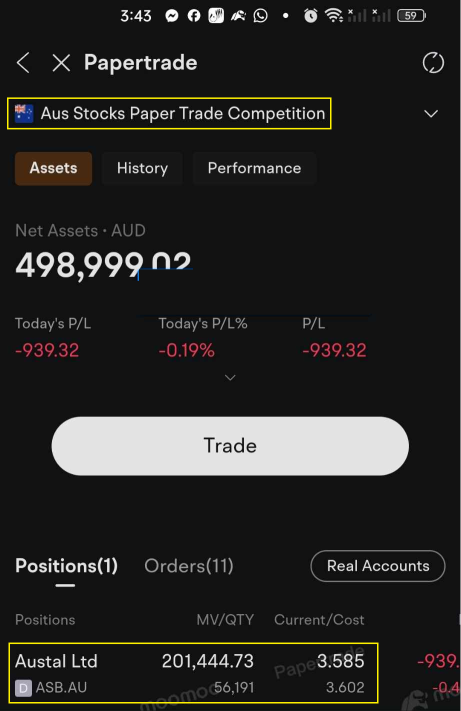

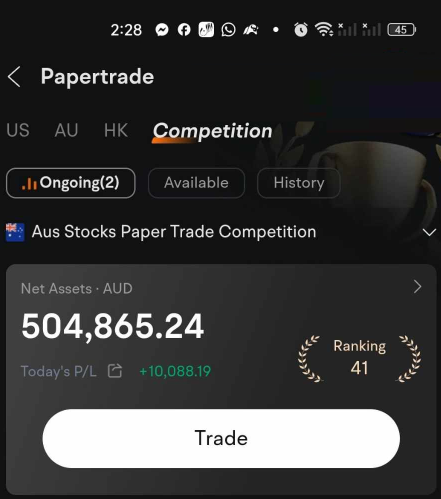

Hello fellow Moo'ers! Today is my 8th Year Anniversary as a Trader & Technical Analyst! ![]()

I want to take this opportunity to THANK everyone for reading my detailed post and I really hope I can be selected as 1 of the Top 3 to not only earn 300 bonus points, but the grand prize of 2,000 @Moomoo AU. I need the assistance of the community here & IF you find any of this informative, educational and entertaining to also PLEASE hit the Like and ...

I want to take this opportunity to THANK everyone for reading my detailed post and I really hope I can be selected as 1 of the Top 3 to not only earn 300 bonus points, but the grand prize of 2,000 @Moomoo AU. I need the assistance of the community here & IF you find any of this informative, educational and entertaining to also PLEASE hit the Like and ...

+12

19

1

2

No comment yet

TWIMO (151403908) : Does this herd of bull have the conviction?

-Leprechaun- TWIMO (151403908) : i think today’s bulls might have foot and mouth disease.

yea they’re bulls but we’re going to have to take em out back and shoot em lol.

-Leprechaun- TWIMO (151403908) : too much data likely to hurt the market on the horizon wouldn’t you say?

TWIMO (151403908) -Leprechaun- : Too much data? We’ll need to remove the noisy bits. I can’t wait for Ms. Amir’s reply.

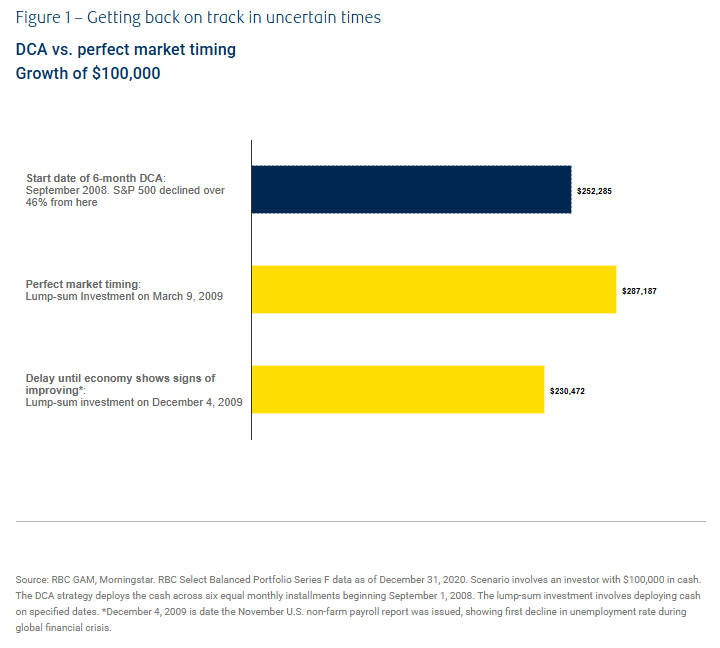

Just to divert a little, I noticed a pattern in Finance/trading experts on Youtube. When the market is up, they tend to recommend stocks, blow own horns, predict and dare viewers to be the next millionaire. However, when the market is down, they advocate being long term investors, quote names of famous investors, steer clear of addressing the stocks that were recommended.