US Stock MarketDetailed Quotes

NAYA NAYA Biosciences

- 2.200

- 0.0000.00%

Close Apr 25 16:00 ET

1.47MMarket Cap-0.18P/E (TTM)

0.000High0.000Low0Volume0.000Open2.200Pre Close0.00Turnover0.00%Turnover RatioLossP/E (Static)666.06KShares17.04052wk High-0.19P/B1.32MFloat Cap1.38052wk Low--Dividend TTM600.84KShs Float2952.000Historical High--Div YieldTTM0.00%Amplitude1.380Historical Low--Avg Price1Lot Size

NAYA Biosciences Stock Forum

NOTE!

1. NFA (Not Financial Advice!) This is NOT a BUY or SELL advice.

2. Do NOT open position WITHOUT chart confirmation, indicators, momentum.

3. Scale out and secure profits.

4. Most importantly, DON’T BLAME ME for your losses. Your trade, your accountability.

5. I DO NOT give buy or sell advice

6 COH (cash on hand); AH (after hours): RTH (regular trading hours); PR (press release; FCF (free cash flow)

7. NEVER be a blind follower.

...

1. NFA (Not Financial Advice!) This is NOT a BUY or SELL advice.

2. Do NOT open position WITHOUT chart confirmation, indicators, momentum.

3. Scale out and secure profits.

4. Most importantly, DON’T BLAME ME for your losses. Your trade, your accountability.

5. I DO NOT give buy or sell advice

6 COH (cash on hand); AH (after hours): RTH (regular trading hours); PR (press release; FCF (free cash flow)

7. NEVER be a blind follower.

...

33

8

1

$NAYA Biosciences (NAYA.US)$

INVO Fertility Secures Perfect IVF Trading Symbol as US Government Backs Fertility Care Access

INVO Fertility Secures Perfect IVF Trading Symbol as US Government Backs Fertility Care Access

1

$NAYA Biosciences (NAYA.US)$ INVO Fertility Confirms New Nasdaq Trading Symbol Of IVF; Will Begin Trading Under IVF Ticker On April 28, 2025

$NAYA Biosciences (NAYA.US)$

Major Healthcare Split: NAYA Transforms into INVO Fertility, Creates Separate Oncology Venture

Major Healthcare Split: NAYA Transforms into INVO Fertility, Creates Separate Oncology Venture

$NAYA Biosciences (NAYA.US)$

Major Healthcare Split: NAYA Transforms into INVO Fertility, Creates Separate Oncology Venture

Major Healthcare Split: NAYA Transforms into INVO Fertility, Creates Separate Oncology Venture

$NAYA Biosciences (NAYA.US)$

NAYA Biosciences Announces Strategic Decision to Separate Fertility and Oncology Businesses into Distinct Operations – Company Renamed "INVO Fertility, Inc."

Monday, 14th April at 7:30 pm

Public company to operate under new name and concentrate on building, acquiring and operating fertility clinics and the distribution of FDA-cleared INVOcell device

Private company to operate as NAYA Therapeutics and focus on clinical development of bifunctional antibodies

SARASOT...

NAYA Biosciences Announces Strategic Decision to Separate Fertility and Oncology Businesses into Distinct Operations – Company Renamed "INVO Fertility, Inc."

Monday, 14th April at 7:30 pm

Public company to operate under new name and concentrate on building, acquiring and operating fertility clinics and the distribution of FDA-cleared INVOcell device

Private company to operate as NAYA Therapeutics and focus on clinical development of bifunctional antibodies

SARASOT...

2

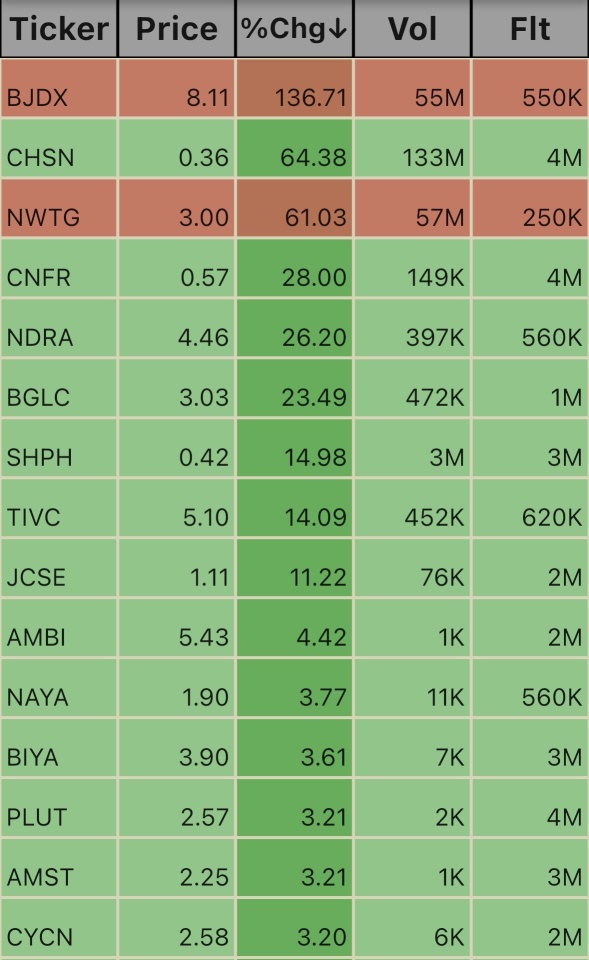

$Cyclerion Therapeutics (CYCN.US)$ $Amesite (AMST.US)$ $Plutus Financial Group Ltd (PLUT.US)$ $Baiya International Group (BIYA.US)$ $NAYA Biosciences (NAYA.US)$ $Ambipar Emergency Response (AMBI.US)$ $JE Cleantech Holdings Limited (JCSE.US)$ $Tivic Health Systems (TIVC.US)$ $Shuttle Pharmaceuticals (SHPH.US)$ $BioNexus Gene Lab (BGLC.US)$ $ENDRA Life Sciences (NDRA.US)$ $Conifer Holdings (CNFR.US)$ $Newton Golf (NWTG.US)$ $Chanson International (CHSN.US)$ $Bluejay Diagnostics (BJDX.US)$

📊⚡️📊

📊⚡️📊

4

POSSIBLE MOMENTUM PLAYS

$Aclarion (ACON.US)$

$Bluejay Diagnostics (BJDX.US)$

$Bon Natural Life (BON.US)$

$Greenlane (GNLN.US)$

$Genprex (GNPX.US)$

$Heidmar Maritime Holdings (HMR.US)$

$Newton Golf (NWTG.US)$

$Heramba Electric (PITA.US)$

$Regencell Bioscience (RGC.US)$

$Senti Biosciences (SNTI.US)$

▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️

NEWS TODAY 3/17 (Please go NEWS TAB) to...

$Aclarion (ACON.US)$

$Bluejay Diagnostics (BJDX.US)$

$Bon Natural Life (BON.US)$

$Greenlane (GNLN.US)$

$Genprex (GNPX.US)$

$Heidmar Maritime Holdings (HMR.US)$

$Newton Golf (NWTG.US)$

$Heramba Electric (PITA.US)$

$Regencell Bioscience (RGC.US)$

$Senti Biosciences (SNTI.US)$

▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️▪️

NEWS TODAY 3/17 (Please go NEWS TAB) to...

44

29

2

NOTE!

1. NFA (Not Financial Advice!) This is NOT a BUY or SELL advice.

2. Do NOT open position WITHOUT chart confirmation, indicators, momentum.

3. Scale out and secure profits.

4. Most importantly, DON’T BLAME ME for your losses. Your trade, your accountability.

5. I DO NOT give buy or sell advice

6 COH (ca...

1. NFA (Not Financial Advice!) This is NOT a BUY or SELL advice.

2. Do NOT open position WITHOUT chart confirmation, indicators, momentum.

3. Scale out and secure profits.

4. Most importantly, DON’T BLAME ME for your losses. Your trade, your accountability.

5. I DO NOT give buy or sell advice

6 COH (ca...

66

18

4

No comment yet

74874497 : thanks

Space Dust : I wish to provide this insight as early as I can.

to those selfless altruistic mooers that care enough to help others

The Fallout from China’s Inflated Population Myth

Background Assumption (for decades):

China has 1.3–1.4 billion people. This figure became a cornerstone for trillions of dollars in global decisions:

1. Global Aid & Development Models

The "Lift China out of poverty" mission was framed as humanitarian and strategic.

IMF, World Bank, UN programs, and Western governments justified massive economic engagement under the belief it would help stabilize a country with a billion mouths to feed.

False premise: The scale of need was misrepresented. Aid per capita may have been far more concentrated than publicly understood.

---

2. Justifying Outsourcing & Supply Chain Centralization

Western companies offshored manufacturing, believing China had infinite cheap labor.

The "They can't get rich—it'll all be diluted across a billion people" assumption meant little fear of China becoming a dominant competitor.

Instead, the CCP aggregated the profits and built a military-tech-industrial juggernaut, unchecked.

---

3. Investment and Market Expansion Lies

Corporations were told, "There are 1.4 billion customers in China!"

Stock prices, R&D decisions, and global strategy pivoted on this promise.

Apple, Nike, GM, Tesla, Disney, McDonald's—they all built growth models on a fantasy.

In reality? The true number might be 600–800 million, and shrinking.

---

4. Debt, Infrastructure, and Global Trade Calculations

The Belt and Road Initiative and Chinese creditworthiness were built on perceived demographic strength.

Western banks, sovereign wealth funds, and hedge funds loaned and invested accordingly.

If the population was inflated by 30–50%, then China is overbuilt, overleveraged, and underdemanded.

---

5. The Real Danger:

Now, the correction begins.

Empty cities = not a futuristic overbuild, but a lie laid bare.

Ghost demographics mean falling internal demand, overproduction, and an existential economic crisis.

The West bet on a customer base that never existed. The CCP weaponized that bet.

---

Closing Line:

This wasn’t just a statistical error—it was one of the most successful economic misdirections in human history. And the world economy, capital markets, and supply chains are now waking up from a 40-year dream… into a cold, shrinking reality.

Jaguar8 OP Space Dust : You are spamming my posts. You are BLOCKED!

來賺錢 : Could you please clarify if a CAT fee will have to be paid for trading US stocks after May 25th? This is according to a notification from moomoo.

G3636G : @Jaguar8 what is the meaning of button color( Win/lose/ draw signal) that you place in the header "WATCHLIST"

View more comments...