No Data

K Kinross Gold Corp

- 20.410

- +0.330+1.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Gold Outlook: Record Highs on Ice as Bearish Signals Build

Base Metal Prices Mixed as Copper Gains on Record Chinese Inventory Decline -- Market Talk

Gold has come to a sudden stop, long positions have drastically decreased, and analysts warn that the trend has diverged from the fundamentals.

Barclays strategist Stefano Pascale stated that the surge in Gold Call Options after Trump's tariffs, leading to an inverted skew indicator, coupled with a sharp reduction in hedge fund long positions and the recent pullback in Gold prices, are all reasons to adopt a cautious outlook on Gold prices in the short term. The movement of Gold has already "decoupled" from the "fundamental drivers" such as the US dollar and real interest rates.

Canadian Stock Movers for Monday | Denison Mines Corp Was the Top Gainer; Agriculture Led Gains

Gold Falls Globally: US$ -1.29%, RM -1.34%

Betting on Gold for 15 years, Paulson achieved great success; he did not buy gold bars, but instead bought gold mines.

As early as when gold prices were around $900 per ounce, Paulson heavily bought gold mining stocks, including Perpetua Resources, Agnico Eagle Mines, and International Tower Hill Mines, among which several saw an increase of over 30% last year. Paulson believes that as gold prices rise, the profits of mining companies will multiply, and mining costs are relatively fixed, so even if gold prices adjust, there will still be room for profits.

Comments

Read More: BoC Interest Rate Decision Preview: CPI Report Paves Way for BoC Rate Cuts, Tariffs Add Uncertainty

Leading this impressive rally is the Information Technology Sector, which has skyrocketed by 50.88% since...

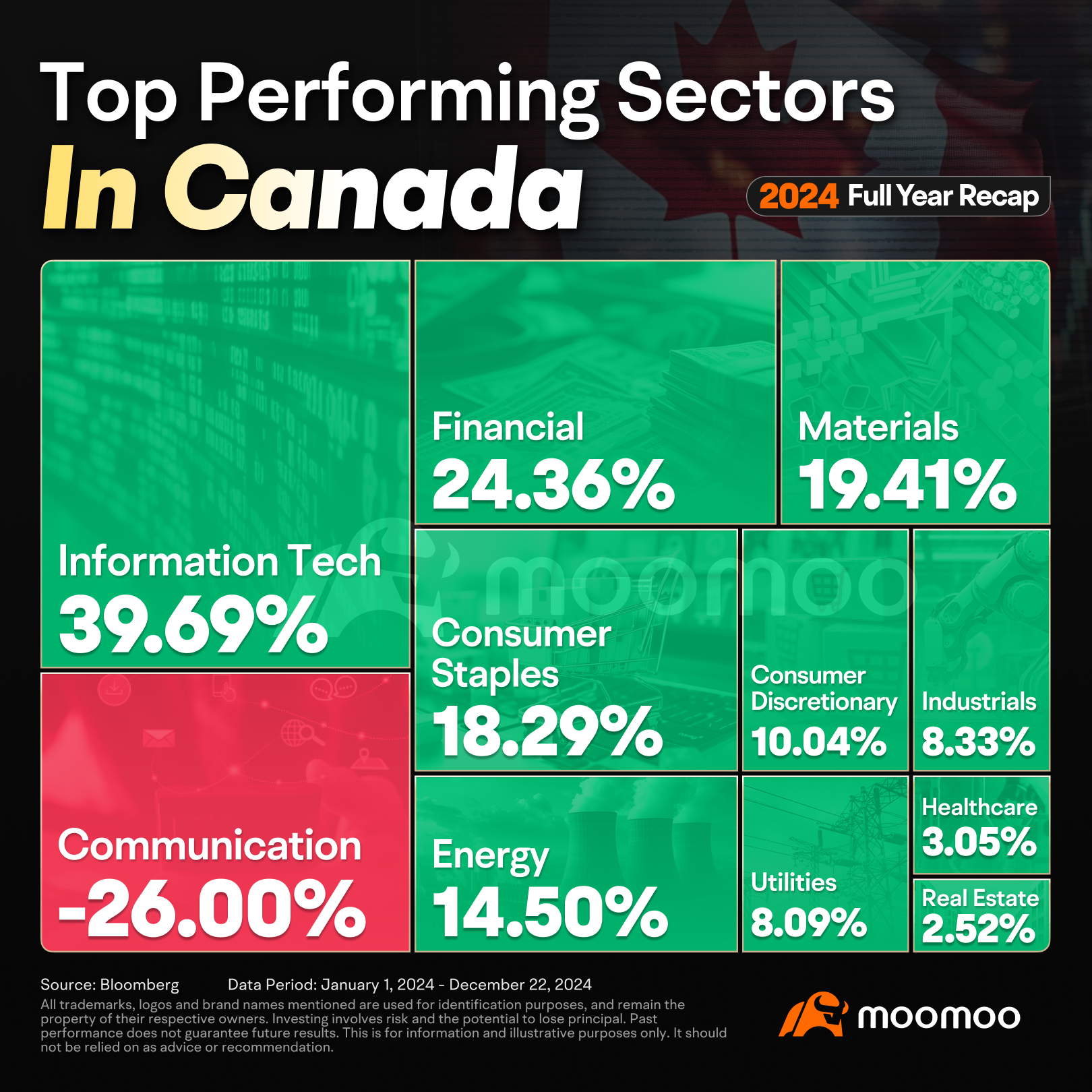

■ How did each sector perform in 2024?

Among all sectors in Canada, t...

•Base metals: Copper prices have risen again

•Precious metals: Gold and silver experienced a resurgence

•Bulk commodity: Iron ore prices have fallenl to the lowest point in over two weeks

Spot Price Snapshot

Key Price Moves

$Gold Futures(JUN5) (GCmain.US)$ and $Silver Futures(JUL5) (SImain.US)$ ...

Ella Ou :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)