No Data

US ETFDetailed Quotes

FXE Currencyshares Euro Trust Euro Currency Shares Npv

- 105.510

- +0.600+0.57%

Close Apr 28 16:00 ET

105.530High104.870Low

105.530High104.870Low248.10KVolume104.870Open104.910Pre Close26.09MTurnover5.11%Turnover Ratio--P/E (Static)4.85MShares106.46052wk High--P/B511.92MFloat Cap93.76652wk Low1.86Dividend TTM4.85MShs Float153.892Historical High1.76%Div YieldTTM0.63%Amplitude84.740Historical Low105.171Avg Price1Lot Size

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Deutsche Bank Analysts Turn "Bullish" Again on European Stocks

Euro Zone Consumers Increase Inflation Expectations for the Coming Years- Survey

European Stocks Head for Mixed Open as Investors Eye Tariff Impact on Earnings

ECB's Christine Lagarde Says Euro-area Disinflation 'Well on Track'

ECB May Have to Cut Rates Below Neutral, Muller Says - Report

Gold Hits Record High, Dollar Weakens As Trump's Policy Stance And Fed Chair Criticism Induces Uncertainty

Comments

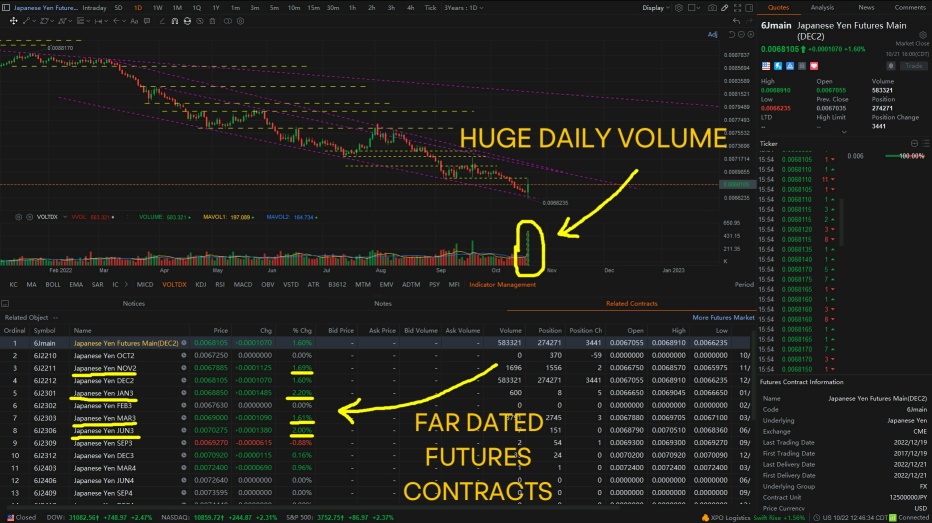

$Japanese Yen Futures(JUN5) (6Jmain.US)$

The Japanese Yen experienced a very bullish day Last Friday. One of the most bullish days it has had in quite some time. This was caused by news headline coming from the Bank of Japan. The BOJ is going to intervene in the FX markets to support the japanese yen. This strengthened the yen big time by creating artificial demand for the yen which added to the bearishness of the US dollar on Friday. All of the other...

The Japanese Yen experienced a very bullish day Last Friday. One of the most bullish days it has had in quite some time. This was caused by news headline coming from the Bank of Japan. The BOJ is going to intervene in the FX markets to support the japanese yen. This strengthened the yen big time by creating artificial demand for the yen which added to the bearishness of the US dollar on Friday. All of the other...

+3

8

7

2

$Currencyshares Euro Trust Euro Currency Shares Npv (FXE.US)$ day to set up puts! for me at least idk what most are doing

There have been many instances in the past where the stock market has crashed. You can blame it on a war, a financial crisis, a pandemic, or just simple monetary policy. Currently our bear market is mainly due to the Fed tightening monetary policy by increasing interest rates. Either way when the market crashes we can lose money. What do we do when our investments are crumbling?

It can be nerve wrecking watching your long term investments going do...

It can be nerve wrecking watching your long term investments going do...

19

5

15

Read more

solo invest : Yea this barely affected the markets last month. I doubt investors will have any confidence in the BOJ with the central bank still stimulating the economy. I wonder if all of the other major currencies were rising just because of this catalyst as well. Like maybe this news brought down the dollar enough to cause the momentum to bring up the other currencies. I mean i cant point out why every other currency was ripping like crazy. It seems like it was simply because the dollar was dropping. Was japan the only catalyst? Or were there other Macro events or headlines that are not mentioned here? I didn’t see anything else myself. I’m just wondering… What do yo think of this post @iamiam??

solo invest : Do you have an opinion on this one @Mcsnacks H Tupack? Do you follow forex?

SpyderCall OP solo invest : good person to ask. I might not have noticed any other major forex news last friday. i didnt see anythin else

iamiam solo invest : this is a fed pivot play. There were FED pivot rumors from a convenient WSJ article at 8am (the FED has entered lock down and they can't speak to refute the article). like the post says it came at a support level on the markets and resistance on the dollar and they broke the dollar as it was rallying (we were about to have a -300 nasdaq market day). My guess is the dollar now falls back to the 50MA. Could the article be legitimate? sure, but I wouldn't bet on it.

solo invest iamiam : Agreed. If the dollar goes red then I dont think it will last that long. But who knows

View more comments...