No Data

ETHV VanEck Ethereum ETF

- 26.720

- +0.380+1.44%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Ethereum Foundation Revamps Leadership With 'Twin Goals' – More Inside

Trump-backed World Liberty Financial Partners With CZ, Pakistan to Drive Crypto Adoption

The moat and investment value of Ethereum.

Ethereum, backed by a strong moat and an innovative team culture, currently has zero cash flow, but its future free cash flow potential is immense. The investment value lies in the long-term ecological development and the increase in scarcity brought about by the deflationary mechanism.

Three main reasons why Ethereum is in trouble.

This article will elaborate on three more pragmatic reasons: talent crisis, fragmented user experience, and governance issues.

Ethereum Whales Pull Back, but Traders, Watch Out THIS 'Make-or-break' Level!

What is a reciprocal tariff? How does it affect the cryptocurrency Industry?

When governments of various countries start imposing tariffs on each other, it sends a signal of instability - and financial markets dislike uncertainty. When Global trade flows are disrupted, Stocks, Bonds, and Cryptos will react.

Comments

April 11, 2025

1. Multi-Timeframe Context

Weekly

ETH is still evolving within a major descending channel, characterized by:

Weekly RSI in an extreme oversold zone.

Weekly MACD very negative, but visible flattening: selling pressure is starting to slow down.

Weekly SLOWKD also in deep oversold territory, with no clear rebound signal yet.

> Weekly Conclusion:

The dynamic remains heavy and bearish, but sellers are starting to show signs of fat...

March 18, 2025

1️⃣ Part 1 - Complete Technical Analysis of Ethereum

📊1. Multi-Timeframe Analysis (15min, 1h, 4h, Daily)

General Trend & Market Structure

15min: Strong bullish trend with potential exhaustion.

1h: Confirmation of a strong rally with indicators in the overbought zone.

4h: Ongoing bullish recovery, with signs of momentum excess.

Daily: Returning to a bullish phase, key resistance around $1950.

---

2. Volume & Liquidi...

March 5, 2025:

🔹️Part 1: Context, Trends, and Market Structure

---

1. Multi-Timeframe Analysis and Market Structure

Multi-timeframe analysis is essential to identify underlying trends and avoid false signals. We will analyze ETH across multiple timeframes to detect key levels and the current market dynamics.

a) Monthly Chart (Long-Term)

General Trend: ETH is in a bullish recovery phase after a strong recent correction. Monthl...

March 4, 2025

1️⃣ Phase 1: Trend Analysis and Multi-Timeframe Chart Structures

---

1. Weekly Chart Analysis

General Trend:

Main trend: Bearish within a long-term descending channel.

Key Support: $2002 (last tested low).

Key Resistance: $2837 (BBI) and $3152 (VWAP).

Technical Indicators:

RSI: 19.31 (extremely oversold), indicating a potential technical rebound.

MACD: -299.61 (strong negative divergence, but the bearish ...

Phase 1: Trend Analysis and Chart Structure Review

---

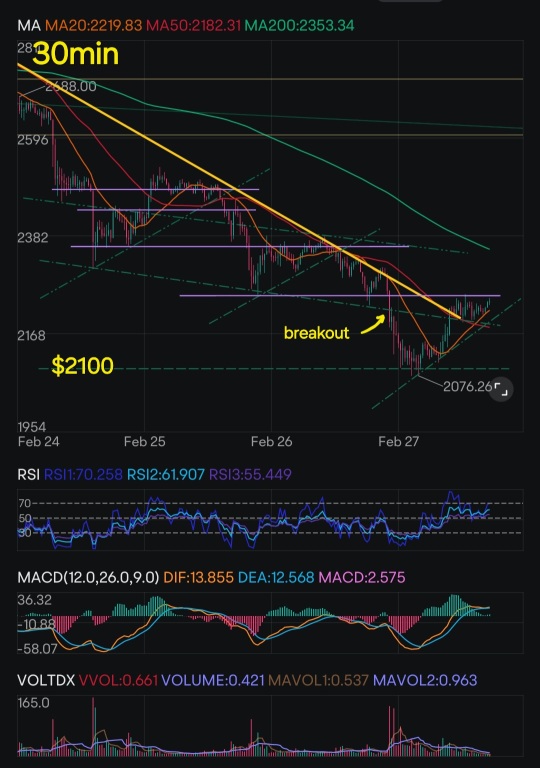

1. Trend Analysis and Chart Patterns

✅ Weekly Chart

Overall Trend: Bearish within a long-term descending channel.

Key Support: $2076, repeatedly tested with a potential rebound.

Key Resistance: $2947, aligned with the BBI and the 50MA.

RSI: 21.61 (extremely oversold), signaling a potential rebound.

MACD: -248.879 (very bearish), but losing momentum.

SLOWKD: K:...

Bitcoin is slow and expensive to use (10 minutes per transaction on average, high fees).

Bitcoin is slow and expensive to use (10 minutes per transaction on average, high fees).

John Constantine : wonder when will be at its previous ATH … i guess 2-3 years time …. mine at 3.4K price .

Kevin Matte OP John Constantine : While the current distance from the previous ATH can feel discouraging, every major cycle reset also sets the stage for new long-term opportunities.

ETH is currently rebuilding its technical structure step-by-step. Breaking through key levels such as $1680, $2000, and $2500 will be essential to re-establish a true bullish foundation.

Instead of focusing solely on past prices, it’s more strategic to focus on how the present consolidation phase can provide better positioning for future growth.

Recent data also shows some encouraging developments:

Whales have been discreetly accumulating ETH between $1550 and $1620 levels.

Funding rates are stabilizing after several weeks of negative bias.

Options activity is leaning slightly bullish, with an increase in CALL positions between $1650 and $1700.

Spot volumes are starting to pick up slowly, reflecting a cautious but improving sentiment.

Markets evolve in phases — what matters is how we adapt to the current cycle to maximize upcoming opportunities.

Additionally, there are alternative strategies that can help depending on your market view.

If you believe prices will rise, leveraged ETFs can amplify gains; if you expect further declines, Inverse ETFs can offer protection or short exposure without direct short-selling.

Knowing how to use these tools appropriately can make a significant difference when navigating volatile periods

Jason HF : Thank you for analyzing with care.