No Data

EDU New Oriental

- 46.800

- +0.680+1.47%

- 47.990

- +1.190+2.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Overview of international financial hotspots last night and this morning _ April 26, 2025 _ Financial news

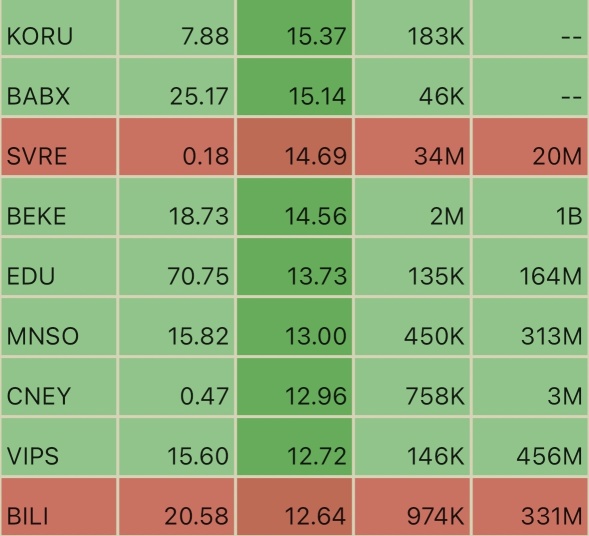

For more global financial news, please visit the 7×24 hours real-time financial news market closing: US stocks closed higher with Technology stocks leading the rise. This week, the Nasdaq increased by over 6.7%. On April 25, the top 20 US stocks by trading volume: Tesla surged 9.8%, reports suggest the USA plans to relax autonomous driving regulations. On Friday, China Concept Stocks had mixed results, with New Oriental rising by 1.53%, while Weiwu dropped by 11.44%. WTI June Crude Oil Product futures rose by 0.37%, while spot Gold fell nearly 1% on Friday, accumulating a decline of 0.30% this week. Major European stock indices closed with collective increases, with the German DAX30 Index rising by 0.81%. Macroeconomically, Trump stated that he likes 'a million rich.'

Growing Distrust In US Education Could Impact This Stock

【Brokerage Focus】Guosen maintains the "Outperform" rating for New Oriental (09901), stating that there is still pressure on the demand for studying abroad and recommends continued attention.

Jingwu Financial News | Guosen Securities Research Pointed Out that New Oriental (09901) FY2025 Q3 revenue is 1.183 billion USD, a decrease of 2.0%, mainly due to the impact of "Walking with Glory" in July 2024, with non-selective business revenue at 1.038 billion USD, an increase of 21.2%, at the upper limit of the previous guidance range (18-21%). The firm indicated that the K9 Education new business grew by 35%, with 0.408 million people in non-academic literacy training, up by 14.9%, and 0.309 million paid active users of learning machines, up by 64.4%. Growth remains resilient, but the growth rate has somewhat slowed due to base effects.

New Oriental Education & Technology May Face Near-Term Pressure in Revenue Growth -- Market Talk

Goldman Sachs: Maintains Buy rating on NEW ORIENTAL-S (09901) and raises the Target Price to 42 Hong Kong dollars.

The bank gained confidence from New Oriental's earnings report conference call for the February quarter. Management emphasized their focus on cost control and improving operation efficiency during the meeting, and they expect that the operating profit margin (OPM) for New Oriental's core business will expand in the May quarter and the 2026 fiscal year.

[Brokerage Focus] BOCOM INTL maintains a Buy rating on New Oriental (09901), expecting cost reduction and efficiency improvement to be reflected in the fourth quarter.

Jinwu Financial News | BOCOM INTL's Research Reports indicate that New Oriental (09901) has announced its third-quarter results for the fiscal year 2025, with revenue decreasing by 2% year-on-year; excluding EAST BUY, the revenue from Education and cultural tourism increased by 21% year-on-year. The adjusted operating profit margin is 12%, and the operating profit margin excluding EAST BUY is 13%, which is a decline from 15% in the same period last year, mainly impacted by the pressure on the growth rate of studying abroad business revenue and investment in cultural tourism. For the outlook of the fourth quarter, the bank expects core education (including cultural tourism) revenue to increase by 13% year-on-year (management guidance is 10-13% growth), which is basically consistent with previous expectations, and the growth rate slowdown is mainly due to the international business income.

Comments

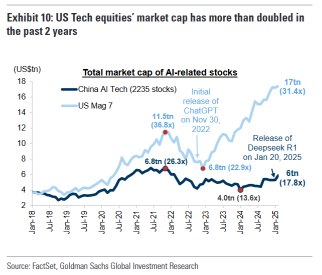

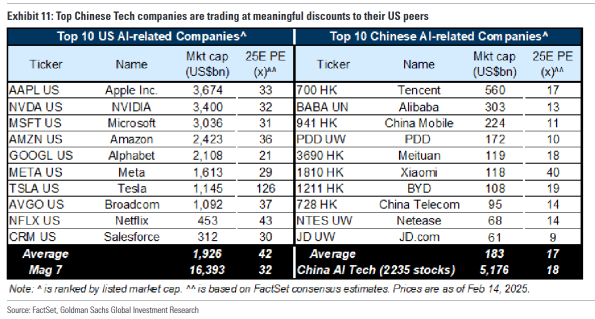

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

$New Oriental (EDU.US)$ $EAST BUY (01797.HK)$ $NEW ORIENTAL-S (09901.HK)$ $TAL Education (TAL.US)$ $Gaotu Techedu (GOTU.US)$

📊⚡️📊

104088143 : Good

104456407 : moomoo

Nchiwla : amazing!

104554083 : good

1TOPCat : Wow!

View more comments...