US OptionsDetailed Quotes

DAL250502P35500

- 0.01

- 0.000.00%

15min DelayClose Apr 29 16:00 ET

0.01High0.01Low

0.01Open0.01Pre Close247 Volume319 Open Interest35.50Strike Price247.00Turnover91.15%IV15.66%PremiumMay 2, 2025Expiry Date0.00Intrinsic Value100Multiplier2DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type-0.0094Delta0.0081Gamma4208.00Leverage Ratio-0.0093Theta0.0000Rho-39.44Eff Leverage0.0009Vega

Delta Air Lines Stock Discussion

Columns 80 days since Trump's been in. 4 elements pressuring markets & creating opportunities for the brave

What’s happening in markets, with uncertainty in the air this entire quarter

It’s been 80 days since Donald Trump was inaugurated. About 10 days since markets were disrupted by “Liberation Day” and Trump hit much of the world with tariffs. China retaliated, Europe did too. Sure, Trump said he’s open to negotiate. And he paused some tariffs for 90 days, the EU then paused counter-tariffs. But wit...

It’s been 80 days since Donald Trump was inaugurated. About 10 days since markets were disrupted by “Liberation Day” and Trump hit much of the world with tariffs. China retaliated, Europe did too. Sure, Trump said he’s open to negotiate. And he paused some tariffs for 90 days, the EU then paused counter-tariffs. But wit...

From YouTube

148

9

2

$Delta Air Lines (DAL.US)$ fake pump, dump at earnings

1

1

Before the Bell U.S.

Stock futures plummeted Wednesday following China's announcement of retaliatory tariffs on U.S. products, further intensifying global trade conflicts.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ fell 1.43%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went down by 1.12%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went down 614 points, or 1.62%.

Top News

China Raises Additional Tariffs o...

Stock futures plummeted Wednesday following China's announcement of retaliatory tariffs on U.S. products, further intensifying global trade conflicts.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ fell 1.43%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went down by 1.12%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went down 614 points, or 1.62%.

Top News

China Raises Additional Tariffs o...

42

13

76

$Delta Air Lines (DAL.US)$ This is unbelievable

in 3 months Delta went from a guidance that was outstanding now they reversed it 180° and their growth has stalled

cruise ships are screwed a month ago they were saying everything is great all of the cruise liners everything's great and that's because people book cruises 6 months 3 months a year in advance.

now the cruise liners it's way the hell down and airlines it's way down is their guidance. despite oil prices dropping dramatically which is t...

in 3 months Delta went from a guidance that was outstanding now they reversed it 180° and their growth has stalled

cruise ships are screwed a month ago they were saying everything is great all of the cruise liners everything's great and that's because people book cruises 6 months 3 months a year in advance.

now the cruise liners it's way the hell down and airlines it's way down is their guidance. despite oil prices dropping dramatically which is t...

1

10

1

$Delta Air Lines (DAL.US)$

Delta's Mixed Q1 Results: Record $2B From AmEx While Suspending 2025 Guidance

Delta's Mixed Q1 Results: Record $2B From AmEx While Suspending 2025 Guidance

• US markets: US tariffs come into effect within hours. Trump raises US tariffs on China to 104% in total. China to "fight back to the end"

• Aussie markets: ASX200 falls 2% in first 10 minutes of trade as investors continue to move out of stocks and commodities and go into cash, bracing for more pain.

• Stocks to watch: Big banks to report earnings JPM, MS, Wells Fargo, GS, BAC, C, then Netflix next week. Followed...

• Aussie markets: ASX200 falls 2% in first 10 minutes of trade as investors continue to move out of stocks and commodities and go into cash, bracing for more pain.

• Stocks to watch: Big banks to report earnings JPM, MS, Wells Fargo, GS, BAC, C, then Netflix next week. Followed...

From YouTube

10

1

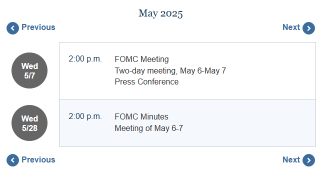

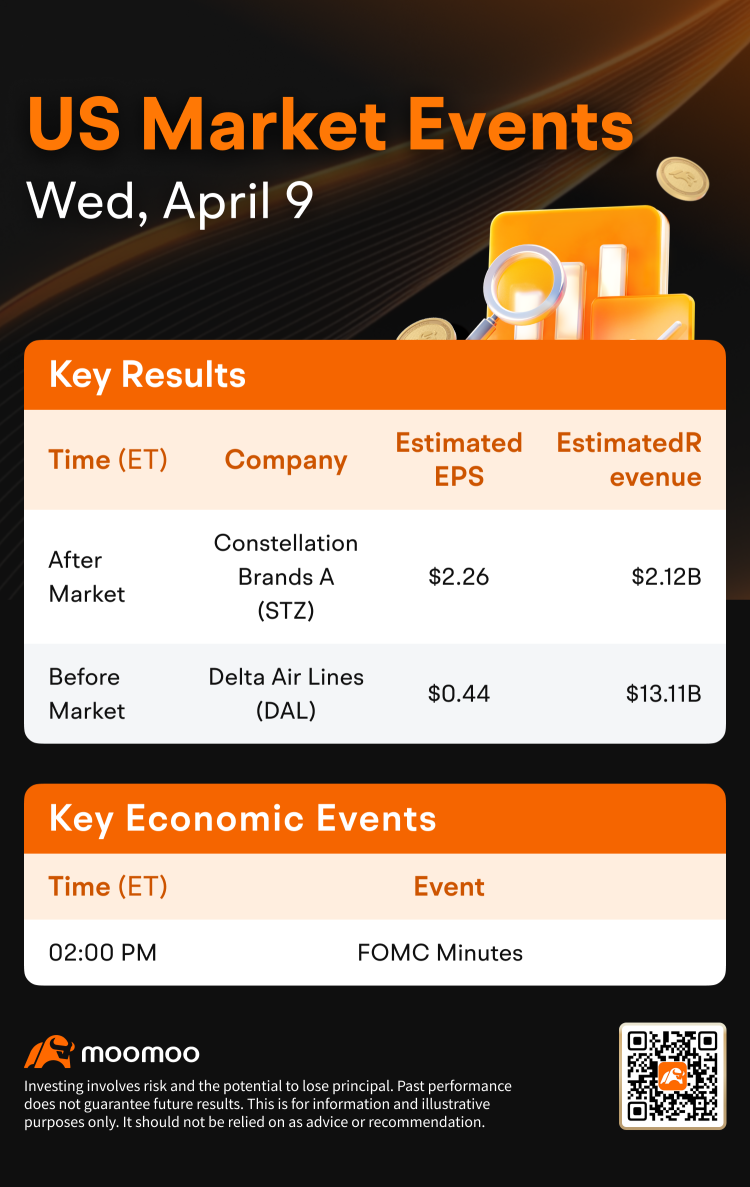

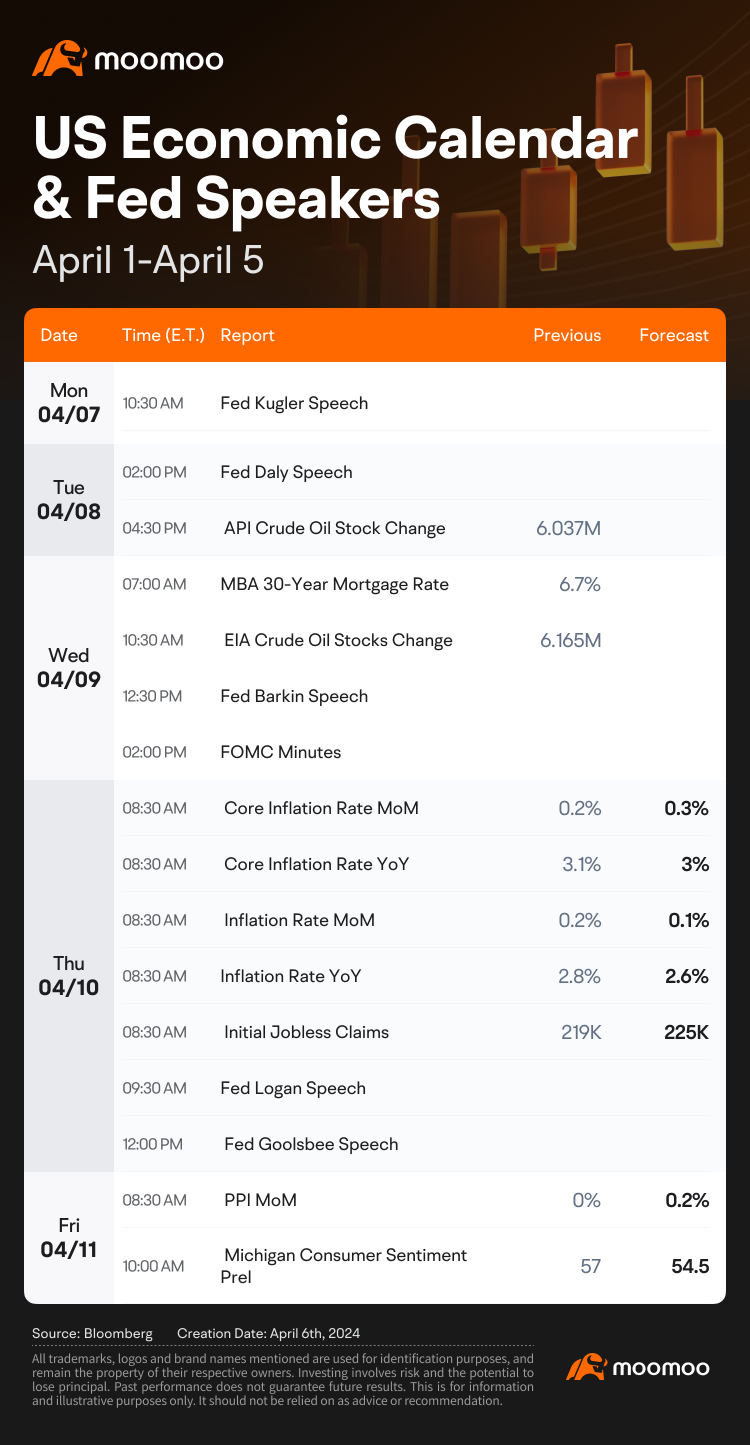

Hi mooers!

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $JPMorgan (JPM.US)$ and $Delta Air Lines (DAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earni...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $JPMorgan (JPM.US)$ and $Delta Air Lines (DAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earni...

11

3

1

Earnings Preview

As the first-quarter earnings season begins next week, several major companies are set to address the effects of recent economic developments on their operations and customers. $Delta Air Lines (DAL.US)$ , $CarMax (KMX.US)$ , and $Constellation Brands (STZ.US)$ will likely discuss the impact of newly implemented tariffs by the U.S. administration during their earnings calls.

The economic landscape wil...

As the first-quarter earnings season begins next week, several major companies are set to address the effects of recent economic developments on their operations and customers. $Delta Air Lines (DAL.US)$ , $CarMax (KMX.US)$ , and $Constellation Brands (STZ.US)$ will likely discuss the impact of newly implemented tariffs by the U.S. administration during their earnings calls.

The economic landscape wil...

+3

43

7

29

Agent:On Monday04/08/2025-PleaseAllocateCurrent&CumulatedDivedendsAvailableFrom:$ $Delta Air Lines (DAL.US)$ & $NVIDIA (NVDA.US)$ & $Apple (AAPL.US)$ =20%>CentralPacificBank:PayToTheOrderOf:GabrielSpencerKApilando+Account#:8901754512&Routing#:121301578//25%intoMoomooUSCashAccount#:73824065-GabrielSApilando//

5

$Delta Air Lines (DAL.US)$ is expected to release its quarterly earnings result for fiscal Q1 2025 on 09 April 2025 before the market open.

The consensus estimate for Q1 2025 revenues is expected to come in at $13.8 billion. The earnings per share consensus estimate for Q1 2025 is anticipated to be at 44 cents per share, this is a slight drop from same period last year.

Delta Air Lines (DAL) Last Positive Earnings Call Saw Decline O...

The consensus estimate for Q1 2025 revenues is expected to come in at $13.8 billion. The earnings per share consensus estimate for Q1 2025 is anticipated to be at 44 cents per share, this is a slight drop from same period last year.

Delta Air Lines (DAL) Last Positive Earnings Call Saw Decline O...

+1

16

No comment yet

>

>

TWIMO (151403908) : giggle…. chuckle…. are you thinking it’s just another Friday or it’s Friday already? I’ve spent more time observing and reading Mooers posts than trade…. wondered daily if it was the bottom and now it’s the bottom’s history already?

It would’ve been a lonely place in here if not for this communication forum… Anyways, have a good weekend

057特蓝不靠普 : Great leader would have anticipated the implications to the stock markets and the economy for his policy. Lets dont disappoint him, join the rally let it to the Max. Everything will then sorted out and starts again new

Space Dust : China has better p/e ratios ..

when will Trump bring that up, ? lol

Jknight : Thanks for the big racks of information and analysis. Trump is really making everything uncertain, not sure if his 90 days of calm will yield anything in the market as there seems to be no rule of law with regards to his actions, I mean in WTO there were rules of respecting trade agreements made between countries but he just proved america is not true to its word of which means the 3 months of calm still mean uncertainty and caution, dipping the whole world economy. I think only medical and essentials will go up, if not just due to the cost of the tariffs in the future.

73372627 Jknight : In fact the 90 days has a reason. Now everybody know the tariffs and where and how will be apply. 90 days it is for negotiations (first day after announcment, 52 countries want negotiations). The most hit will be for China with estimate at minimum -2% GDP and at least 30 millions job loose.

Here the sectors: Healthcare, Financial, Aluminium, Copper, Steel, Mining, Oil will expand. The most sectors to boom on market will be (with stocks No):

1. - 68 in Semiconductors, 2. - 56 in Communication equipment, 3.- 48 in Electronic components, 4. - Semiconductors Equipment & Materials.

The 90 days it is also to give to companies time to reorganise and also to exporters in US to end theirs high taxed composants stocks.

In consumer sector many companies based only on Chinese import will suffer most till manufacturing sector will addapt to the new reality.

Agricol sector will boom also versus 3rd quarter of this year.

The basic of the tariffs stay on the concept the money spend and stay inland.

The drop in market at the base now it is on massive shorting attacks, just analize the following pic I attach here: (the small redish near the symbol represent SEC-201 rule applyied). This mean squeeze of the market and institutional accumulations like in 2020 and then market boom.

View more comments...