AU Stock MarketDetailed Quotes

CIP Centuria Industrial REIT

- 2.980

- +0.040+1.36%

20min DelayNot Open Apr 29 16:00 AET

1.89BMarket Cap39.21P/E (Static)

2.990High2.945Low1.27MVolume2.960Open2.940Pre Close3.77MTurnover3.26752wk High0.24%Turnover Ratio634.93MShares2.73952wk Low0.155EPS TTM1.56BFloat Cap3.555Historical High39.21P/E (Static)523.79MShs Float0.506Historical Low0.076EPS LYR1.53%Amplitude0.16Dividend TTM0.77P/B1Lot Size5.44%Div YieldTTM

Centuria Industrial REIT Stock Forum

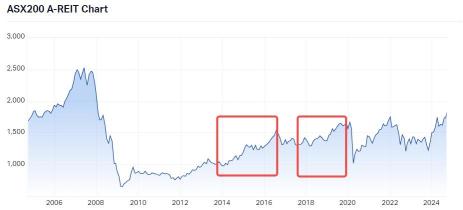

Impacted by Trump's tariff policies and concerns over a potential U.S. economic downturn, both the U.S. and Australian stock markets have experienced significant declines recently, with $S&P/ASX 200 (.XJO.AU)$ falling over 8% from its February peak as of March 18th. Australian industry sectors have also seen notable drops, yet Australian Real Estate Investment Trusts (A-REITs) have highlighted their value with their high d...

31

1

17

Australian Real Estate Investment Trusts (A-REITs) offer investors a way to engage in the commercial real estate market without directly holding physical property. These A-REITs own, operate, or finance a range of real estate sectors, generating income as a result.

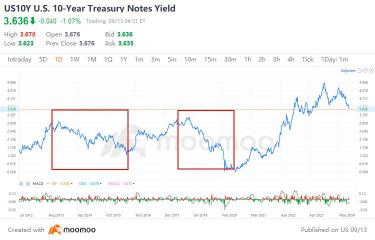

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

+2

11

1

6

Columns Riding the Wave of Growth: Capturing the Momentum of Australia's Industrial Property Expansion

Investors have been drawn to Australia's thriving industrial property sector in recent years. According to the latest report from CBRE, the total value of Australia's industrial property market has more than doubled in under three years, soaring to nearly A$300 billion.

By December 2023, the value of industrial real estate in Australia had surged from A$137 billion in September 2021 to A$293 billion. In...

By December 2023, the value of industrial real estate in Australia had surged from A$137 billion in September 2021 to A$293 billion. In...

+2

8

3

Quick macro take, US CPI revision, RBA to hold

The all-important US CPI revisions will be on watch on Feb 9 while US initial jobless claims will be released on Feb 8 (and are expected to rise). While in Australia, the RBA meets on Feb 6 with a hold at 4.35% widely expected. Here is what to expect and consider.

In the US; we know the Fed Fund Futures are now pricing a Fed interest rate cut in May, inst...

The all-important US CPI revisions will be on watch on Feb 9 while US initial jobless claims will be released on Feb 8 (and are expected to rise). While in Australia, the RBA meets on Feb 6 with a hold at 4.35% widely expected. Here is what to expect and consider.

In the US; we know the Fed Fund Futures are now pricing a Fed interest rate cut in May, inst...

6

G'day, mooers! Check out the latest news on today's stock market!

• S&P 500 backs off record after tech shares drop

• ASX slips ahead of CPI

• Stocks to watch: Credit Corp, Origin Energy, Liontown Resources

- Moomoo News AU

Wall Street Summary

Technology shares slipped as investors awaited earnings from industry heavyweights that have pushed the $S&P 500 Index (.SPX.US)$ to fresh records.

The benchmark index edged down 0.1 per ...

• S&P 500 backs off record after tech shares drop

• ASX slips ahead of CPI

• Stocks to watch: Credit Corp, Origin Energy, Liontown Resources

- Moomoo News AU

Wall Street Summary

Technology shares slipped as investors awaited earnings from industry heavyweights that have pushed the $S&P 500 Index (.SPX.US)$ to fresh records.

The benchmark index edged down 0.1 per ...

4

1

G'day, mooers! Check out the latest news on today's stock market!

• US stocks fall in strong week for U.S. Treasury yields

• ASX drops sharply

• Stocks to watch: Judo Bank, Treasury Wine Estates, South 32

- Moomoo News AU

Wall Street Summary

Stocks fell Friday, capping a week of losses for U.S. markets.

The fell $S&P 500 Index (.SPX.US)$ 1.3%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped 1.5%. The blue chip $Dow Jones Industrial Average (.DJI.US)$ declined ...

• US stocks fall in strong week for U.S. Treasury yields

• ASX drops sharply

• Stocks to watch: Judo Bank, Treasury Wine Estates, South 32

- Moomoo News AU

Wall Street Summary

Stocks fell Friday, capping a week of losses for U.S. markets.

The fell $S&P 500 Index (.SPX.US)$ 1.3%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped 1.5%. The blue chip $Dow Jones Industrial Average (.DJI.US)$ declined ...

4

G'day, mooers! Check out the latest news on today's stock market!

• US stock market's summer rally cools off

• ASX opens 0.4% lower

• Stocks to watch: Beach Energy, Carsales, JB Hi-Fi

- Moomoo News AU

Wall Street Summary

The summer stock market rally has started to cool after the S&P 500 fell modestly for a second consecutive week.

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ was Friday's worst major index performer, falling 0.7% to a one-...

• US stock market's summer rally cools off

• ASX opens 0.4% lower

• Stocks to watch: Beach Energy, Carsales, JB Hi-Fi

- Moomoo News AU

Wall Street Summary

The summer stock market rally has started to cool after the S&P 500 fell modestly for a second consecutive week.

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ was Friday's worst major index performer, falling 0.7% to a one-...

4

G'day, mooers! Check out the latest news on today's stock market!

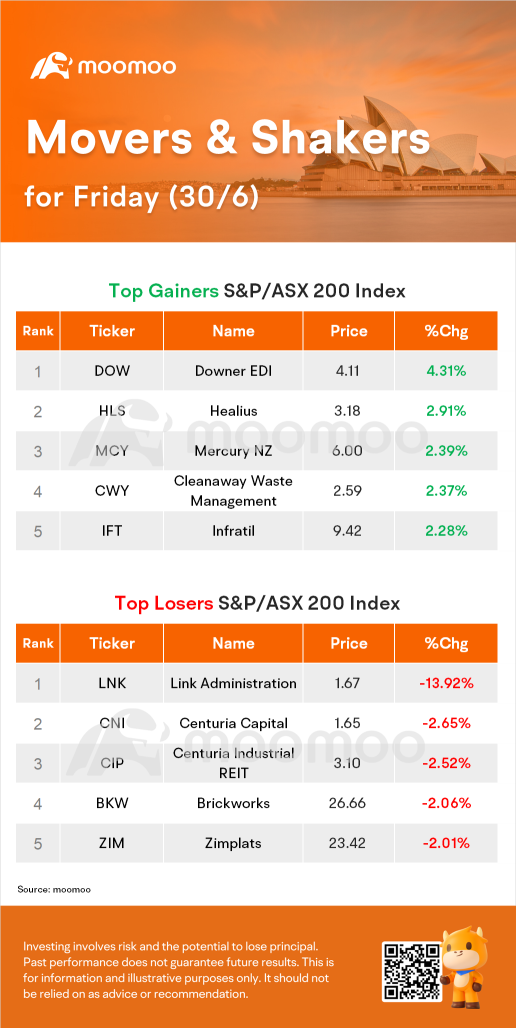

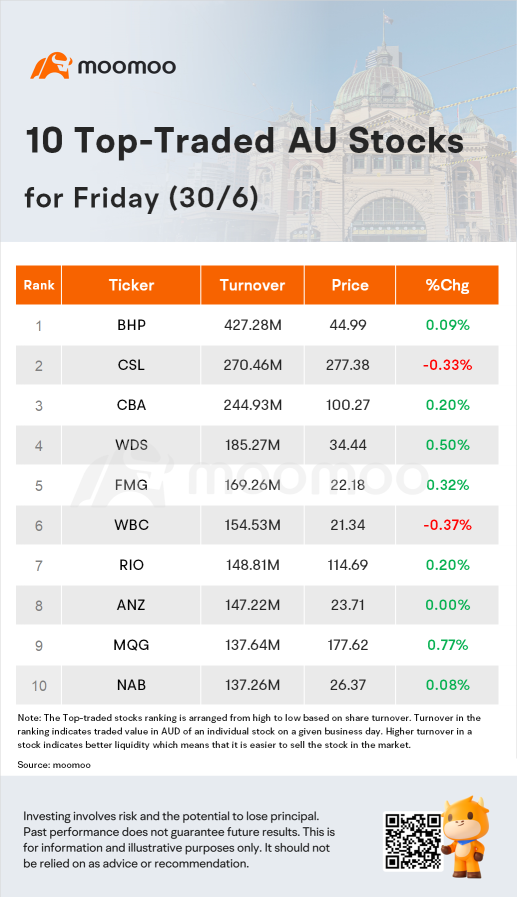

• Top gainers: $Downer EDI Ltd (DOW.AU)$, $Healius Ltd (HLS.AU)$, $Mercury NZ Ltd (MCY.AU)$

• Top losers: $Link Administration Holdings Ltd (LNK.AU)$, $Centuria Capital Group (CNI.AU)$, $Centuria Industrial REIT (CIP.AU)$

- moomoo News AU

The $S&P/ASX 200 (.XJO.AU)$ rose 0.1 per cent on Friday, tipping a return of 9.7 per cent for the financial year.

The benchmark S&P/ASX 200 was u...

• Top gainers: $Downer EDI Ltd (DOW.AU)$, $Healius Ltd (HLS.AU)$, $Mercury NZ Ltd (MCY.AU)$

• Top losers: $Link Administration Holdings Ltd (LNK.AU)$, $Centuria Capital Group (CNI.AU)$, $Centuria Industrial REIT (CIP.AU)$

- moomoo News AU

The $S&P/ASX 200 (.XJO.AU)$ rose 0.1 per cent on Friday, tipping a return of 9.7 per cent for the financial year.

The benchmark S&P/ASX 200 was u...

7

G'day, mooers! Check out the latest news on today's stock market!

• US markets flat, Fed survey flags weaker demand for all loan types

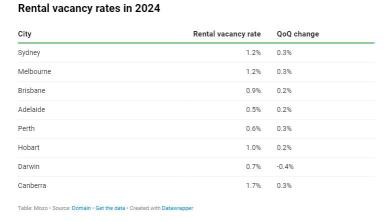

• ASX slips, weighed down by real estate and banks

• Stocks to watch: Stockland, Commonwealth Bank, Pilbara Minerals

- Moomoo News AU

Wall Street Summary

Another slide in regional-bank stocks and data showing tightening lending conditions left major stock indexes little changed on Monday.

Shares of ...

• US markets flat, Fed survey flags weaker demand for all loan types

• ASX slips, weighed down by real estate and banks

• Stocks to watch: Stockland, Commonwealth Bank, Pilbara Minerals

- Moomoo News AU

Wall Street Summary

Another slide in regional-bank stocks and data showing tightening lending conditions left major stock indexes little changed on Monday.

Shares of ...

6

G'day, mooers! Check out the latest news on today's stock market!

• S&P 500 posts second best day of the year, Amazon and Meta rally

• ASX 200 opened 0.17% higher, following a strong lead from Wall Street

• Stocks to watch: Megaport, Mirvac, PointsBet

- Moomoo News AU

Wall Street Summary

Stocks rallied Thursday, after a strong round of corporate earnings helped reverse a selloff earlier this week.

The $S&P 500 Index (.SPX.US)$ ro...

• S&P 500 posts second best day of the year, Amazon and Meta rally

• ASX 200 opened 0.17% higher, following a strong lead from Wall Street

• Stocks to watch: Megaport, Mirvac, PointsBet

- Moomoo News AU

Wall Street Summary

Stocks rallied Thursday, after a strong round of corporate earnings helped reverse a selloff earlier this week.

The $S&P 500 Index (.SPX.US)$ ro...

4

1

No comment yet

knees in the breeze :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)