No Data

C250502P60000

- 0.02

- -0.01-33.33%

- 5D

- Daily

News

Wealthy Consumers Upped Their Spending Last Quarter, While the Rest of America Is Cutting Back

Express News | Citigroup Inc. : Oppenheimer Raises Target Price to $94 From $91

Oppenheimer Adjusts Price Target on Citigroup to $94 From $91, Maintains Outperform Rating

Citibank: China Shenhua Energy's net income in the first quarter was below expectations, maintaining a "Buy" rating.

Citigroup released a Research Report indicating that China Shenhua Energy (01088) had a Net income of 13.4 billion yuan in the first quarter, a year-on-year decline of 25%, but an increase of 13% compared to the previous quarter. This is equivalent to 24% of the bank's and market's forecast for the annual Net income, which is below expectations, mainly due to unit gross margins and self-produced coal sales being lower than anticipated. The bank maintains a Target Price of HKD 32.7 for China Shenhua Listed in Hong Kong and retains a "Buy" rating. Excluding one-time expenses, the company's quarterly core Net income is estimated to be 12.8 billion yuan, a year-on-year and quarterly decline of 30% and 10% respectively. The quarterly gross margin is 21.3 billion yuan, a year-on-year and quarterly drop of 22% and 12% respectively.

Citi: Raises the Target Price for CHOW TAI FOOK to HKD 10.20, maintains a "Buy" rating.

Citigroup released a research report, responding to the latest operating performance for the fourth fiscal quarter ending in March this year and the strengthening of gold prices which may drive an increase in gross margin. The adjusted Net income forecast for CHOW TAI FOOK (01929) for the fiscal years 2025 to 2027 has been raised by 19%, 11%, and 4%. However, considering the stronger than expected rise in gold prices, the forecasts for CHOW TAI FOOK in fiscal years 2026 and 2027 remain basically unchanged, and the Target Price has been raised from HKD 9.9 to HKD 10.2, maintaining a "Buy" rating.

Citibank: BYD Electronics' quarterly Net income only meets the lower limit of some market expectations, rating "Neutral".

Citi released a Research Report indicating that BYD Electronics (00285) saw revenue in the first quarter rise by 1% year-on-year to 36.88 billion yuan, a decrease of 33% quarter-on-quarter, which is worse than the five-year seasonal quarter-on-quarter decrease of 18%, possibly affected by seasonal factors related to iPhone casing. The quarterly gross margin fell by 0.6 percentage points year-on-year to 6.3%, but rose by 0.4 percentage points quarter-on-quarter, influenced by the product mix. The company’s quarterly net income increased by 2% year-on-year to 0.622 billion yuan, just reaching the lower limit of some investors' expectations, as smart driving products did not contribute significantly. The bank currently gives BYD Electronics a "neutral" rating, with a Target Price of 36 Hong Kong dollars.

Comments

Visa Inc. (V), a global leader in digital payments, is set to report its fiscal Q2 2025 earnings on April 29, 2025, after market close, with a conference call at 5:00 PM ET. With a market capitalisation of approximately $625.30 billion as of April 20, 2025, Visa facilitates transactions across over 200 countries, proce...

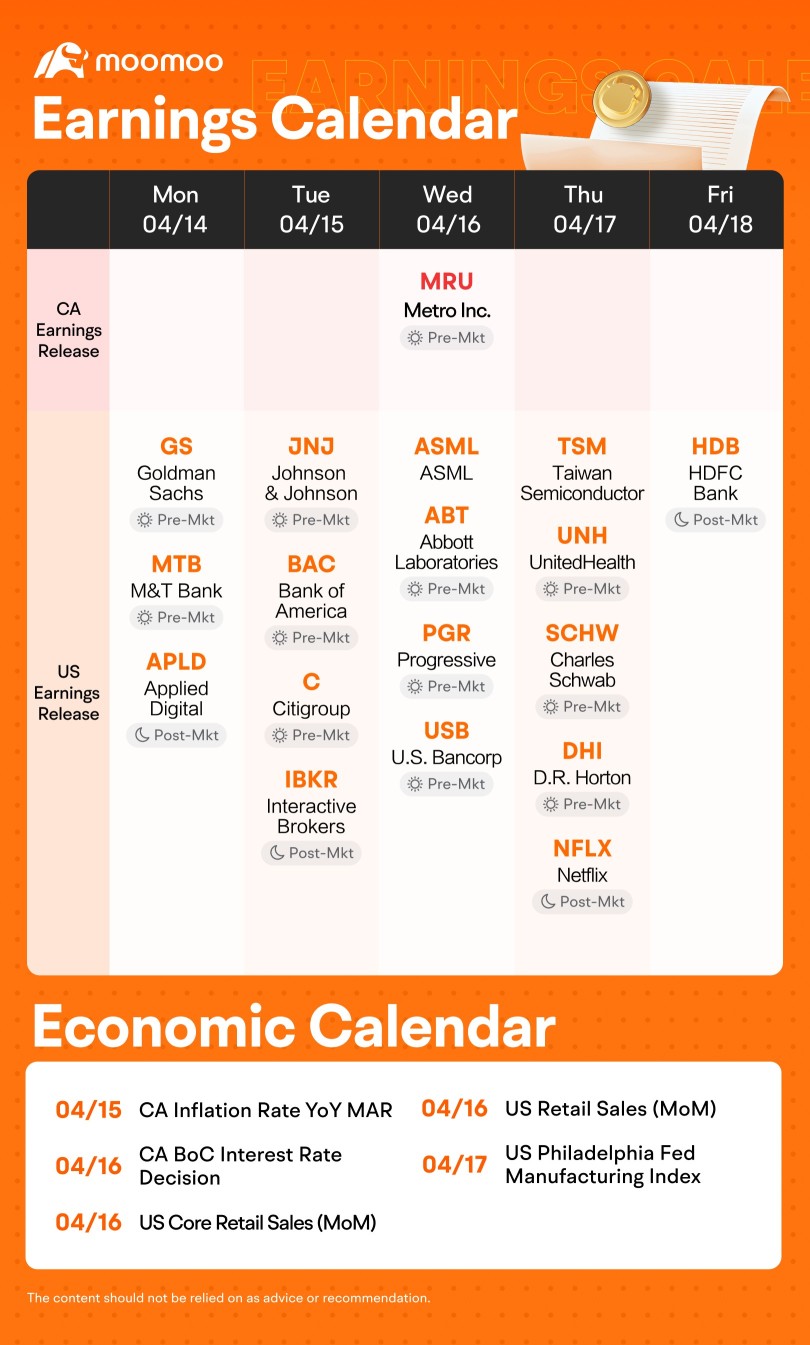

As the earnings season progresses, attention is focused on reports from companies such as $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $ASML Holding (ASML.US)$, $Taiwan Semiconductor (TSM.US)$ and $Netflix (NFLX.US)$. These reports are anticipated to provide valuable insights into how market volatility and tariff uncertainties are influencing their operations.

$Taiwan Semiconductor (TSM.US)$ is schedu...

Deezy_McCheezy : I get the growth story, but isn’t Visa’s valuation already sky-high?

Wendyfbe : I’m also eyeing that 0.74% dividend as a safety net. Thoughts?