No Data

C Citigroup

- 68.430

- +0.270+0.40%

- 68.320

- -0.110-0.16%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Citigroup: BYD's first-quarter net profit meets market expectations, maintaining its status as an "Industry preferred choice."

Citi released a Research Report stating that BYD (01211) had a net income of 9.16 billion RMB for the first quarter, a year-on-year growth of 100%, which meets market expectations. The bank expects a quarter-on-quarter shipment increase of 25% to 35% in the second quarter, reaching at least 1.25 million units. After excluding profits from BYD Electronics, the bank estimates that BYD's net profit per vehicle for the first quarter is approximately 8,733 RMB and expects that the net profit per vehicle in the first half of the year will stabilize at around 9,000 RMB. The bank believes that in April, the three main sales benchmarks for BYD (wholesale/domestic retail/export) should all record quarter-on-quarter growth. Citi maintains BYD as its "

Credit Card Delinquency Rates Ease in March: Credit Pulse

Warren Buffett's Top Stock Picks Now Come With a 15% Income Bonus Through This Fund

New York foreign exchange market: The dollar rose due to month-end fund flows and signals of tariff easing.

The USD rose across the board against other G-10 currencies on Friday, as traders became increasingly optimistic about signs of a potential easing in trade tensions. The yen suffered the largest declines. The Bloomberg USD Index rose by 0.4% at one point; it increased by 0.1% this week, following three consecutive weeks of decline. USA President Donald Trump stated in an interview with Time magazine on Friday that a trade agreement is expected to be reached with partners seeking lower tariffs in the "next three to four weeks." Two traders based in Europe indicated that month-end fund flows also contributed to the USD rebound. The USD index is heading towards its worst performance in the first hundred days of a new USA president since data has been available since the Nixon era. USD/JPY.

Citigroup Options Spot-On: On April 25th, 124.04K Contracts Were Traded, With 1.9 Million Open Interest

Market Chatter: Sycamore Discussing Debt Offering With Goldman Sachs, Others to Fund Portion of Walgreens Buyout

Comments

Visa Inc. (V), a global leader in digital payments, is set to report its fiscal Q2 2025 earnings on April 29, 2025, after market close, with a conference call at 5:00 PM ET. With a market capitalisation of approximately $625.30 billion as of April 20, 2025, Visa facilitates transactions across over 200 countries, proce...

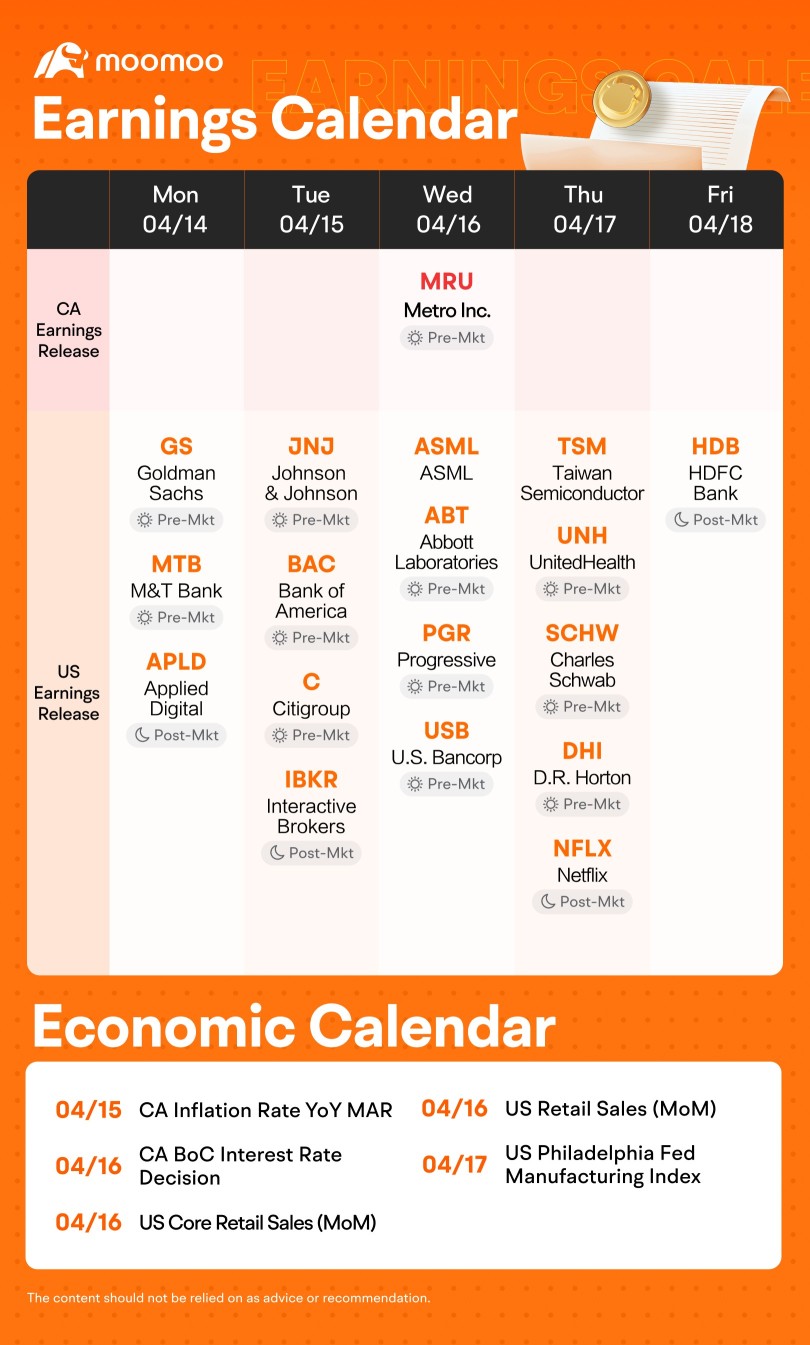

As the earnings season progresses, attention is focused on reports from companies such as $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $ASML Holding (ASML.US)$, $Taiwan Semiconductor (TSM.US)$ and $Netflix (NFLX.US)$. These reports are anticipated to provide valuable insights into how market volatility and tariff uncertainties are influencing their operations.

$Taiwan Semiconductor (TSM.US)$ is schedu...

Deezy_McCheezy : I get the growth story, but isn’t Visa’s valuation already sky-high?

Wendyfbe : I’m also eyeing that 0.74% dividend as a safety net. Thoughts?