No Data

C Citigroup

- 68.430

- +0.270+0.40%

- 68.350

- -0.080-0.12%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Credit Card Delinquency Rates Ease in March: Credit Pulse

Warren Buffett's Top Stock Picks Now Come With a 15% Income Bonus Through This Fund

New York foreign exchange market: The dollar rose due to month-end fund flows and signals of tariff easing.

The USD rose across the board against other G-10 currencies on Friday, as traders became increasingly optimistic about signs of a potential easing in trade tensions. The yen suffered the largest declines. The Bloomberg USD Index rose by 0.4% at one point; it increased by 0.1% this week, following three consecutive weeks of decline. USA President Donald Trump stated in an interview with Time magazine on Friday that a trade agreement is expected to be reached with partners seeking lower tariffs in the "next three to four weeks." Two traders based in Europe indicated that month-end fund flows also contributed to the USD rebound. The USD index is heading towards its worst performance in the first hundred days of a new USA president since data has been available since the Nixon era. USD/JPY.

Citigroup Options Spot-On: On April 25th, 124.04K Contracts Were Traded, With 1.9 Million Open Interest

Market Chatter: Sycamore Discussing Debt Offering With Goldman Sachs, Others to Fund Portion of Walgreens Buyout

Private Banker Managing $5 Billion Joins BofA From Citi -- Barrons.com

Comments

Visa Inc. (V), a global leader in digital payments, is set to report its fiscal Q2 2025 earnings on April 29, 2025, after market close, with a conference call at 5:00 PM ET. With a market capitalisation of approximately $625.30 billion as of April 20, 2025, Visa facilitates transactions across over 200 countries, proce...

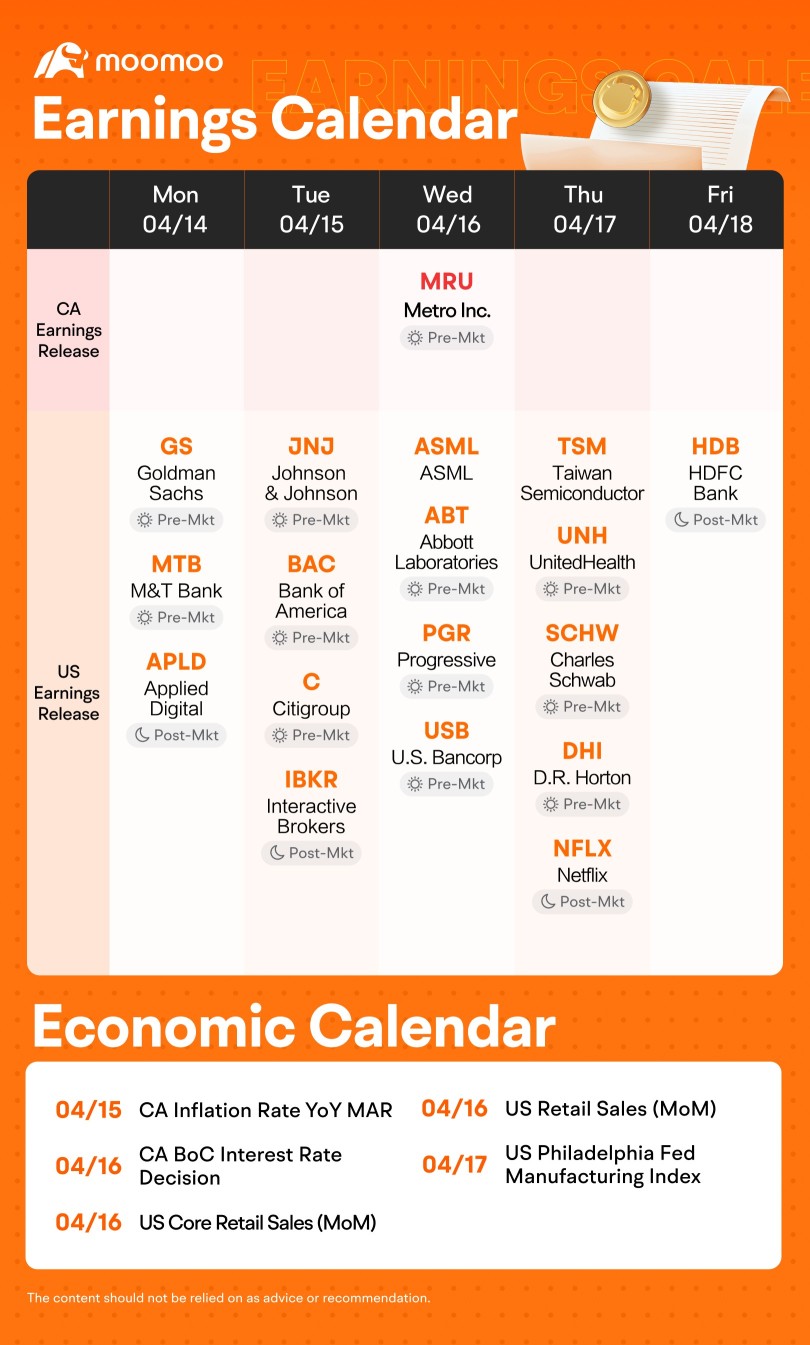

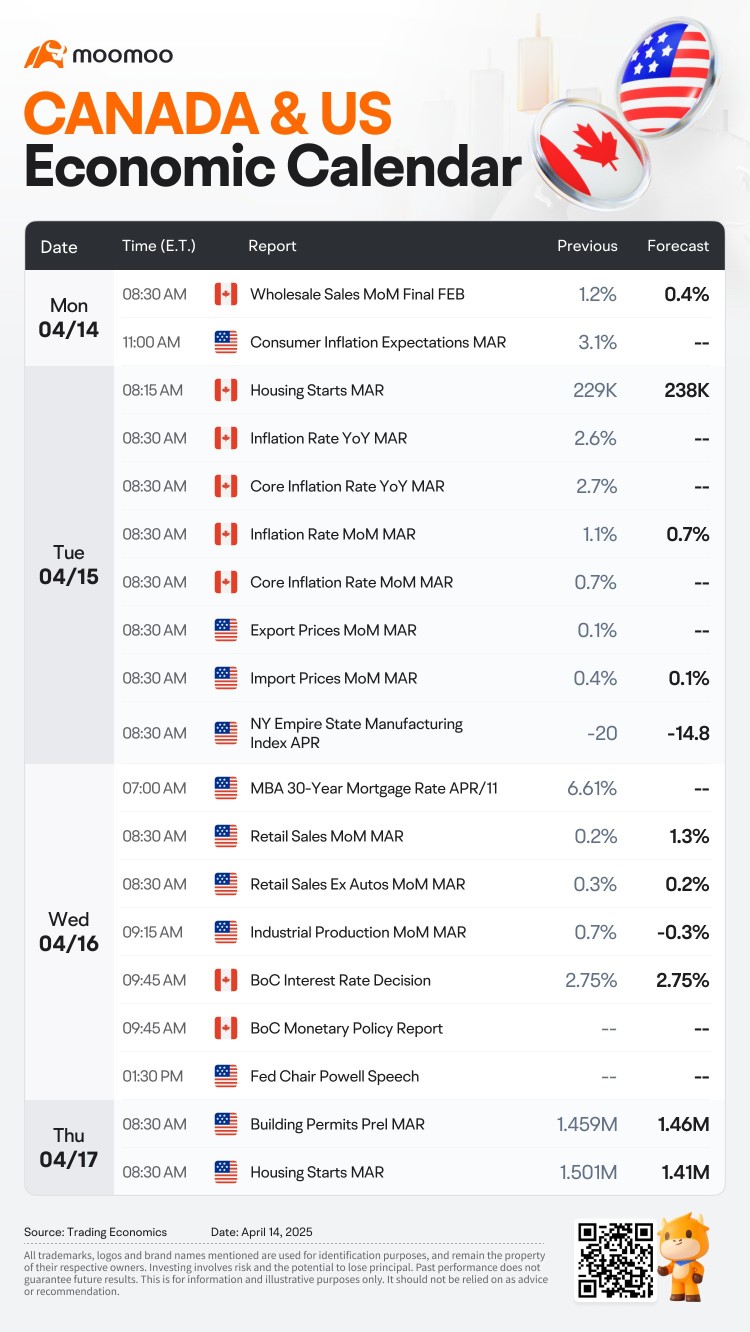

As the earnings season progresses, attention is focused on reports from companies such as $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $ASML Holding (ASML.US)$, $Taiwan Semiconductor (TSM.US)$ and $Netflix (NFLX.US)$. These reports are anticipated to provide valuable insights into how market volatility and tariff uncertainties are influencing their operations.

$Taiwan Semiconductor (TSM.US)$ is schedu...

Deezy_McCheezy : I get the growth story, but isn’t Visa’s valuation already sky-high?

Wendyfbe : I’m also eyeing that 0.74% dividend as a safety net. Thoughts?