No Data

BIL250516P97000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Apollo Warns of Potential Labor Market Weakness Ahead of Friday Payrolls Report

Market Dislocations in U.S. Treasurys Seen Largely Healed -- Market Talk

A JPMorgan survey indicates that the S&P 500 Index has peaked this year, but investors remain bullish on the Magnificent 7.

① A JPMorgan survey shows that 93% of investors believe the S&P 500 Index will hover around 6000 points or lower in the next 12 months, with 40% expecting it to remain within the 5000-5500 points Range; ② Respondents unanimously believe that trade wars and tariff uncertainties will trigger economic consequences, with 61% expecting the USA economy to face stagflation in the next 12 months.

Market Update | Most Autos stocks rose, NIO increased by over 5%, Li Auto grew by 2%, and Trump plans measures to mitigate the impact of car tariffs.

According to market news, President Trump of the USA will announce measures on Tuesday (April 29) to mitigate the impact of auto tariffs.

The sell-off is not over yet! USA Assets are still being "disdained" by overseas investors…

① According to data provided by Deutsche Bank, despite the market recovering over the past week, foreign investors' willingness to invest in USA assets continues to decline; ② Deutsche Bank's Forex research director George Saravelos believes that the recent data on USA capital flows is concerning.

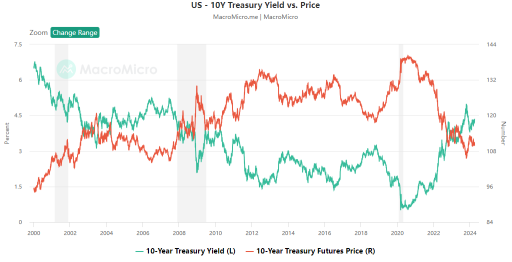

"Debt ceiling" causes trouble! The U.S. Treasury Department's borrowing expectations for Q2 increase threefold, excluding the impact, borrowing decreases instead of increasing.

The U.S. Treasury announced on Monday that the estimated net borrowing for the second quarter is 391 billion dollars higher than expected in February, due to Congress not yet raising the federal debt ceiling, and the initial cash reserves at the beginning of the second quarter being far lower than previously anticipated. The Treasury stated that if the cash balance at the beginning of the season is not taken into account, the estimated borrowing for the second quarter is actually 53 billion dollars lower than the forecast made in February. Some analysts believe this is because DOGE is indeed having an effect, improving the fiscal situation and reducing financing demand.

Comments

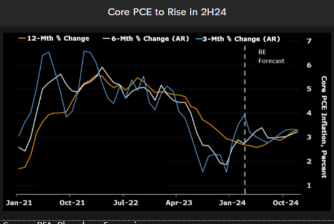

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

In a text book manner, it was options expiry day April 19 so the market' pull back from its record all time highs was naturally going to be exacerbated. Shorts were exercised, the ASX200 $S&P/ASX 200 (.XJO.AU)$ dropped 0.98% on Friday, and then rose up 1.1% on Monday April 22, with market participants e...

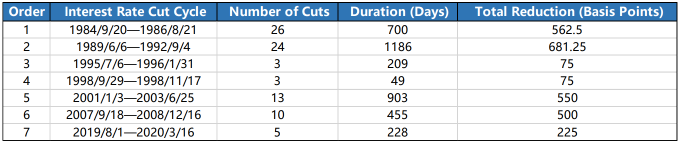

When central banks embark on an easing cyc...

最帅韭菜 : 2026 hit 1200 I think

Dontchaknowme 最帅韭菜 :